So I still see all the fundamentals/trade flows favoring the euro vs the $US, with the EU running a trade surplus and the US a deficit, and low oil prices ‘helping’ the EU trade balance while ‘hurting’ the US’s.

But the portfolio shifts continue to go the other way, including this report of CB’s shifting some 100 billion out of euro, spurred by the belief that what the ECB is doing and the Greek risk is euro unfriendly, and what the Fed is doing is $US friendly.

It’s as if the corn crop failed, and supply fell below demand, but someone with a large warehouse full of corn decided to sell it all. The price would go down until he was finished, and then the shortage due to the ongoing consumption would start driving prices higher.

Subject: flow snippet: last piece of flow news in 2014 is bad for the Euro

Every quarter the IMF puts out a snapshot of global central bank reserve composition (with a quarters lag).

Today, we got the Q3 numbers, and after accounting for valuation effects, the numbers seem to signal a shift in central bank behavior.

Normally, central banks operate with fairly fixed currency allocation targets, and when a currency goes down in value, they accumulate, to stabilize its share.

In Q3, the Euro dropped sharply vs the dollar, but both G10 and EM central banks were on the margin active sellers of Euro’s.

This is a big deal, as it suggest ‘portfolio rebalancing’ has been put on hold.

This means that stabilizing flows, which could have been in the region $100bn, are not materializing.

If this is indeed the new trend, there may be potential for a faster move lower in the Euro in early 2015, driven more purely by private sector flows.

Happy new year!

Jens Nordvig

The Euro share of global central bank reserves fell significantly in Q3. According to IMF COFER data published today, the Euro share of global reserves dropped 1.5 percentage points to 22.6%. This is one of the largest quarterly declines in the share ever. What is particularly interesting about the fall is that it was a function both of the valuation effect (a weaker Euro vs the USD) and active sales of Euros. This is striking, as normally „portfolio rebalancing‟ would create positive flows (EUR buying) to offset valuation effects when the price of the Euro declines (this happened during the early part of the Euro-crisis for example). As such, it seems that global reserve managers have may have put „portfolio rebalancing on hold‟ in the face of monetary policy divergence and negative interest rates on a large portion of their EUR holdings. If this trend continues, leaving central banks on the sidelines as the Euro declines, the Euro has potential to decline steadily in coming months in line with the trend in private sector flows.

Central Banks accumulate reserves, valuation causes total to fall

In the 2014 Q3 update of the IMF Composition of Official Foreign Exchange Reserves (COFER) data, global reserves decreased by $218bn, bringing the total reserves to $11.8trn. This is the first quarter that global reserves have fallen since the first quarter of 2009, and is only the third quarter total since the IMF began providing quarterly COFER data in 1999. The most recent data shows allocated reserves decreased by $128bn, while the unallocated reserves decreased by $90bn. However, the decline in reserves was driven by valuation adjustments. Excluding the valuation adjustments, advanced countries added $21bn in reserves, while emerging markets added $31bn.

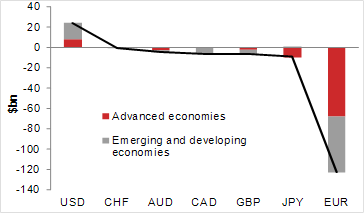

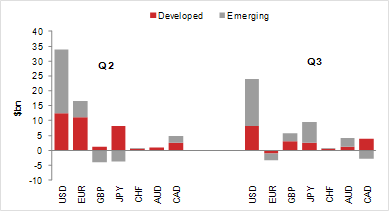

Adjusting the allocated reserves for currency valuation effects, there was central bank reserve buying of $52bn. This was dominated by USD buying, which totaled $24bn, with advanced economies buying $8bn and EM buying $16bn. EUR stood out as the most sold currency, with $3bn sold total, split with $1bn of selling from advanced economies and $2bn from emerging. EUR showed the biggest decline when including valuation and measured in USD, with reserves falling by $123bn (or just over 8% of outstanding EUR denominated (allocated) reserves).

According to our central bank intervention tracker, intervention slowed significantly to just $22bn in Q3, driven primarily by a large change in tact by China, which switched to FX selling (see Quarterly central bank reserve update, 16 October 2014). The valuation-adjusted flows from the IMF also suggest that intervention slowed, although to a lesser degree, with $52bn of total accumulation compared to $71bn in Q2 (in allocated reserves).

Allocation to USD up, EUR down

With the US dollar gaining strength in the third quarter, it would have been logical to assume a tendency to sell USD and buy some of the relatively cheaper currencies in order to maintain allocations in central bank portfolios. At least this has been the general pattern of central bank behavior in the past, including during the Euro-crisis.

However, in Q3 we saw the opposite. Reserve managers actively accumulated USD and sold EUR. Meanwhile, portfolio rebalancing worked as normal for other currencies, with reserve managers actively buying JPY, AUD and GBP during Q3, helping to stabilize allocated shares. With regard to the Euro, the active selling exacerbated the valuation effect rather than countering it. Hence the USD allocation jumped sharply to 62.3% from 60.7% (a 1.6pp increase) globally and EUR allocation fell to 22.6% from 24.1% (a 1.5pp decline). This fall in EUR allocation globally is the largest in a quarter since Q1 2004 (and larger than the declines during the Euro crisis periods). The USD allocation gain is tied historically with Q1 2004 as the largest.

One reason for the shift out of EUR as a reserve currency could be the low and often negative yields in Eurozone assets. As we highlighted in The Trillion Euro Question, a large amount of short-term bonds and deposits held in Eurozone assets were earning negative yield and at risk for a shift out of the Eurozone. If global reserve managers have indeed disabled portfolio rebalancing in the context of their EUR share, it has important negative implications for the Euro in coming months

If global reserve managers have indeed disabled portfolio rebalancing in the context of their EUR share, it has important negative implications for the Euro in coming months.