Highlights

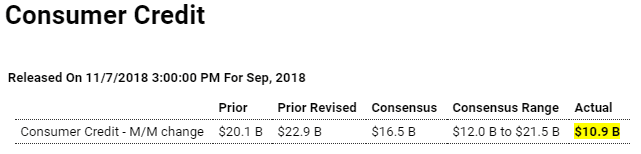

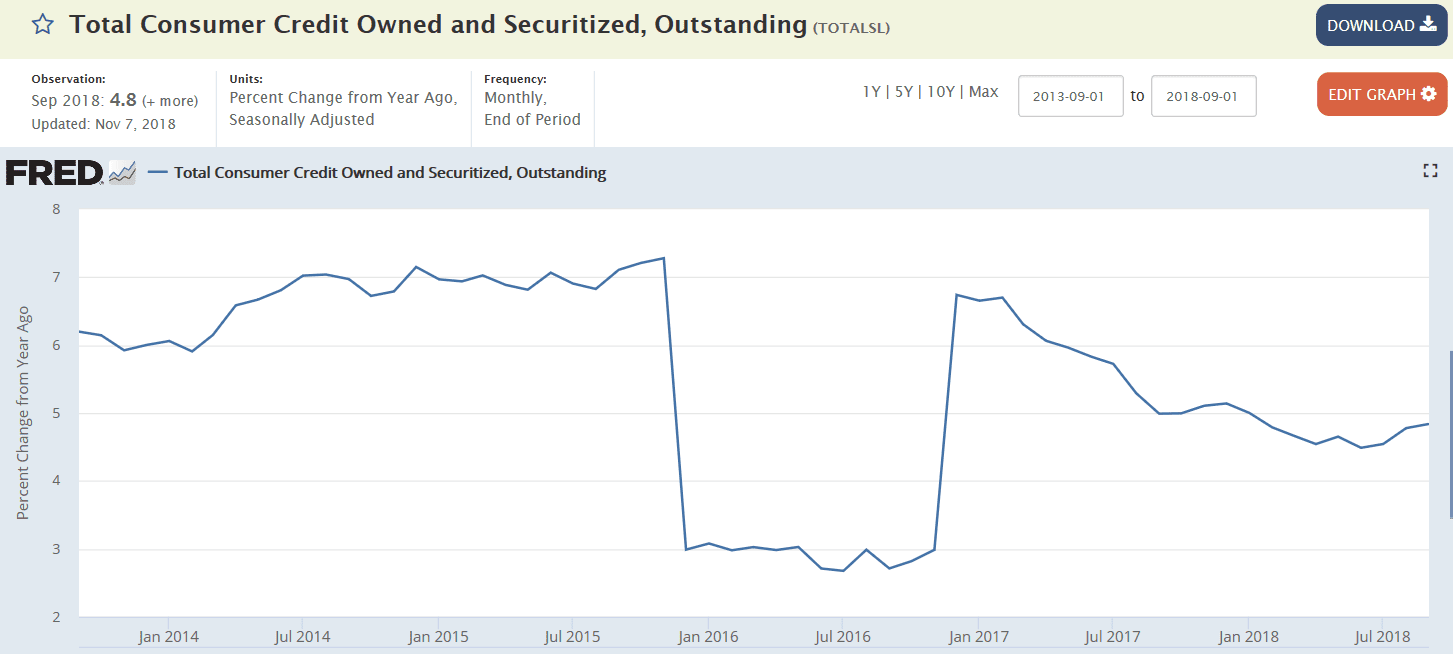

Consumer credit growth slowed more than expected to just $10.9 billion in September, below Econoday’s consensus range and less than half of the upwardly revised $22.9 billion August increase. Growth slowed in nonrevolving credit, which rose $11.2 billion in September versus $18.3 billion previously, while growth in revolving credit stalled completely and posted a marginal decline of $0.3 billion. Gains in nonrevolving credit reflect vehicle financing and student loans while gains in revolving credit reflect credit-card debt.

Today’s report shows that despite strong employment, consumers were cautious in September after splurging a little in August and chose to pay down some of their credit card debt instead. While it may be a plus for household wealth, the thriftiness exhibited is not a plus for consumer spending and the GDP.

