From CS:

JAY FELDMAN : Q4 GDP revision is now tracking 2.4 on our estimates. It was tracking 2.7 before retail sales… and down from the initially reported 3.2.

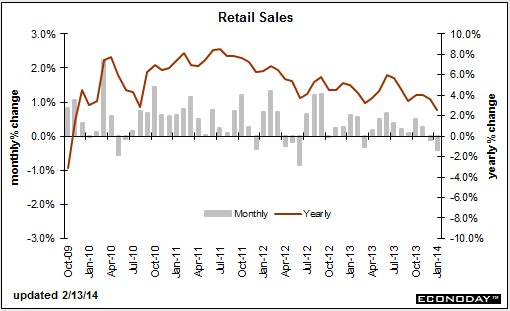

Note October/November/December all marked down lower as well in US retail sales…and even prior to this period as well – will bring down Q4 GDP tracking for consumption.

Again, the income to support sales just doesn’t seem to be there, as the sub 3% federal deficit doesn’t seem to have been providing the spending needed to offset the demand leakages (unspent income):

Retail Sales

Highlights

Overall retail sales in January fell 0.4 percent, following a decrease of 0.1 percent in December (originally up 0.2 percent). The market consensus was for a 0.1 percent dip.

Autos pulled down the total. Motor vehicle & parts declined 2.1 percent, following a decrease of 1.8 percent in December. Excluding autos, sales were unchanged after gaining 0.3 percent the month before (originally up 0.7 percent). Analysts called for a 0.1 percent rise. Gas station sales increased 1.1 percent after jumping 1.5 percent in December. Excluding both autos and gasoline, sales slipped 0.2 percent after rising 0.1 percent in December. The consensus was for a 0.2 percent rise.

In the core, strength was seen in electronics & appliance stores; building materials & garden equipment; and grocery stores. Declines were seen in furniture & home furnishings; health & personal care; clothing; sporting goods, hobby, et al; department stores; nonstore retailers; and food services & drinking places.

The latest report suggests that fourth quarter GDP may be revised down and that first quarter GDP could be soft. Again, atypically adverse weather likely affected the data. Equity futures declined on the news.

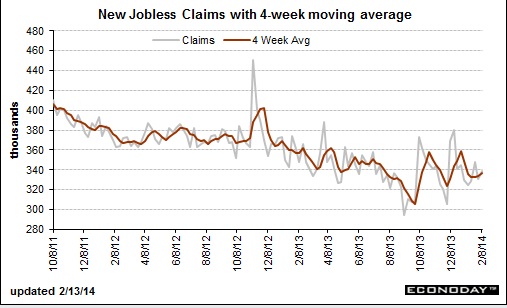

When I squint at this chart if anything it seems to have bottomed and nudging irregularly higher: