Worse than expected and downward revisions as well. Seems related to what looks like a continuing credit collapse:

Highlights

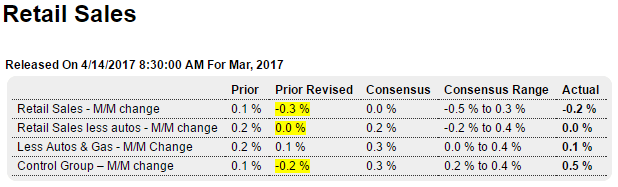

First-quarter consumer spending is in trouble. Retail sales fell 0.2 percent in March which is under the Econoday consensus for no change. Importantly, February sales are revised sharply lower, to minus 0.3 percent vs an initial gain of 0.1 percent.

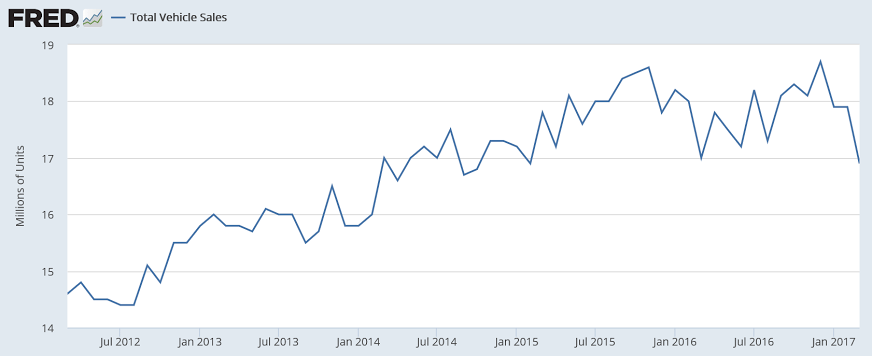

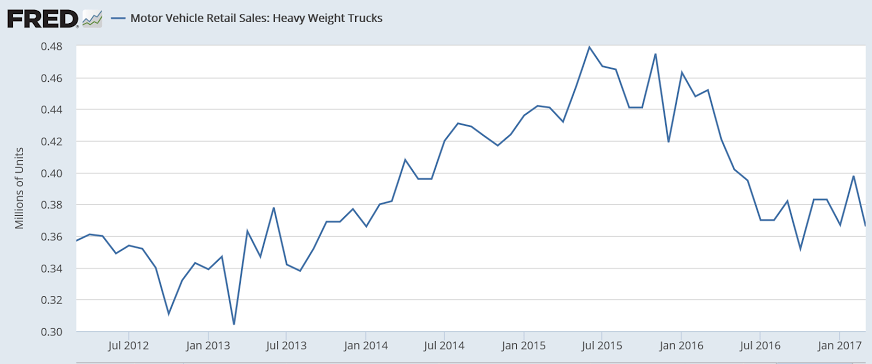

Vehicle sales round out the quarter with a 3rd straight sharp decline at minus 1.2 percent. Sales at gasoline stations, due to lower prices, fell 1.0 percent. But when excluding both vehicles and gasoline, sales could only manage — despite sky high consumer confidence — a second straight 0.1 percent increase.

Other areas of weakness include sporting goods which fell 0.8 percent and furniture stores which were down 0.3 percent. And two special areas of weakness are restaurants which fell 0.6 percent for a second straight decline and building materials which fell 1.5 percent. These last two components are excluded in the control group reading which, boosted by a 2.6 percent gain for electronics & appliances and supported by a 0.3 percent increase for general merchandise, rose an outsized 0.5 percent. But even here, February sales for the control group are revised 3 tenths lower and now stand at minus 0.2 percent.

There are plenty of bad luck wildcards for March including heavy weather and late tax refunds. But today’s report also scales down what had already been a disappointing February. Total consumer spending (which includes services) came in with only 0.1 percent and 0.2 percent gains in the first two months of the year and today’s February revision points to the same for February’s retail sales component (note also that January retail sales are revised down 1 tenth to a 0.5 percent gain). Consumer spending makes up 70 percent of GDP and today’s results, however much they may raise expectations for a snap back, are certain to lower expectations for the first quarter.

Econintersect Analysis:

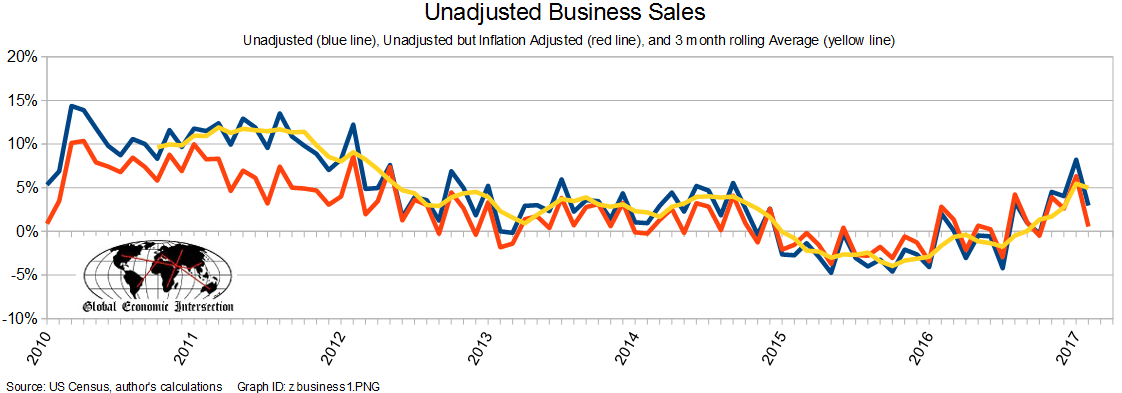

unadjusted sales rate of growth decelerated 5.3 % month-over-month, and up 3.0 % year-over-year unadjusted sales (but inflation adjusted) up 0.6 % year-over-year unadjusted sales three month rolling average compared to the rolling average 1 year ago decelerated 0.5 % month-over-month, and is up 5.0 % year-over-year.

