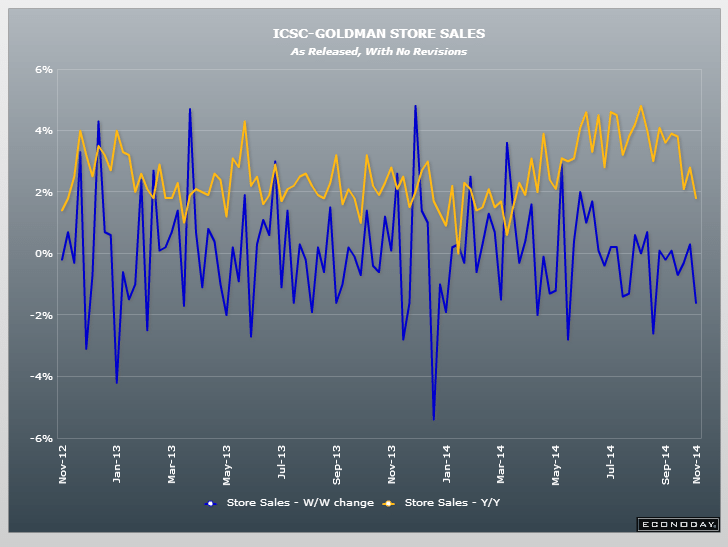

A lesser indicator but might be indicative at the moment:

ICSC-Goldman Store Sales

Redbook

Highlights

Both ICSC-Goldman and Redbook report slowing in the November 1 store-sales week with Redbook’s year-on-year same-store rate down 5 tenths to plus 3.9 percent. Redbook notes that this year’s late week Halloween, which fell on a Friday, may have backfired, having on the one hand boosted sales at those stores focusing on Halloween items but reducing sales at other retailers. Still, Redbook’s month-to-month comparison is plus 0.2 percent which offers a marginally positive indication for the ex-auto ex-gas reading of the government’s October retail sales report. Individual stores will post their October results on Thursday.

Trade a bit less then expected is also a downward revision to q3 GDP as exports fell.

Recall a prior post indicating the trade contribution to GDP looked suspect to the high side.

This is a partial adjustment.

Lower oil prices will help, but that also means less oil income for foreign producers who also buy our exports.

International Trade

Highlights

Slower global growth may have worsened the U.S. trade deficit in September. The trade gap in September expanded to $43.0 billion from $40.0 billion in August,Exports declined 1.5 percent in September, following a rise of 0.3 percent in August. Imports were unchanged, following a 0.1 percent uptick the month before.

The petroleum gap grew to $14.0 billion from $13.1 billion in August. The goods excluding petroleum gap increased to $47.2 billion from $45.5 billion in August. The services surplus slipped to $19.6 billion from $20.2 billion.

Overall, slower global growth is nudging down growth in the U.S. But recently lower oil prices likely will result in a favorable number for October.