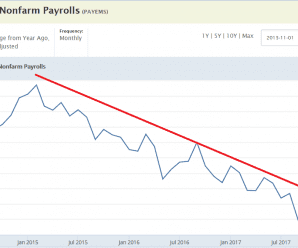

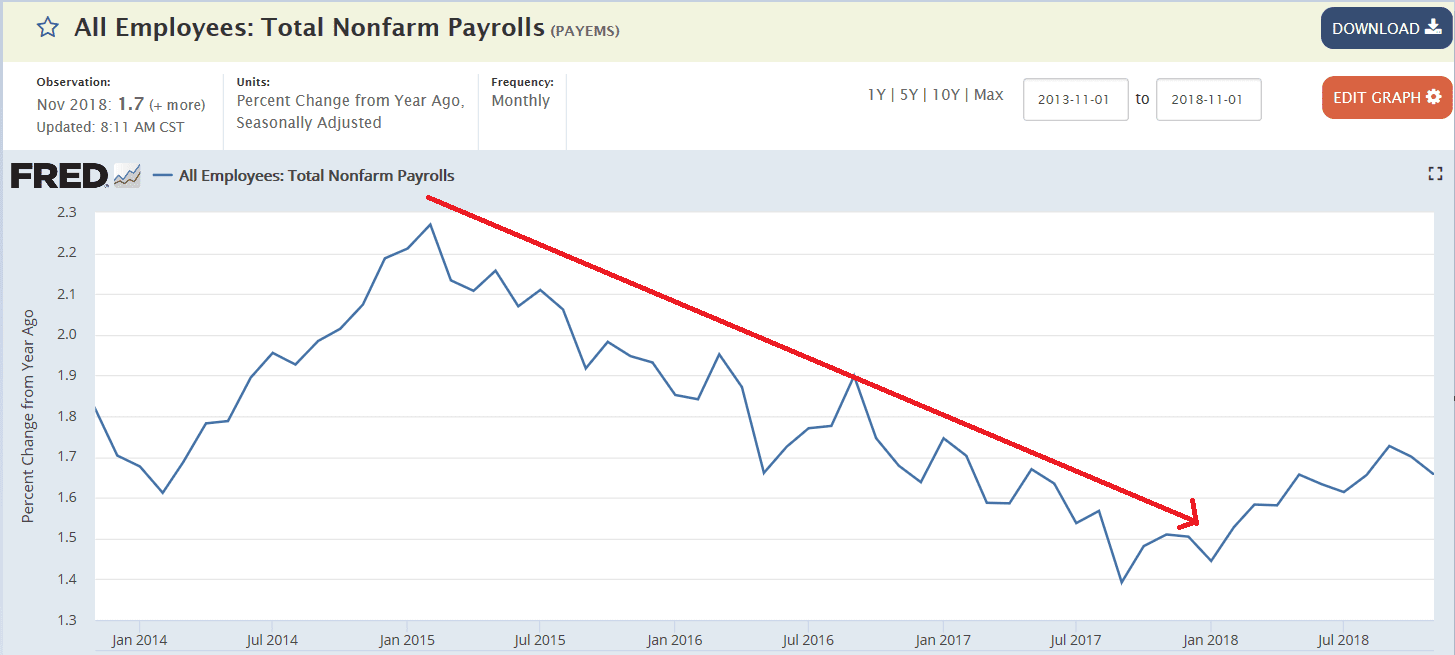

Employment growth had been decelerating with the collapse in oil capex in Dec. 2014, but had started to accelerate with the initial impact of the year-end tax cuts, which now look to be fading:

