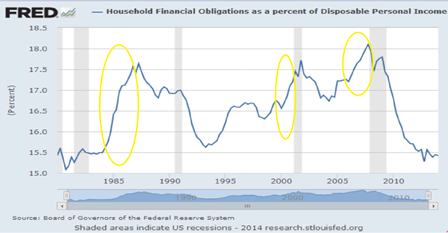

Circled are the credit expansion from the ‘regrettable’ S and L expansion (over $1 trillion back when that was a lot of money), the ‘regrettable’ .com/Y2K credit expansion (private sector debt expanding at 7% of GDP funding ‘impossible’ business plans), and most recently the ‘regrettable’ credit expansion phase of the sub prime fiasco.

All were credit expansions that helped GDP etc. but on a look back would not likely have been allowed to happen knowing the outcomes.

So the question is whether we can get a similar credit expansion this time around to keep things going/offset the compounding demand leakages that constrain spending/income/growth.

Japan, for example, has been very careful not to allow a ‘regrettable’ private sector credit expansion since the last one came apart in 1991…

So yes, debt ratios look low, but without some kind of ‘regrettable’/fraudulent/etc. impetus this is about all we can expect given the demand leakages, etc?

And not to forget this an average of higher and lower income earners, with income being skewed upwards to those with lower propensities to spend. I had suspected the consumer would make a move, somewhat as in past cycles, but then FICA and sequesters took away a large chunk of the income/ammo needed to support it, while the demand leakages continued.

Full size image