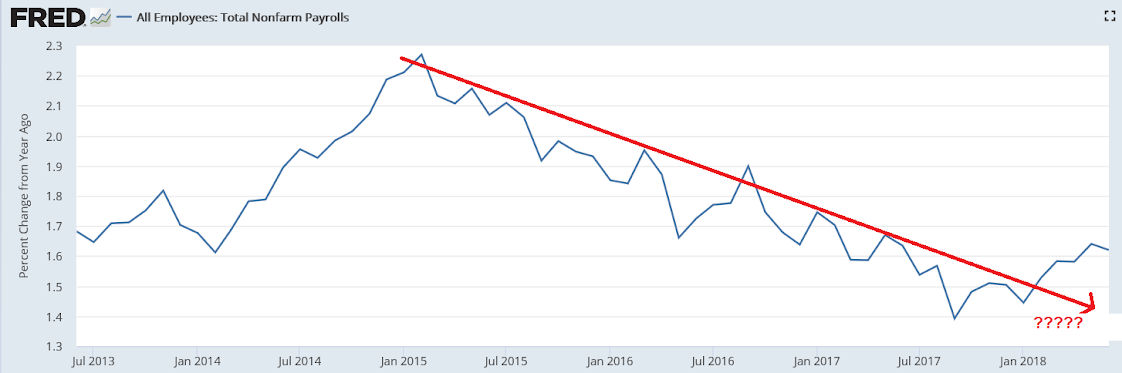

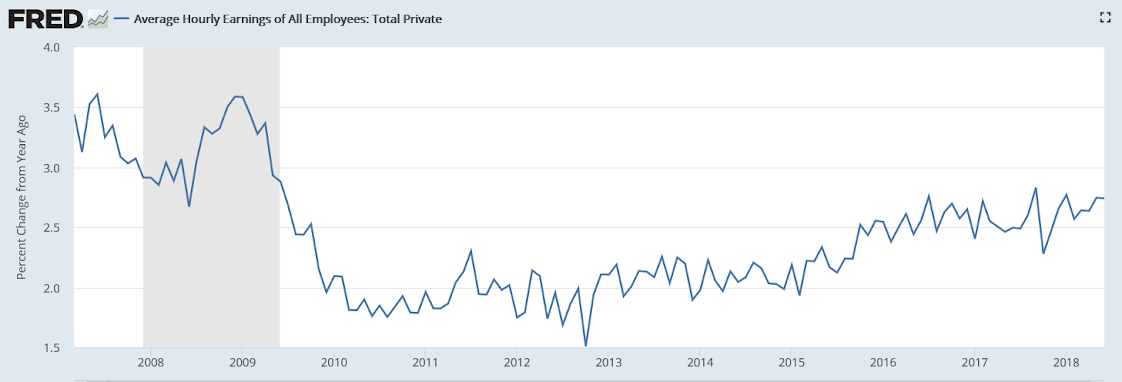

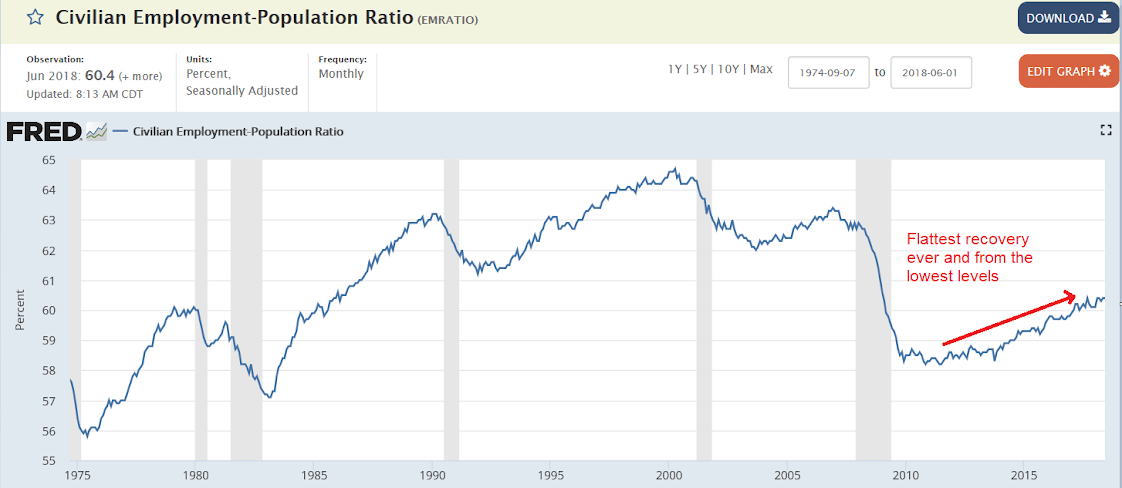

Low wage growth tells me spending remains under pressure:

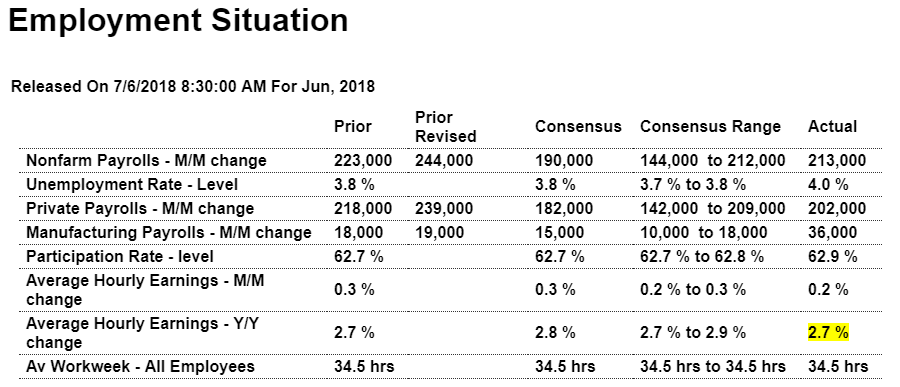

Highlights

A very healthy employment report that shows brisk growth and also a movement into the workforce is headlined by a stronger-than-expected 213,000 rise in nonfarm payrolls for June which just tops Econoday’s consensus range. A sharp rise in the number of unemployed actively looking for a job, to 6.564 million from 6.065 million in May, lifted the unemployment rate 2 tenths to 4.0 percent and also lifted the participation rate 2 tenths to 62.9 percent.

More people looking for work is not a risk for wage inflation as average hourly earnings rose only 0.2 percent on the month and held unchanged on the year at 2.7 percent. Both of these results are at the bottom of the consensus range. Hours data are mixed with the workweek for all employees unchanged at 34.5 hours but with manufacturing showing a bounce back following a May disruption in the auto sector.

The payroll breakdown is headlined by manufacturing which surged 36,000 to double Econoday’s high estimate. Construction added a sizable 13,000 with mining once again higher, up 5,000. Business is bustling and companies are turning to outside contractors with professional & business services up 50,000 and within this temporary help up 9,000, both strong gains. Showing declines, however, are trade & transportation, offering evidence that truckers are hard to find, and also a 22,000 setback for retail which had popped higher in May.

The rise in the number of people looking for a job is very good news, indicating that discouraged workers are more confident in their prospects. And very importantly, this gives FOMC members some breathing room as it reduces wage pressures and underscores Jerome Powell’s stated desire to bring more people into the workforce.

Remains depressed:

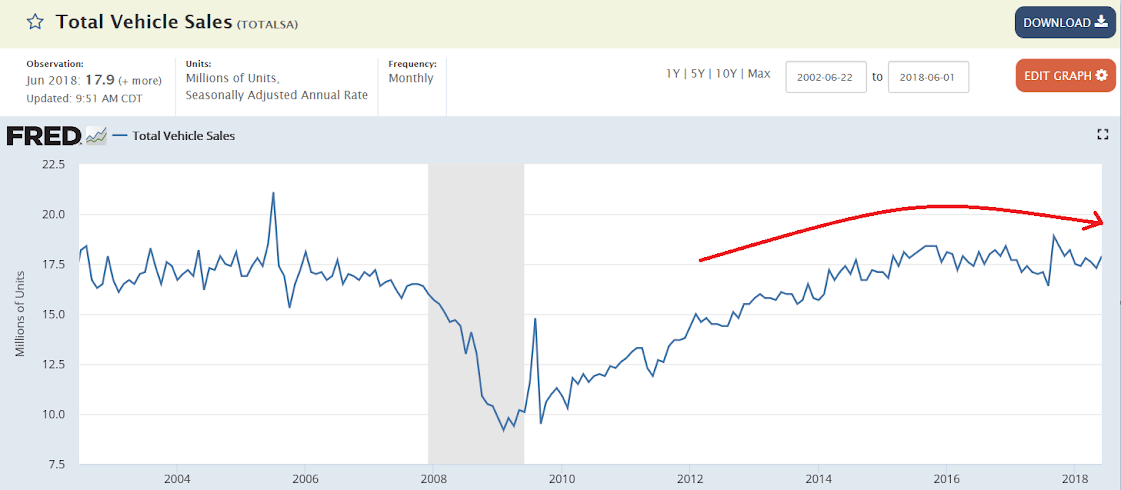

$US spent up only about 2.5% year over year:

U.S. Auto Sales Remain Strong, but Tariffs Could Squash Momentum

(WSJ) — Overall U.S. auto sales increased by 1.9% in the first half of the year. June sales increased by about 5%, according to analysts, boosted by an additional selling day compared with last year. This year, as the price of vehicles continues to rise and sales remain strong, consumers are on track to spend $215 billion on new vehicles in the first half of the year, nearly $5 billion more than the first six months of 2017, according to J.D. Power. The average new vehicle transaction price is expected to reach $32,221 for the first half of the year, a record, said J.D. Power.

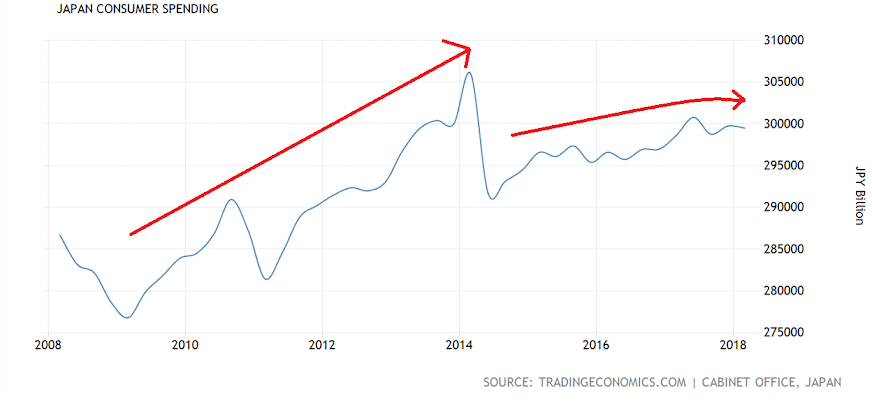

The weak yen policy helped corporate profits at the expense of the consumer:

Japan household spending falls for 4th month in May

TOKYO (Kyodo) — Japanese households reduced spending for the fourth straight month in May, government data showed Friday, further clouding the outlook for economic growth in the second quarter.

Spending by households with two or more people fell 3.9 percent from a year earlier to 281,307 yen ($2,543), the biggest drop since August 2016, according to the Ministry of Internal Affairs and Communications.

The ministry maintained its assessment that spending is “showing weakness.” Expenditures fell across a wide range, from eating out and clothing to durables such as TVs and cameras.

A ministry official who briefed reporters said that the decline was in part due to the Golden Week holiday being shorter than the previous year.

The recent weakness in private consumption, which accounts for the majority of economic activity in Japan, hurts the prospects for the country to rebound from a contraction in the January-March quarter in April-June.