Highlights

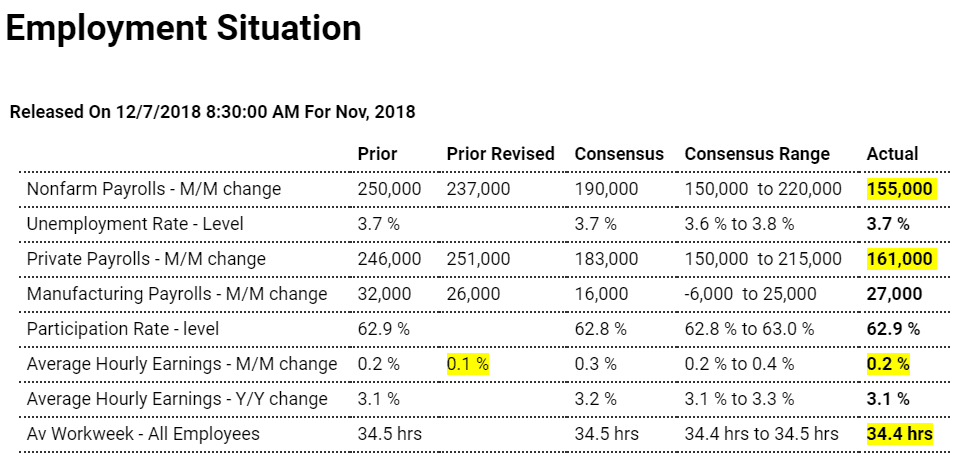

Sustainable non-inflationary strength is the indication from the November employment report as payroll growth proved favorable and moderate and wage pressures modest. Nonfarm payrolls rose 155,000 which is on the low side of expectations while average hourly earnings increased 0.2 percent, also on the low side of expectations. The year-on-year rate for earnings held unchanged at 3.1 percent, again on the low side of expectations.

The unemployment rate, at 3.7 percent, is also unchanged as is the labor participation rate at 62.9 percent, both matching Econoday’s consensus. A sign of moderation comes from average weekly hours which, at 34.4, is at the low end of expectations to hint at easing capacity stress. Manufacturing hours and overtime are soft which points to moderate results for the upcoming industrial production report.

Turning back to payrolls, manufacturing rose a very solid 27,000 in the only reading in today’s report that tops Econoday’s consensus. Trade & transportation, where capacity stress has been elevated, added a very strong 53,000 jobs with professional & business services up 32,000 which is solid but still low for this reading to suggest that the scramble to find full-time employees may be easing.

This report does not raise any urgency for the Federal Reserve to tighten monetary policy and may well raise talk of fewer rate hikes to come in 2019.

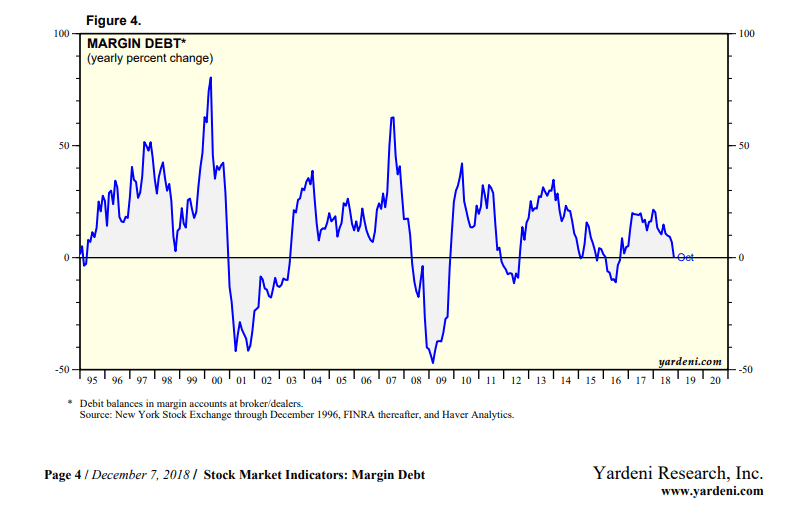

A rising stock market coincides with rising margin debt that seems to provide support for the macro economy. And a drop in the stock market causes a drop in margin debt that removes that support. Additionally, a similar thing happens with other lenders who accept stock as collateral: