This makes sense to me. We have had a post-Covid war slowdown in federal spending that is evidenced by the decelerating economy. But the federal deficit is still high enough to keep things muddling through at modest growth, helped some by the rate hikes which

are universally believed to slow things down when in fact the increased deficit spending for the additional federal interest expense adds a bit of (highly regressive) support for the economy:

are universally believed to slow things down when in fact the increased deficit spending for the additional federal interest expense adds a bit of (highly regressive) support for the economy:

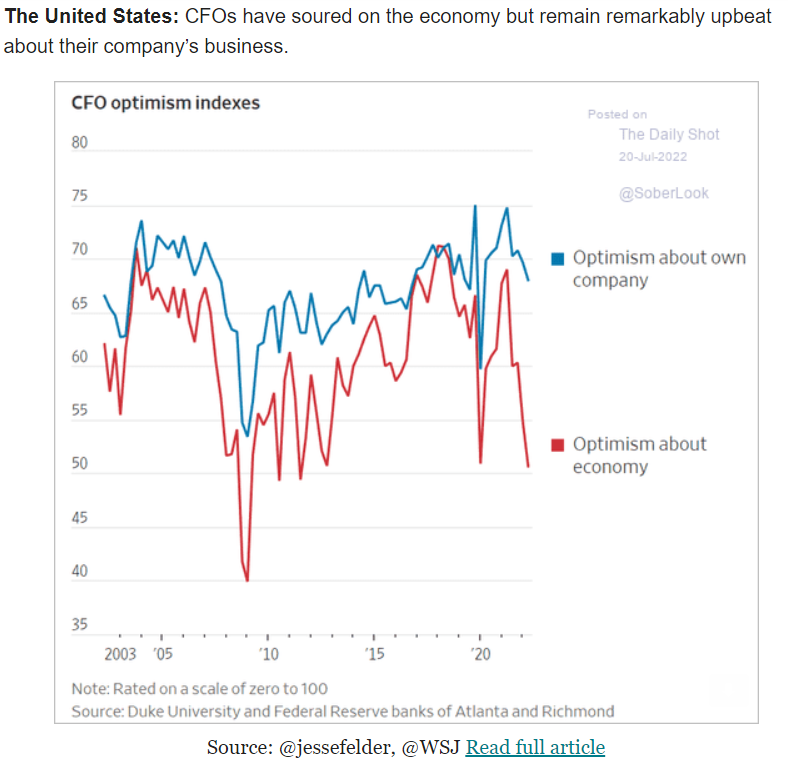

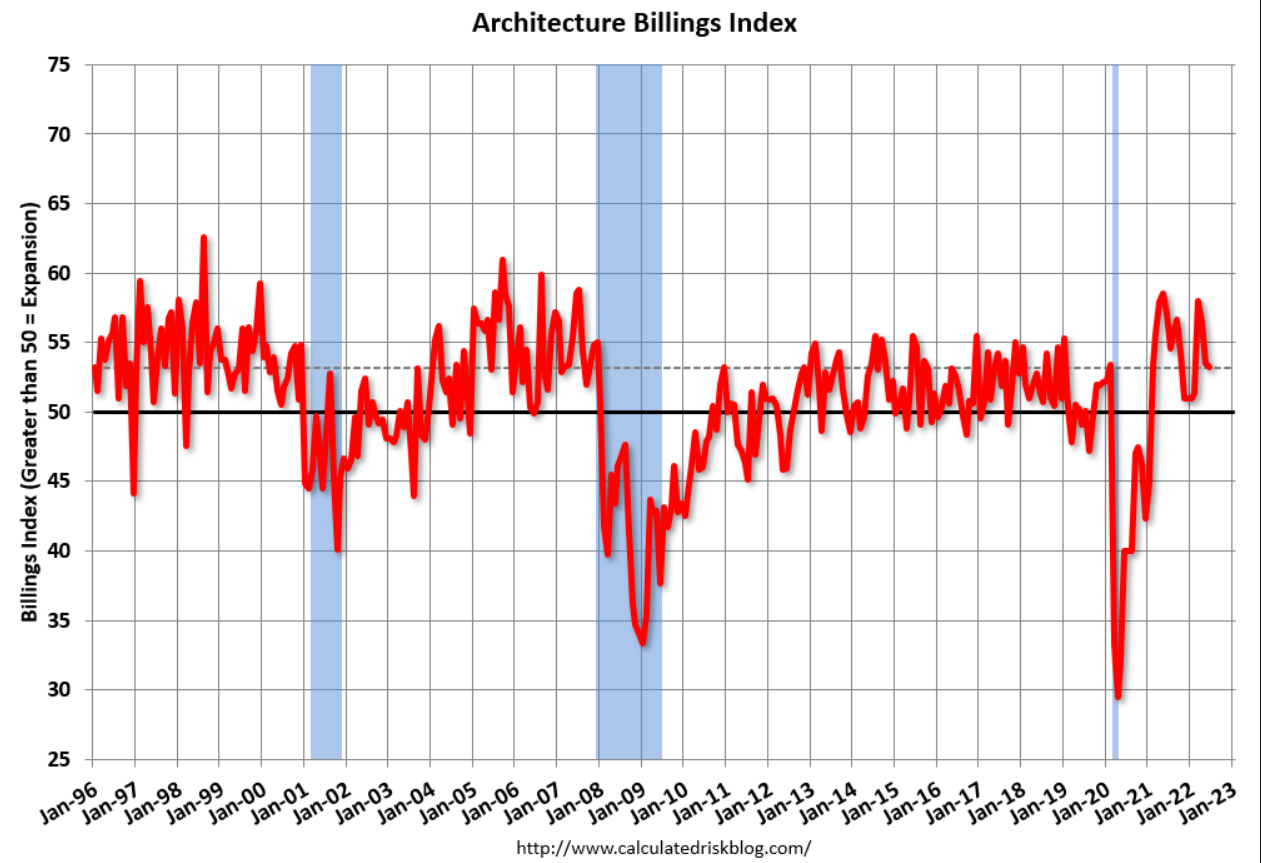

It has fallen off with the slowdown but remains reasonably high historically:

Down from the highs but still showing growth:

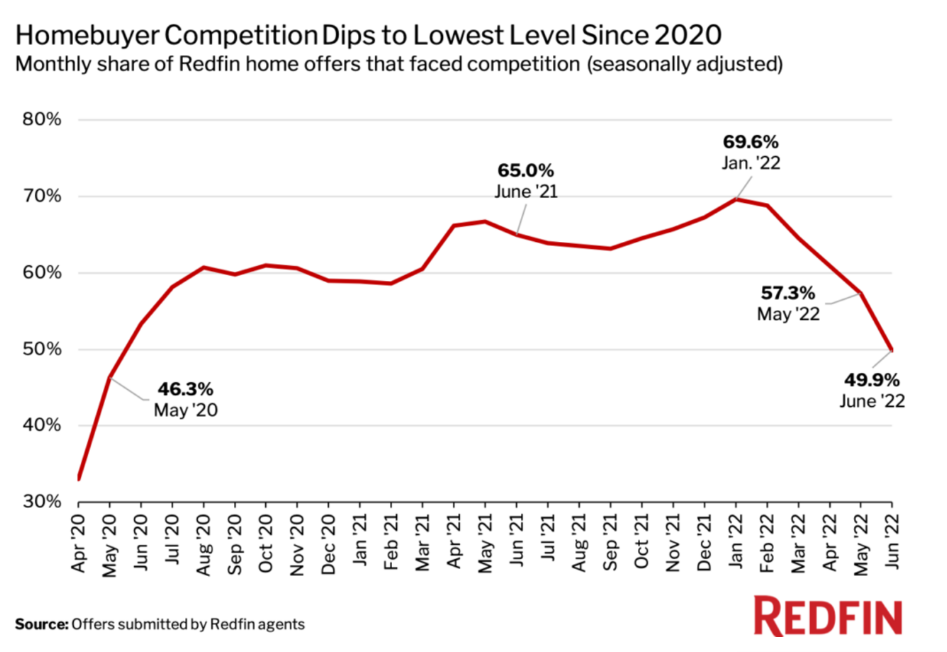

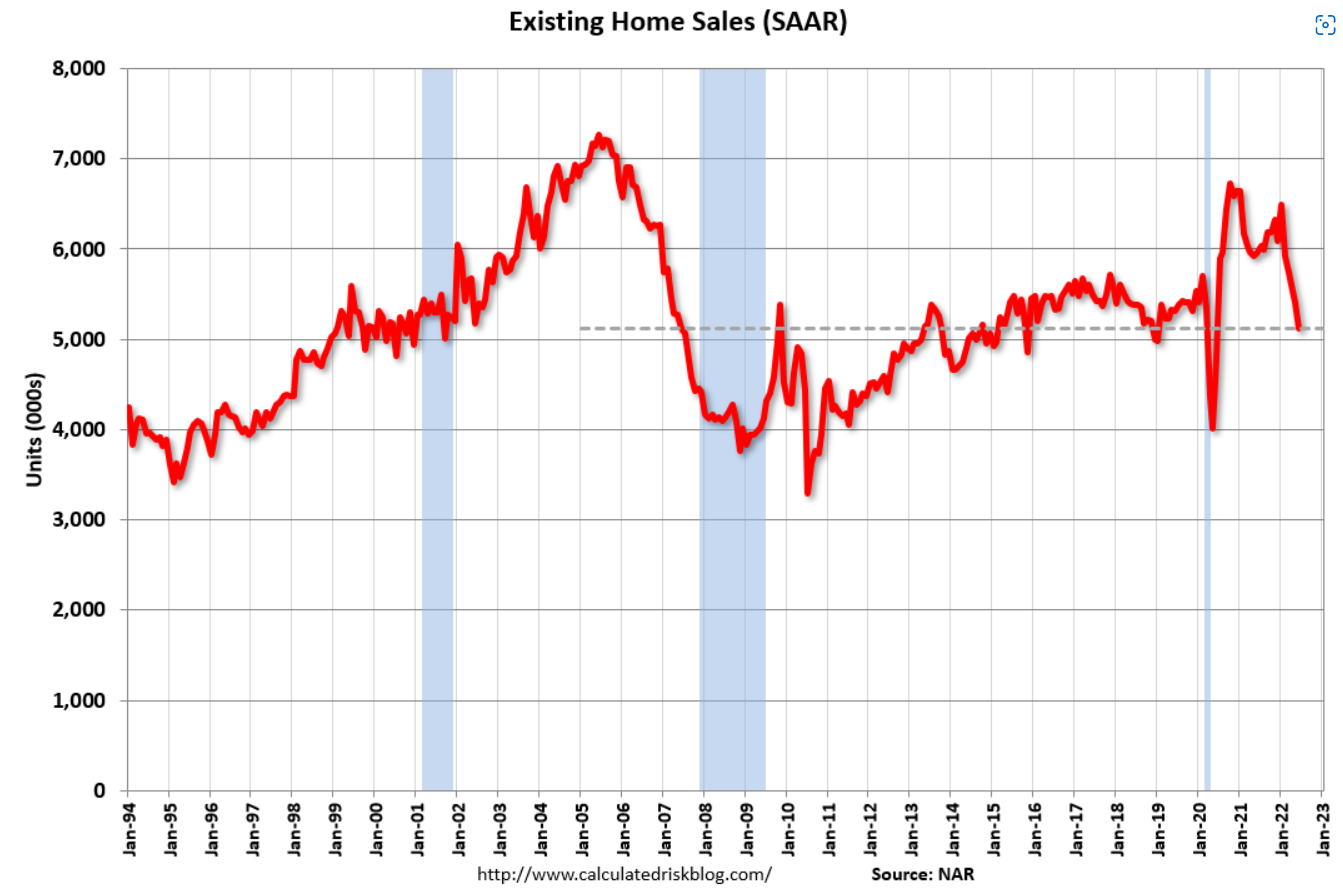

After a large Covid dip followed by a post-Covid recovery sales are just below where they were for most of the pre-Covid years. And with prices a lot higher nominal sales are still much higher:

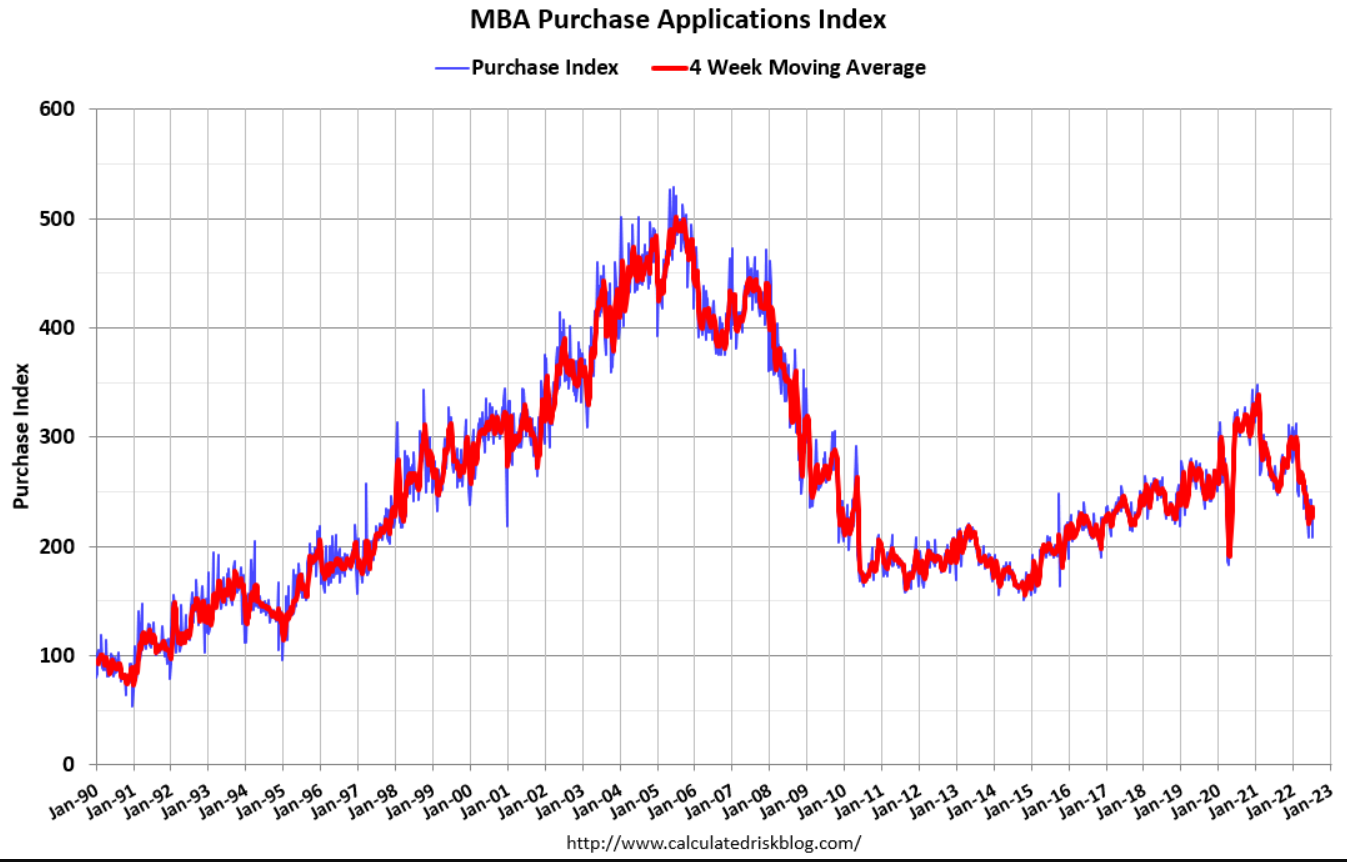

Mortgage purchases applications are also down to levels just below pre-Covid years:

Housing starts remain above pre covid levels, even with higher rates, and the chart gives a good indication of how much housing has declined in size relative to the rest of the economy since the 2006 peak:

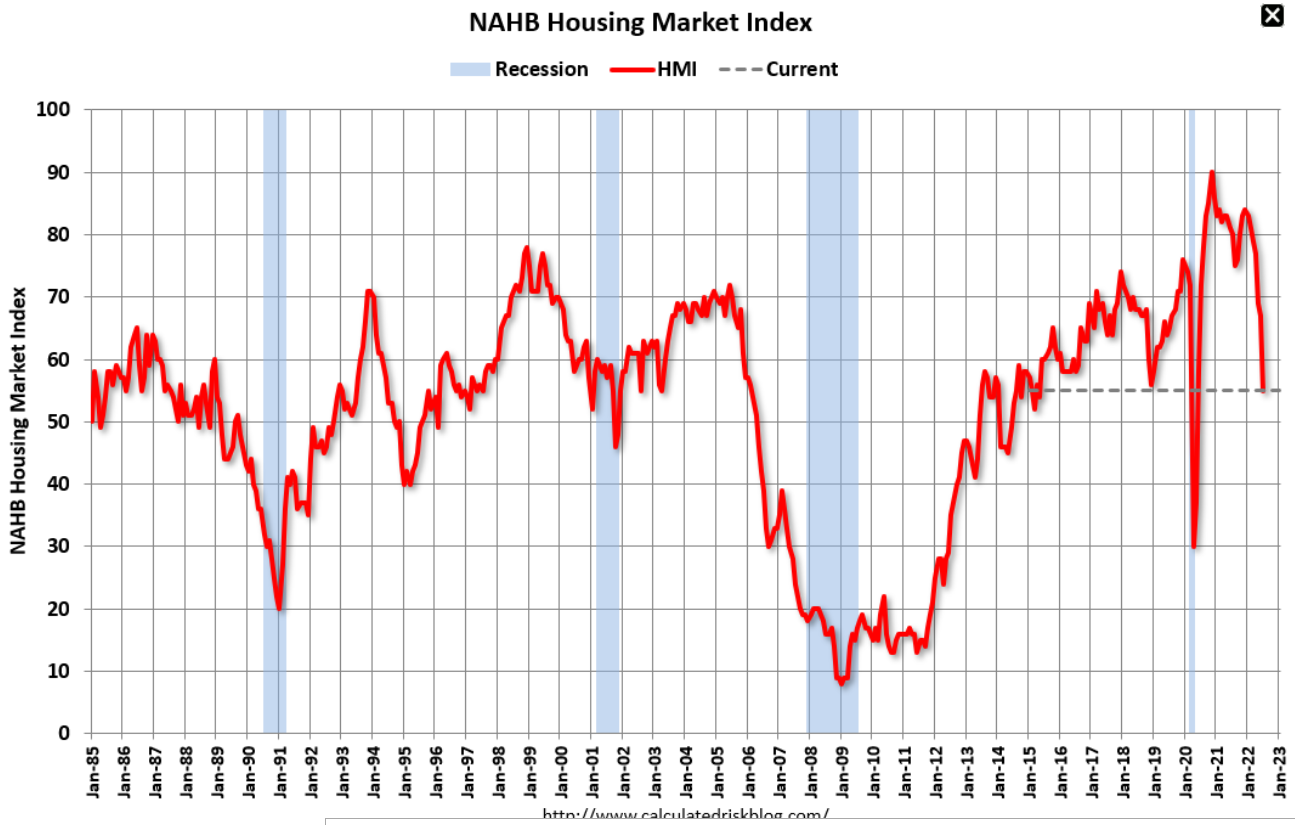

Confidence is down but still above 50 indicating modest growth is expected: