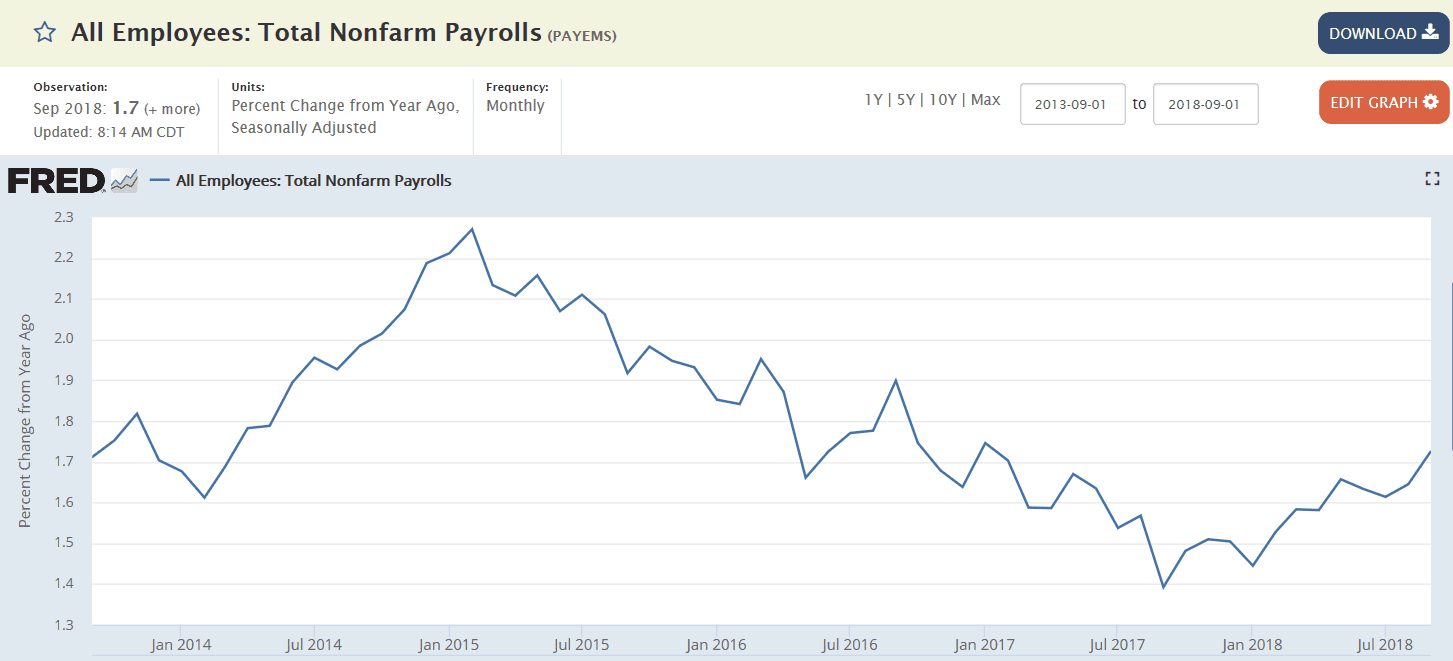

Looks like it’s turned up a bit with the tax cuts?

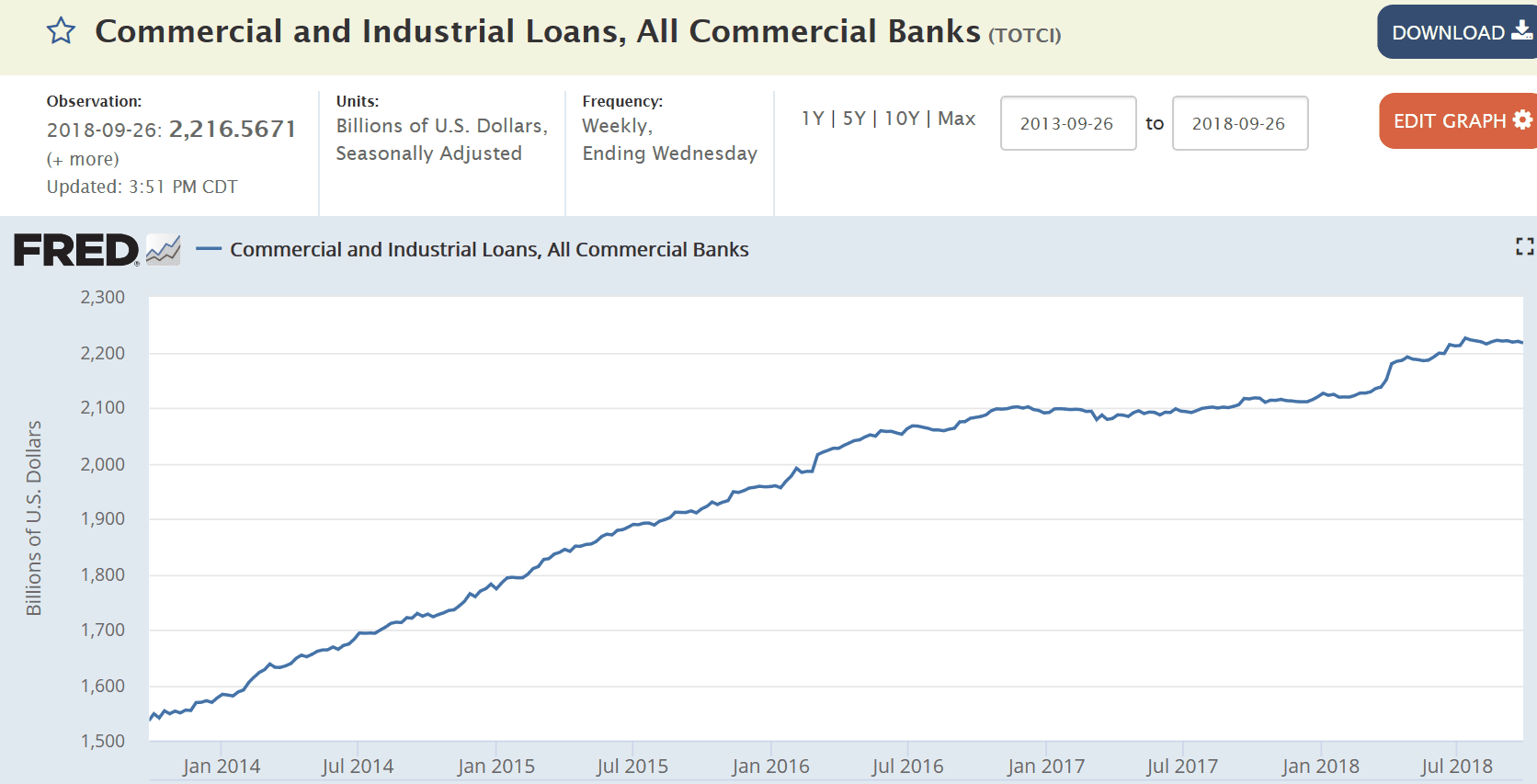

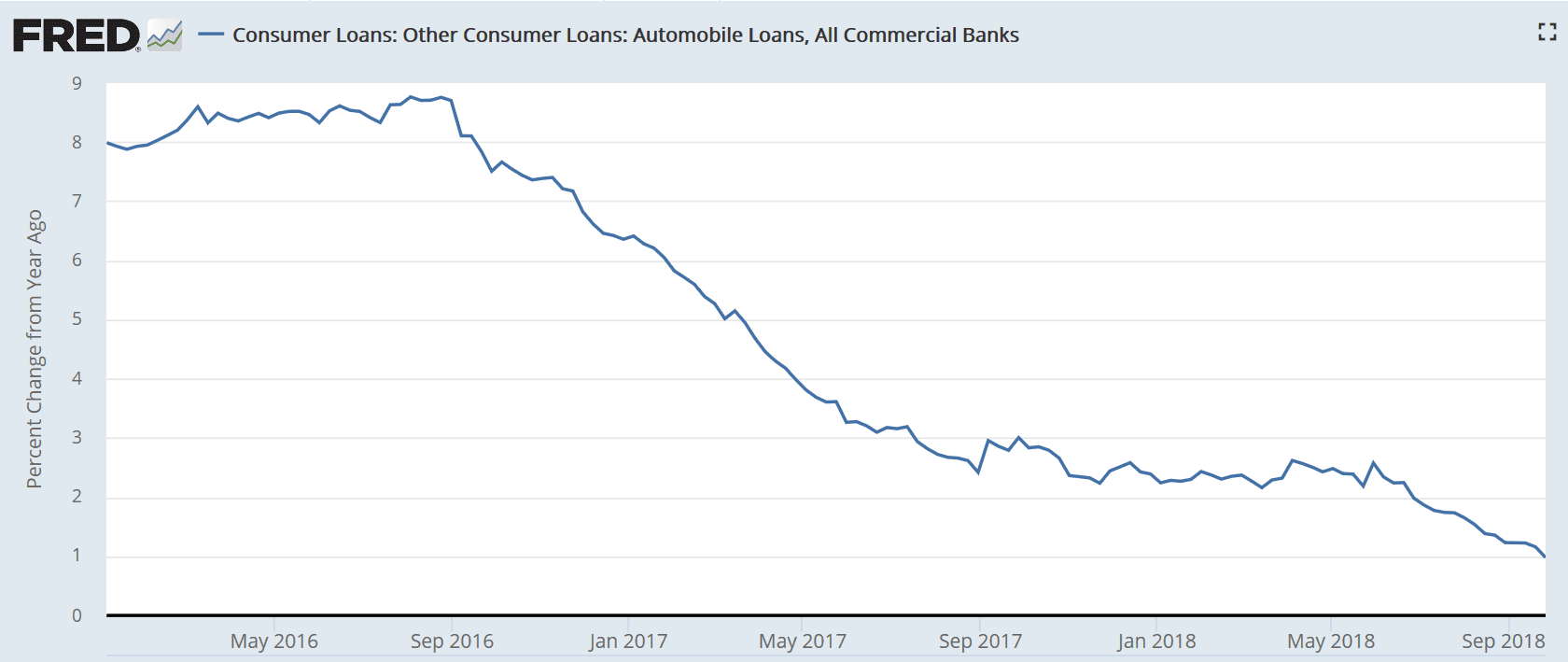

Looks like this source of private sector deficit spending has gone flat again:

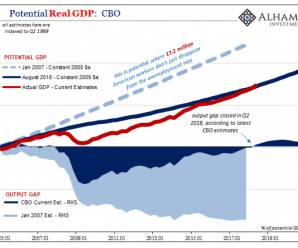

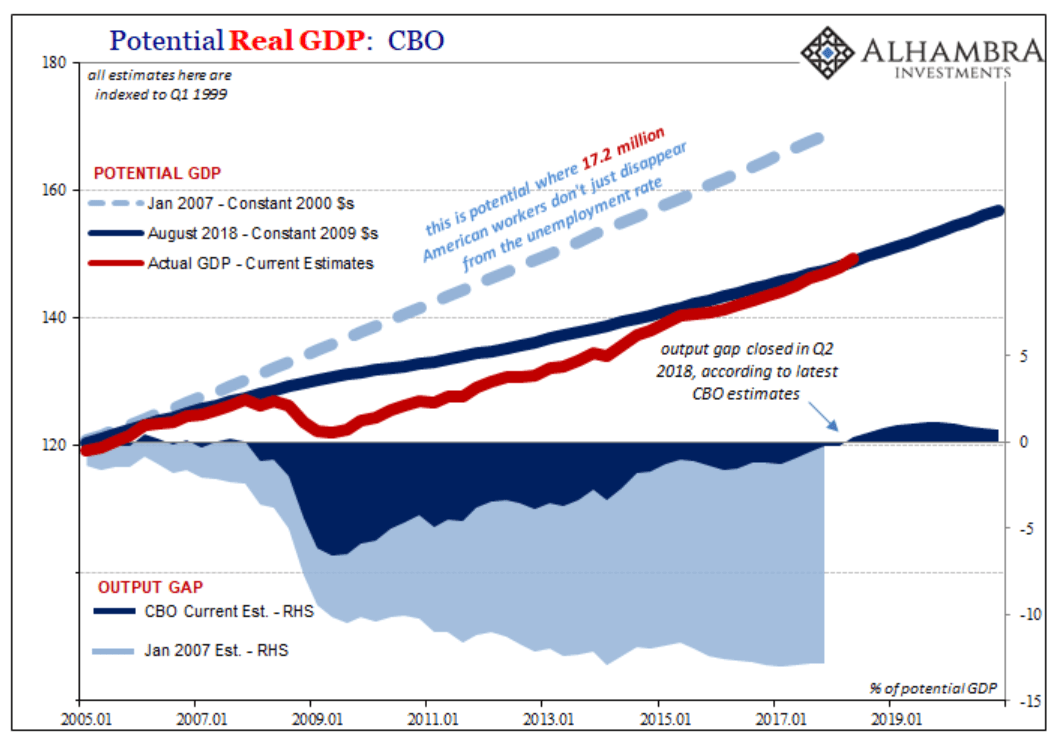

Looks to me a lot more like a deficiency of demand than a demographic shift:

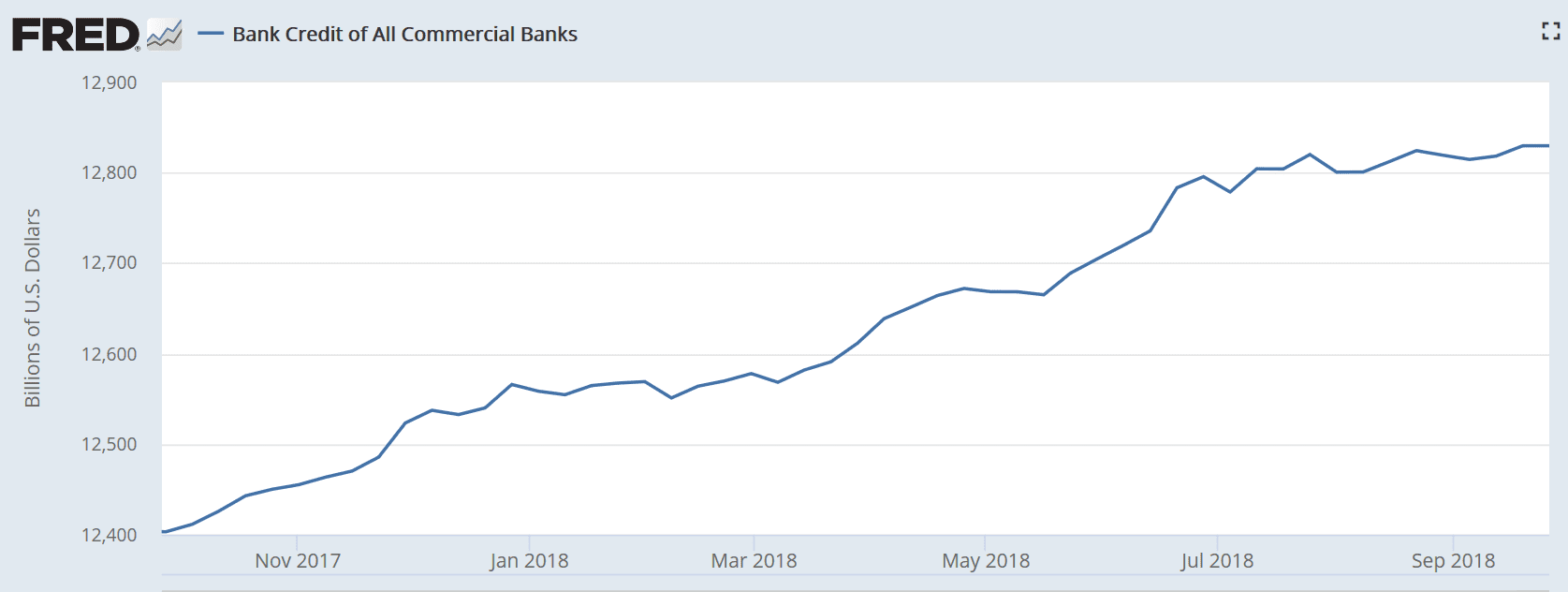

This is a source of $US deficit spending that ‘offsets’ unspent incomes:

China to raise billions in rare US debt deal as trade tensions persist

(Nikkei) China is planning to sell $3 billion in U.S. dollar bonds this month. China is planning to sell bonds that mature in five, 10 and 30 years, and become a regular issuer of sovereign debt. In October 2017, China issued $2 billion in five- and 10-year bonds at slightly higher interest rates than what the U.S. Treasury was paying to borrow at the time. Asian companies outside of Japan have sold $185 billion in U.S. dollar bonds so far in 2018, of which roughly half has come from Chinese firms, according to ANZ Research. Overall Asia ex-Japan corporate debt issuance is down 17% from a year ago.