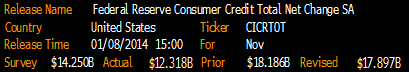

Less than expected

Very steady yoy growth, largely cars and student loans. And car sales slowed in December.

Highlights

Consumer credit rose $12.3 billion in November, under the Econoday consensus for $14.2 billion but still a solid gain. Details show a rare back-to-back gain for revolving credit, up a modest $0.5 billion but following a $4.0 billion gain in October which was the third largest gain of the whole recovery. The last time revolving credit rose 2 months in a row was back in January and February of last year.

Non-revolving credit once again shows a sizable gain, at $11.9 billion reflecting both strength for vehicle loans but also further gains for the student loan component which is being inflated by government acquisitions from private lenders.

The revolving credit component of this report is not quite on fire but it does point to consumer willingness to spend and borrow at the beginning of the holiday shopping season.