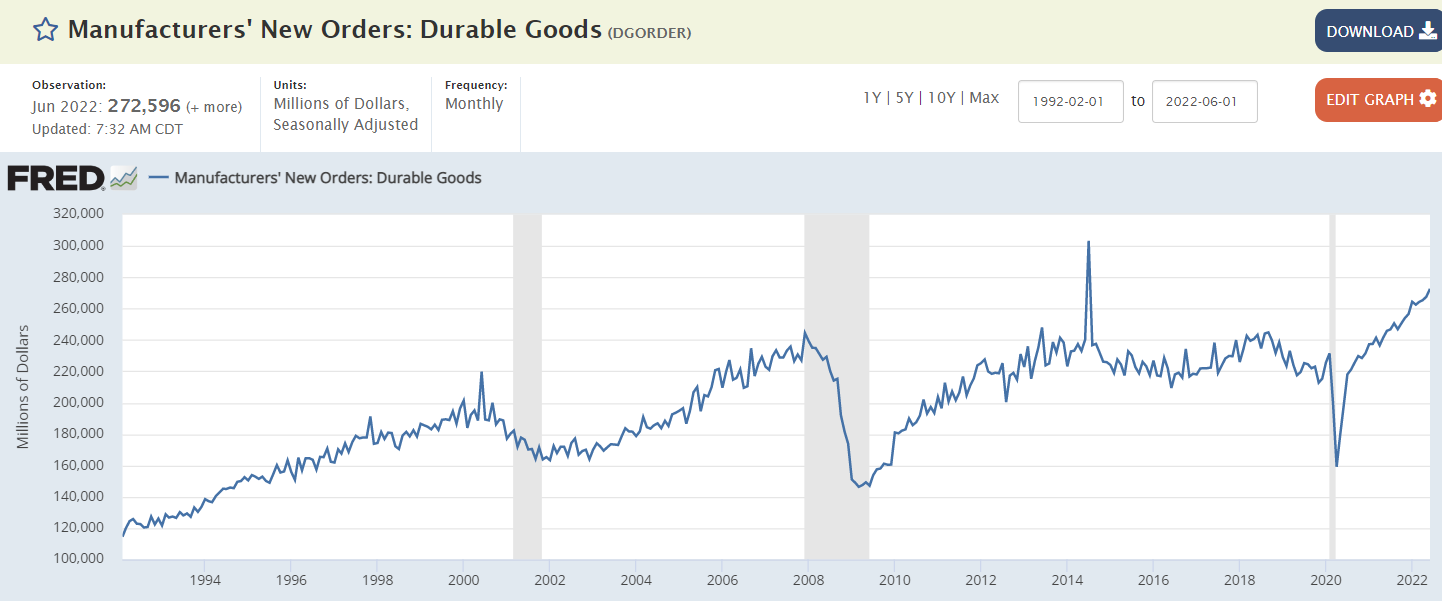

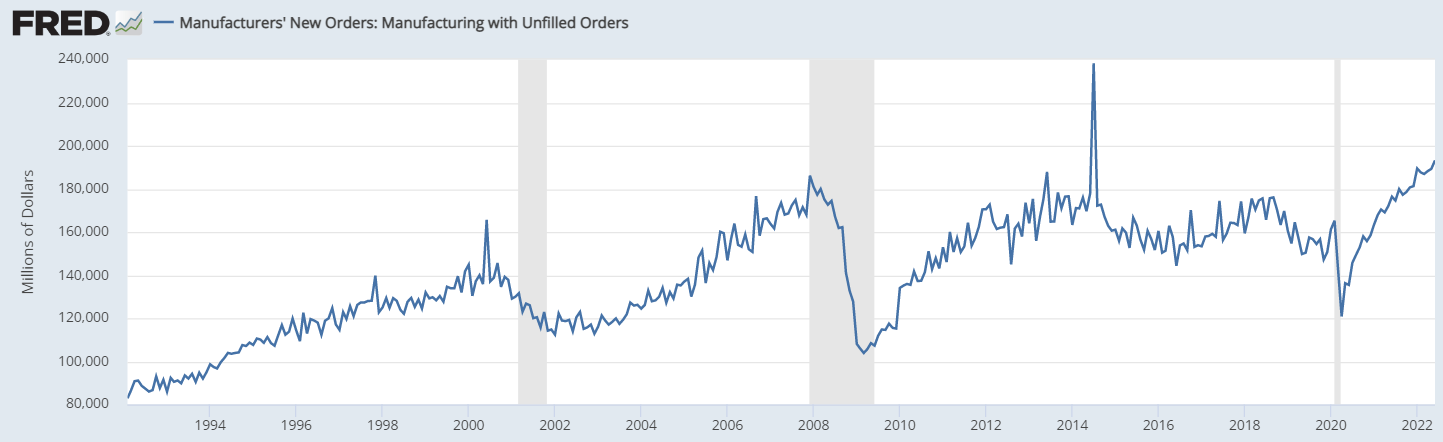

Not adjusted for inflation but not showing signs of recession:

If oil prices remain near current levels the inflation is over and we’re back to pre-Covid low inflation and slow growth, with a government deficit of maybe 5-6% of GDP (including the new interest expense from the rate hikes which support the economy) supporting demand and a Congress that believes the deficit has to come down to contain inflationary pressures.

But I think it’s far more likely that oil prices spike much higher as Saudis have hiked prices again and are working with Russia to destabilize the west. And with higher oil prices it all falls apart again: