Less than expected and still subdued:

Consumer Credit

Highlights

Consumer credit rose $14.1 billion in November though, once again, revolving credit was weak. The revolving credit component, where credit card debt is tracked, fell $0.9 billion in the month for the second contraction of the last four months. In contrast, the non-revolving credit component, as usual, posted a strong gain, up $15.0 billion and once again reflecting demand for auto loans and student loans. But revolving credit is the weak link in the consumer sector that continues to hold back gains for retail spending.

Jobless Claims

Highlights

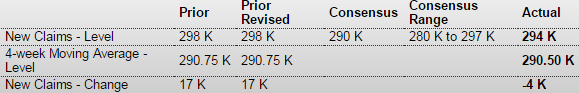

Initial jobless claims fell 4,000 in the January 3 week to 294,000, helping to pull down the 4-week average slightly to 290,500. The average is trending about 10,000 lower than the month-ago comparison which points to steady improvement underway in the labor market.

Data on continuing claims, which are reported with a 1-week lag, are mixed. Continuing claims in the December 27 week rose a sizable 101,000 to 2.452 million but the 4-week average fell 17,000 to 2.397 million. This average has been steady around the 2.400 million mark since late November. The unemployment rate for insured workers is unchanged for a fourth week at a recovery low of 1.8 percent.Las Vegas Real Estate in December: Lowest Sales in Years, Non-contingent Inventory up 18% YoY