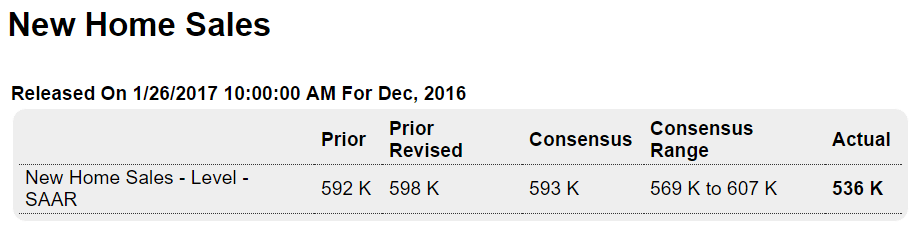

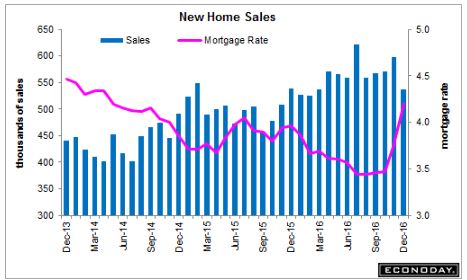

Big miss here. As previously discussed, it’s a case of lenders raising rates due to Fed fears when demand is low, further reducing demand:

Highlights

Consistently volatile is the well deserved reputation of the new home sales report. December sales of single-family homes plunged 10.4 percent in the month to a far lower-than-expected annualized rate of only 536,000. In a small offset, the prior two months have been revised upward by a combined 14,000 (to 598,000 for November and to 571,000 for October).

The 3-month average is of top importance when looking at this report and here the news is less downbeat. Yet the average is down, 12,000 lower in the month to 568,000 which is the softest reading since June. And the year-on-year sales rate, which had been in the double digits, is now negative, at minus 0.4 percent.

The good news in the report is supply which rose 10,000 to 259,000 and is 10.2 percent higher than a year ago. And the drop in sales has also eased the squeeze with supply relative to sales rising to 5.8 months from 5.0 months.

One factor behind December’s sluggish sales appears to have been prices where the median, in what is more good news, jumped 4.3 percent to $322,500 for a year-on-year gain of 7.9 percent.

The positives aside, this report follows Tuesday’s soft results on the resale side with both pointing to a housing sector that, instead of rising into year-end, faded instead. This report, specifically its implications for broker fees in the housing sector, may be a marginal negative for tomorrow’s fourth-quarter GDP report.

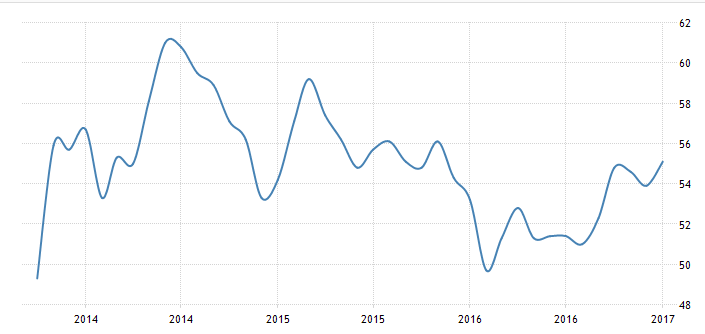

United States Services PMI

The Flash Markit Services PMI in the United States rose to 55.1 in January of 2017 from 53.9 in December, beating market expectations of 54.4. It is the highest reading since November of 2015, due to a robust expansion of business activity and an increase in incoming new work. Employment continued to rise although moderated from December’s 15-month peak and average costs went up. In addition, companies reported the strongest business outlook for just under two years.

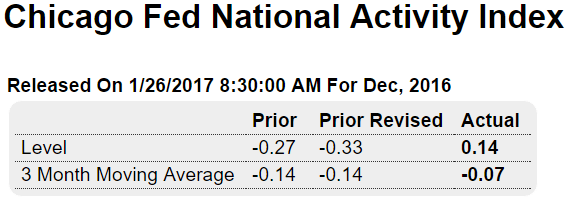

3 month average of this volatile series is still negative:

Highlights

Utility production gave the national activity index a lift in December, to plus 0.14 from a minus 0.33 in November (revised). The production component, boosted by demand for heating, rose to plus 0.20 from November’s minus 0.30. Components for sales, orders & inventories as well as for personal consumption & housing and employment are all flat and little changed. Given the skewing effect from utilities, the 3-month average may be a truer reading of actual activity and it is modestly negative at minus 0.07, a reading that points to slightly lower-than-usual economic growth.

From The New York Times:

Trump’s Voter Fraud Example? A Troubled Tale With Bernhard Langer

The president told lawmakers the pro golfer had seen suspicious people voting while in line to cast his ballot, according to people there. One problem: Mr. Langer, a German, can’t vote.