Highlights

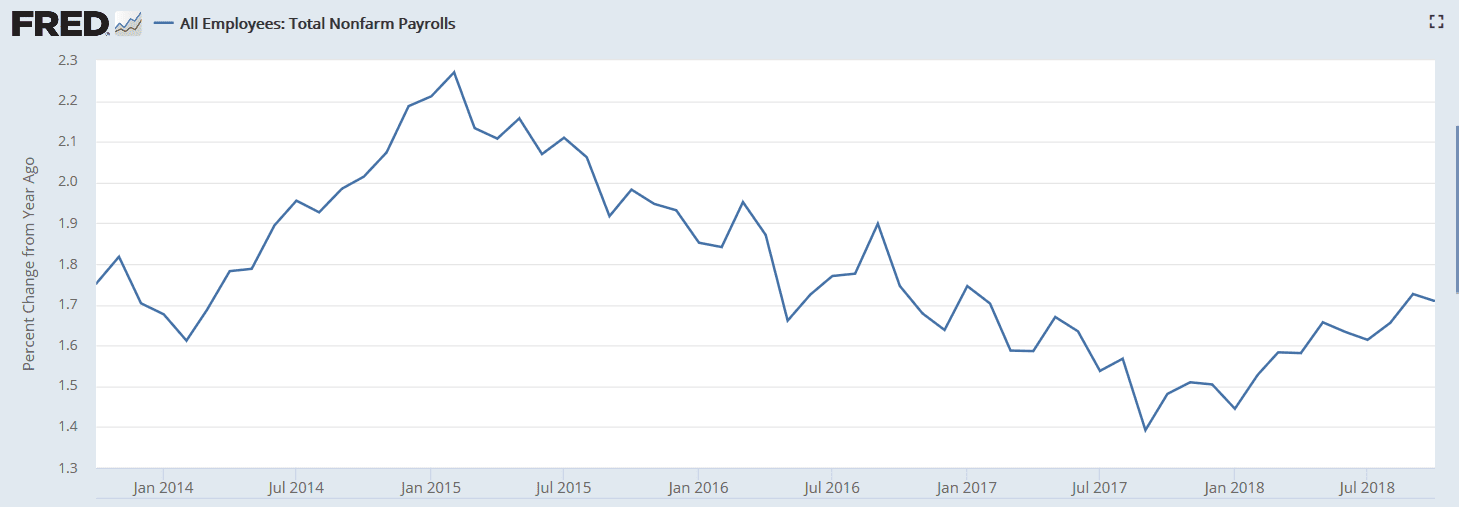

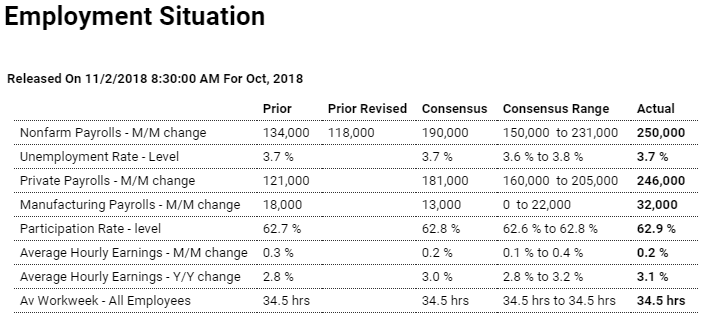

In a very strong showing in which wage pressures may be less severe than they look, October’s nonfarm payroll growth easily surpassed expectations, rising 250,000 in the month and with strength centered in two sensitive components to economic pivots: manufacturing with a much higher-than-expected 32,000 gain and professional & business services where payrolls rose 35,000. And available labor in construction is now more scarce with payrolls here up a very sharp 30,000.

Average hourly earnings posted an expansion high year-on-year rate, up 3 tenths to 3.1 percent. But, importantly, this reflects an easy comparison with October last year. The month-to-month pace actually eased, rising at 0.2 percent vs two 0.3 percent gains and one 0.4 percent gain in the three prior reports.

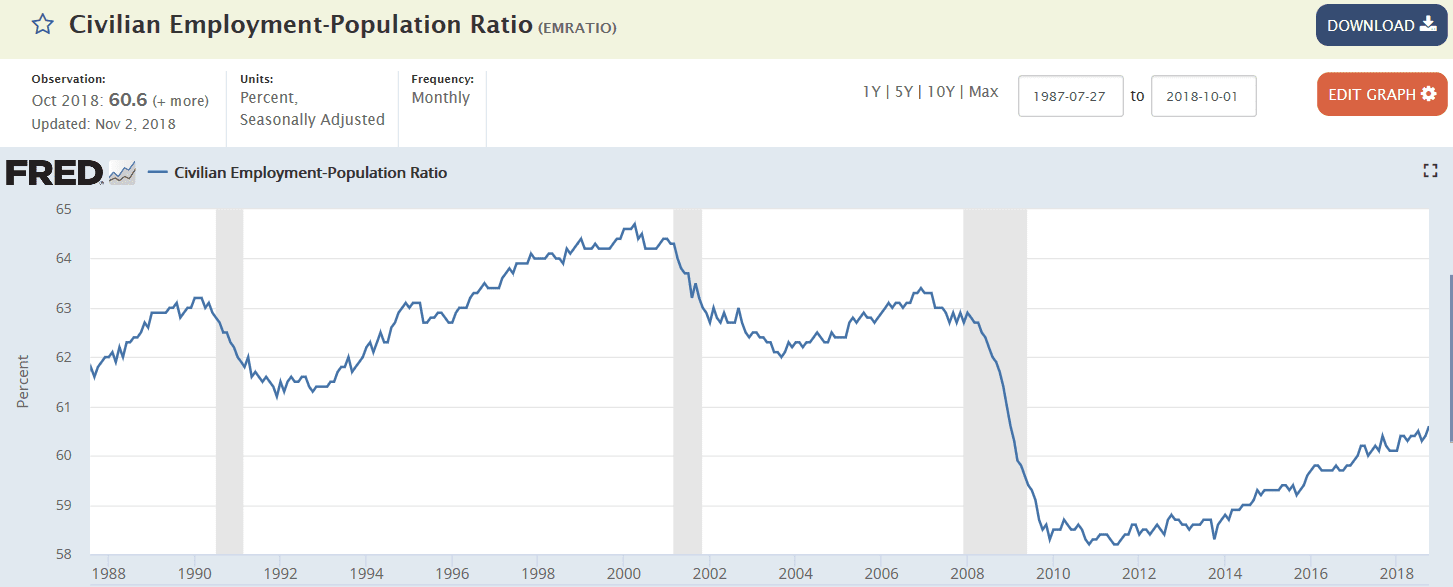

The unemployment rate held at a low and favorable 3.7 percent with the labor participation rate improving 2 tenths to 62.9 percent.

The monthly slowing in wages removes at least some of the urgency felt by the hawks at the Federal Reserve who were voicing their views at the September FOMC that policy may, in a need to cool the economy and the labor market, have to rise beyond neutral and into the restrictive zone. The Fed may not raise rates at their meeting later this month, but today’s report does confirm, and strongly so, expectations for a rate hike at the December FOMC.