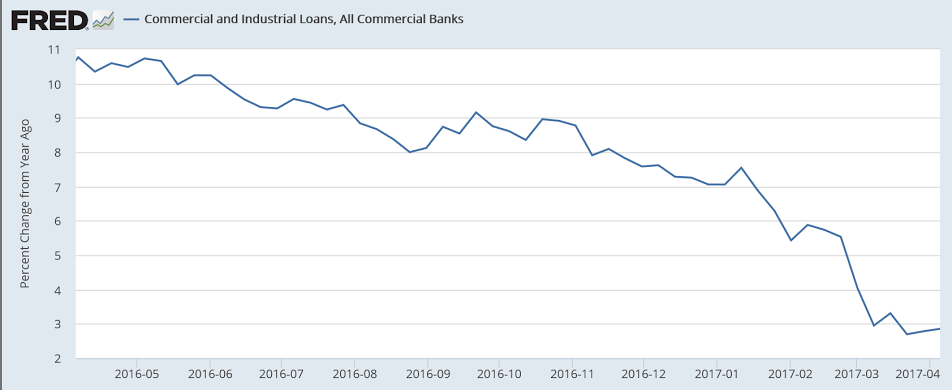

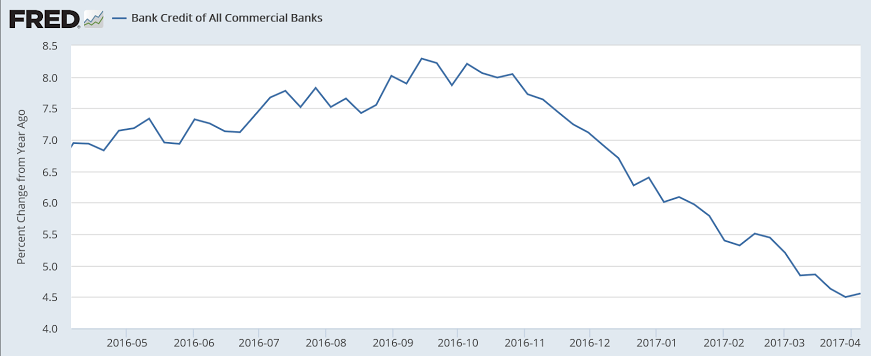

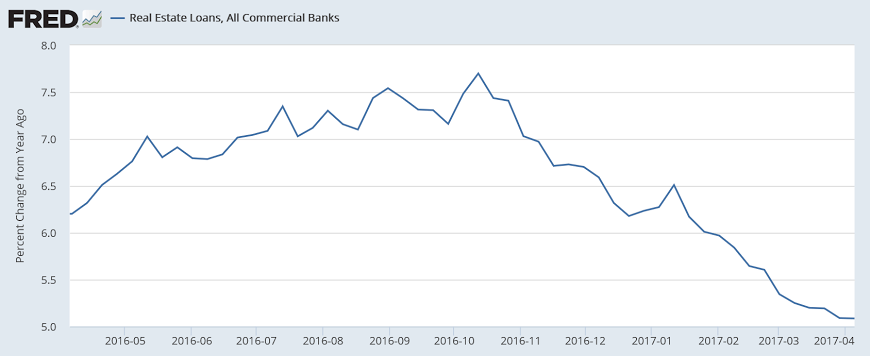

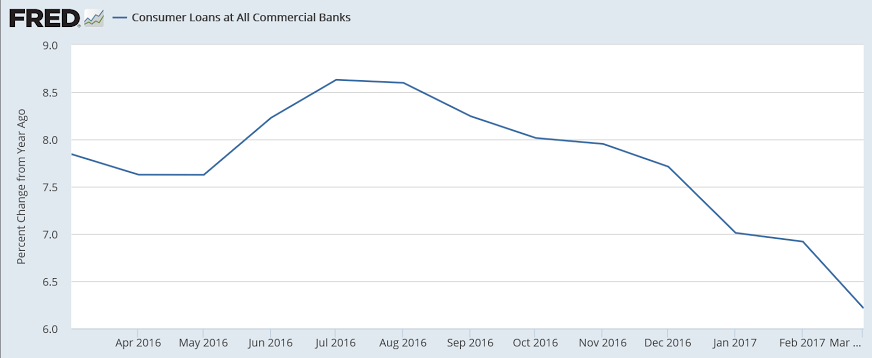

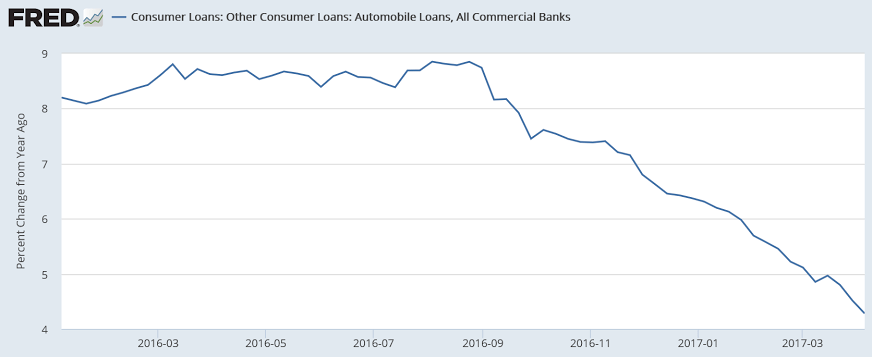

No recovery in sight yet for bank credit growth, which has been the engine driving spending: