Been almost a year, and still looks to me like the oil price collapse was an unambiguous negative for the US and global economies. And for the same reasons. For every buyer of oil who benefited, a seller of oil lost exactly that much. That leaves the drop in capex, as well as the continued decrease in net government spending, which has yet to be ‘replaced’ by alternative spending. Apart from inventory building…

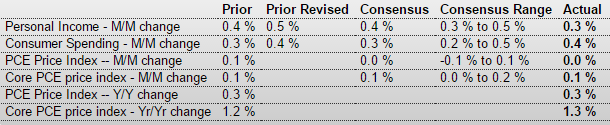

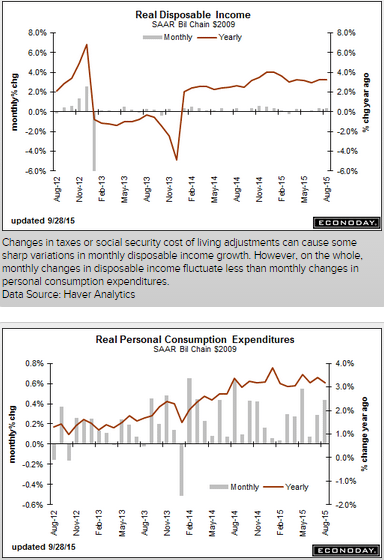

Personal Income and Outlays

Highlights

The consumer is making money and spending money at the same time that inflation is very quiet. Personal income rose 0.3 percent in August which is on the low side of expectations but July is now revised 1 tenth higher to a very solid 0.5 percent. And the wages & salaries component is also very solid, at plus 0.5 and 0.6 percent the last two months. Turning to spending, the gain is 0.4 percent which is 1 tenth above consensus with July revised 1 tenth higher to 0.4 percent also.

Inflation readings came in as expected, at no change for the PCE price index and up only 0.1 percent for the core. Year-on-year, overall prices are up only 0.3 percent, which is unchanged from July, with the core ticking 1 tenth higher to 1.3 percent which is still well below the Fed’s 2 percent target.

The savings rate is solid at 4.6 percent and has been edging lower from 4.9 percent in April. This may be a sign of confidence among consumers who are now willing to spend while saving less. Other details include a rise for rents but a dip for proprietor income.

This report is very healthy but how it plays for the FOMC is uncertain. Income and spending would justify a rate hike but not the inflation readings.

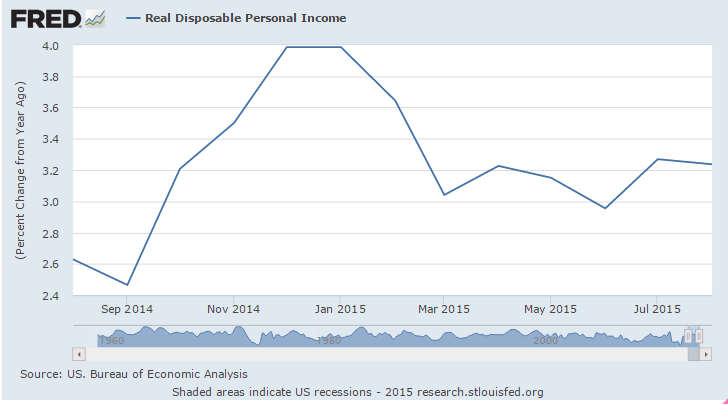

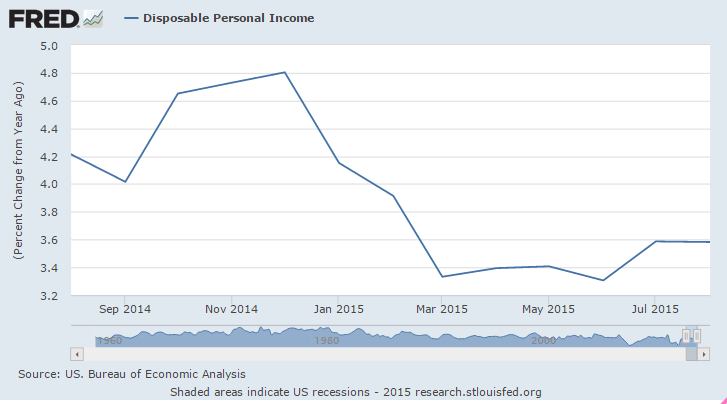

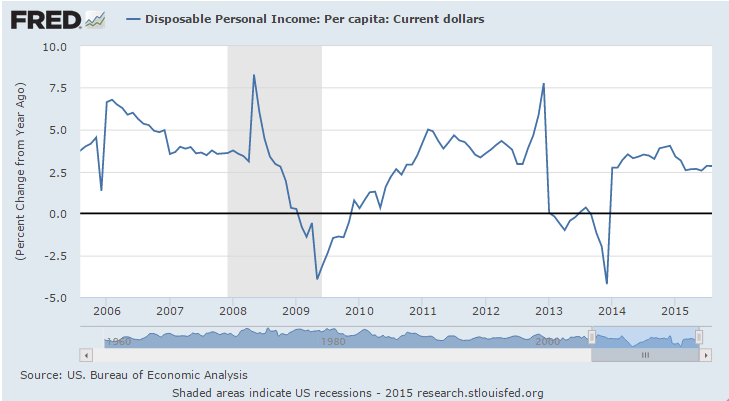

Note the ‘peaks’ back around November when oil prices collapsed:

This is before inflation adjustment:

And this is per capita:

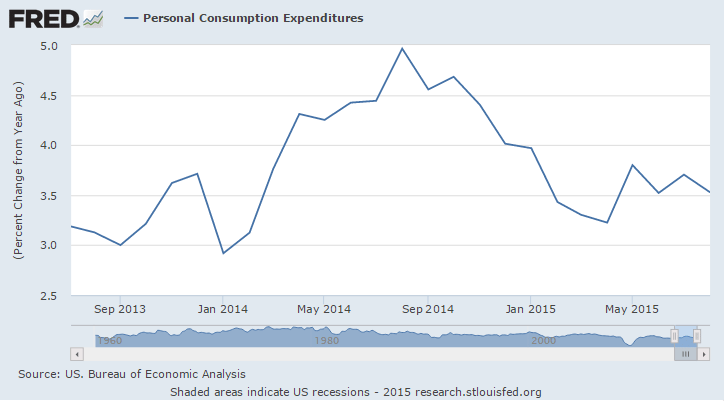

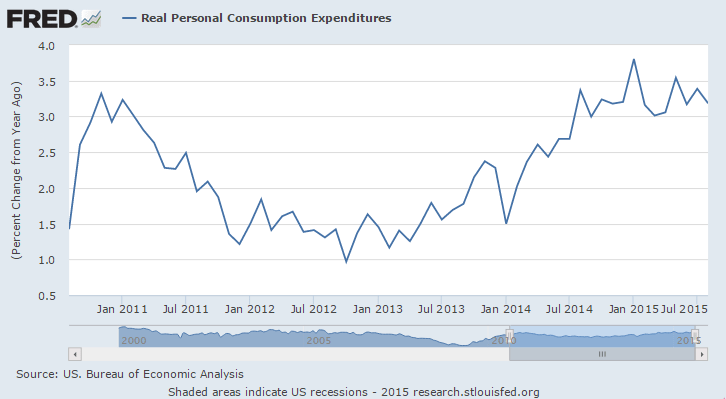

And on the consumption side:

Slipping back as previously suggested:

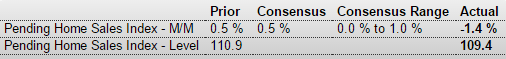

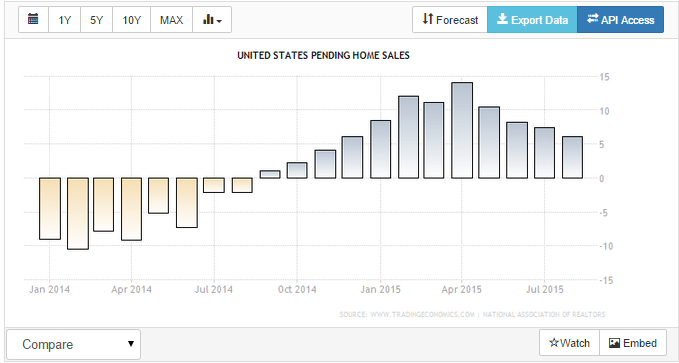

Pending Home Sales Index

Highlights

The existing home sales market looks to remain flat in the coming months based on the pending home sales index which fell a disappointing 1.4 percent in August. Three of four regions posted declines led by the Northeast at 5.6 percent with the South, which is by far the biggest housing region, down 2.2 percent. Only the West posted a gain, at 1.8 percent.

Existing home sales are being limited by lack of homes on the market which itself, however, reflects softness in home prices and general demand. But there is strength in housing and that’s in new home sales and construction. Watch for Case-Shiller home price data on tomorrow’s calendar.

Less worse, but remains negative:

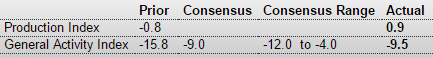

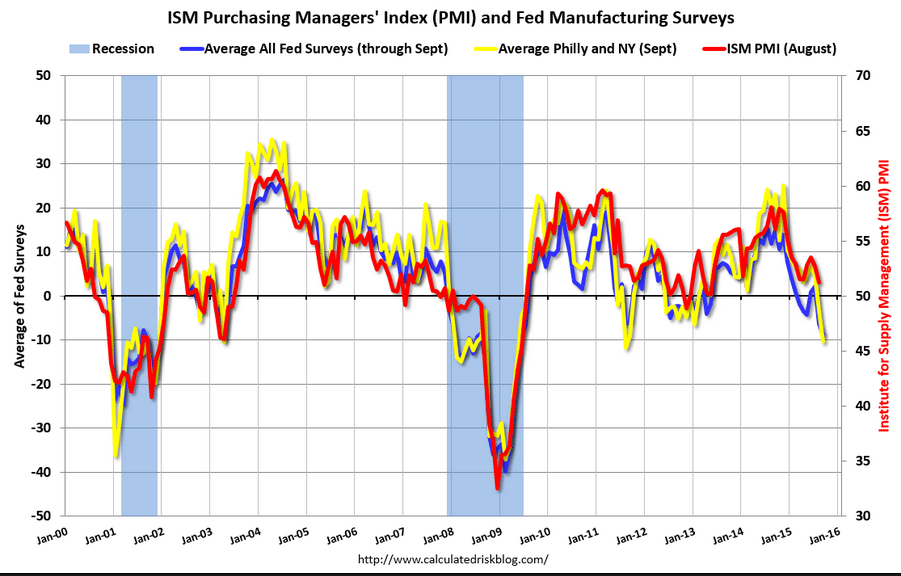

Dallas Fed Mfg Survey

Highlights

The Dallas Fed rounds out a full run of negative indications on the September factory sector with the general activity index remaining in deeply negative ground at minus 9.5. New orders are at minus 4.6 which, however, is an 8 point improvement from August. Production is actually in positive ground at 0.9.

Other readings include a decline in the workweek and the fifth straight contraction for employment. Price readings show little change for inputs but, like other reports, contraction for finished prices.

The Texas economy has been depressed all year by the energy sector while the nation’s factory sector continues getting hurt by weak foreign demand and strength in the dollar.

Looks a lot like a recession, no?

China’s industrial restructuring cuts power use, freight volume

Sept 26 (Xinhua) — Zhang Xiaoqiang, executive deputy director of China Center for International Economic Exchanges. Zhang admitted that there were some doubts about China’s economic growth rate in the first half (H1), as two key indicators of economic growth, namely power consumption and freight volume, dropped remarkably. The discrepancy between economic growth and the two key indicators’s growth in the first six months did not fit with previous patterns, but industrial restructuring is a new factor, and should be taken into account when analyzing the new situation, he said.