More deceleration:

US Home Price Growth Slows to New 7-Year Low

The S&P CoreLogic Case-Shiller 20-city home price index in the US rose 2% year-on-year in July, missing market expectations of 2.2%. It was the smallest annual gain in house prices since August 2012. Phoenix recorded the biggest increase in home prices, followed by Las Vegas and Charlotte, while the smallest gains were seen in San Francisco, New York and Los Angeles. Prices in Seattle continued to drop.

Highlights

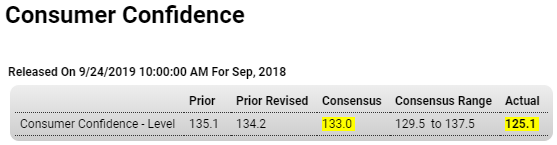

The consumer confidence index had been showing exceptional strength but did fall back unexpectedly in September to 125.1 which is down sharply from a revised 134.2 in August and 135.8 in July. Nevertheless, this index has been trending higher this year in continued contrast to the rival consumer sentiment index which has been slumping noticeably.

The difference between the two indexes is the focus on labor market factors which are central to the consumer confidence report and where today’s results are mixed. Those saying jobs are currently hard-to-get did fall 4 tenths to 11.6 percent, which is a positive indication of increasing strength, in contrast to those who say jobs are currently plentiful which fell 5.5 percentage points to 44.8 percent. The outlook for future employment strength is negative with fewer saying there will be more jobs (17.5 vs August’s 19.9 percent) and more saying there will be fewer jobs (15.7 vs 13.7 percent).

A strong negative in today’s report is a sharp decline in those who see their income improving over the next months, falling to 19.0 percent versus August’s 24.7 percent, a downturn reflecting not only caution over the jobs outlook but also a tangible drop in stock market confidence where bears, at 35.3 percent, now outnumber bulls at 31.6 percent. This is the first time since January this year that bears are on top.

Among other readings, inflation expectations are flat at 4.8 percent, down 1 tenth for this reading from August, with buying plans all noticeably lower including for autos and homes.

Today’s report offers a measure of caution and if nothing else suggests that further acceleration in consumer spending, which the Federal Reserve considers to be by far the strongest segment of the economy, may be limited.