>

> Here’s Bob Toll on the TOL conference call yesterday. Given its

> market niche, I would expect TOL to be the strongest of the

> homebuilders—and note that 20% of sales were all cash. (I don’t

> know how that compares with historical experience, but it seems

> high.) This was from the prepared remarks, fyi.

>

Since August 1, 2013, the beginning of our fourth quarter, through this past weekend, which is halfway through our first quarter, our business has been basically flat compared to the same period of time one year ago. During that 19-week timeframe last year, two weeks were highly unusual. Hurricane Sandy hit on Thursday, October 25, 2012, and wiped out sales in about half our markets that weekend. The contracts which would have been signed that last weekend of October 2012 were pushed into the first week of November 2012. Because November is a new fiscal quarter for us, our reported results and comparisons to last year are affected. Excluding this first week of November 2012, our last five weeks of business have been flat to one year ago.

And as mentioned, the full 19-week period since August 1 has also been flat. We believe this leveling of demand will prove temporary based on still significant pent-up demand, the gradual strengthening of the economy and the improving prospects of our affluent customers.

Highlights

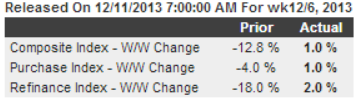

A big jump in rates held back mortgage applications in the December 6 week which, after very steep declines in the prior week, inched only 1.0 percent higher for purchase applications and 2.0 percent higher for refinance applications. Down 10 percent year-on-year, the purchase index remains especially depressed in a what is a negative indication for underlying home sales. The average rate for 30-year mortgages with conforming loans ($417,500 or less) jumped a steep 10 basis points in the week to 4.61 percent.