The setbacks continue:

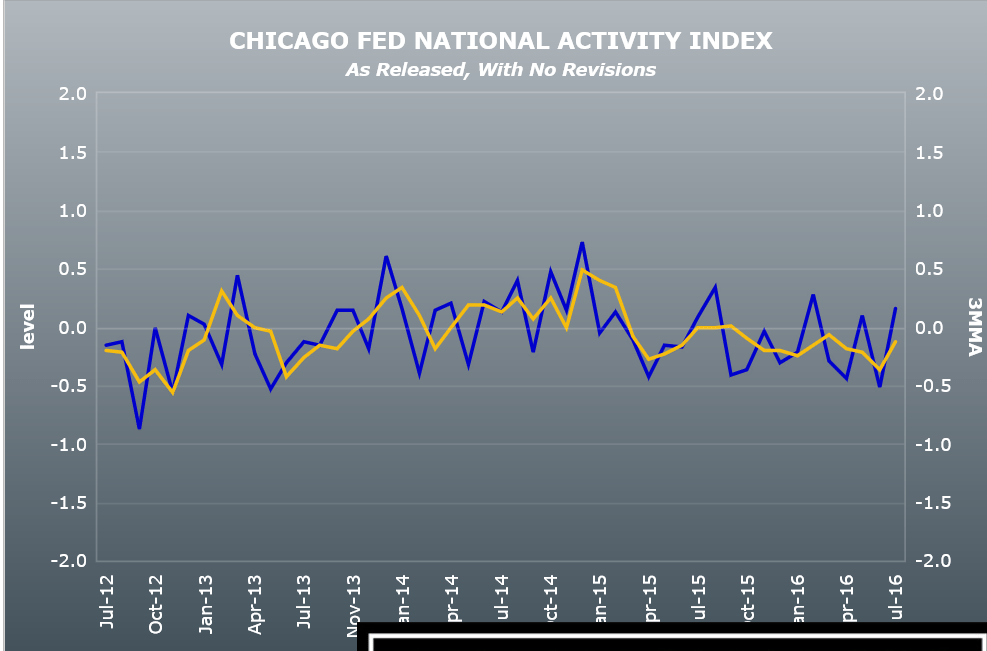

As is the general case, this indicator rose with the oil capex boom then peaked with the collapse in oil capex, and remains in negative territory:

Same here. Peaked when the oil capex boom ended and the 3 month average is still in negative territory:

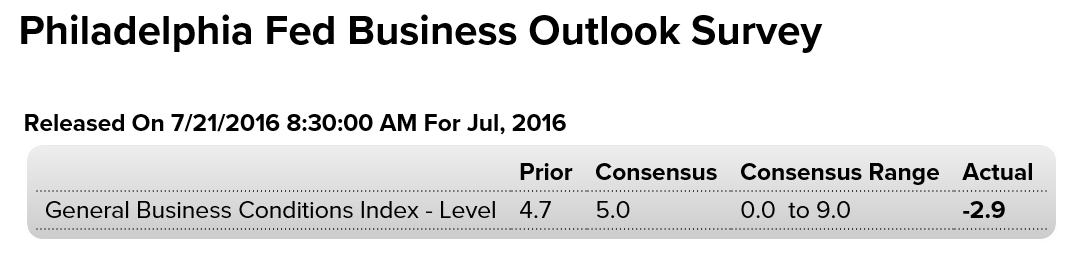

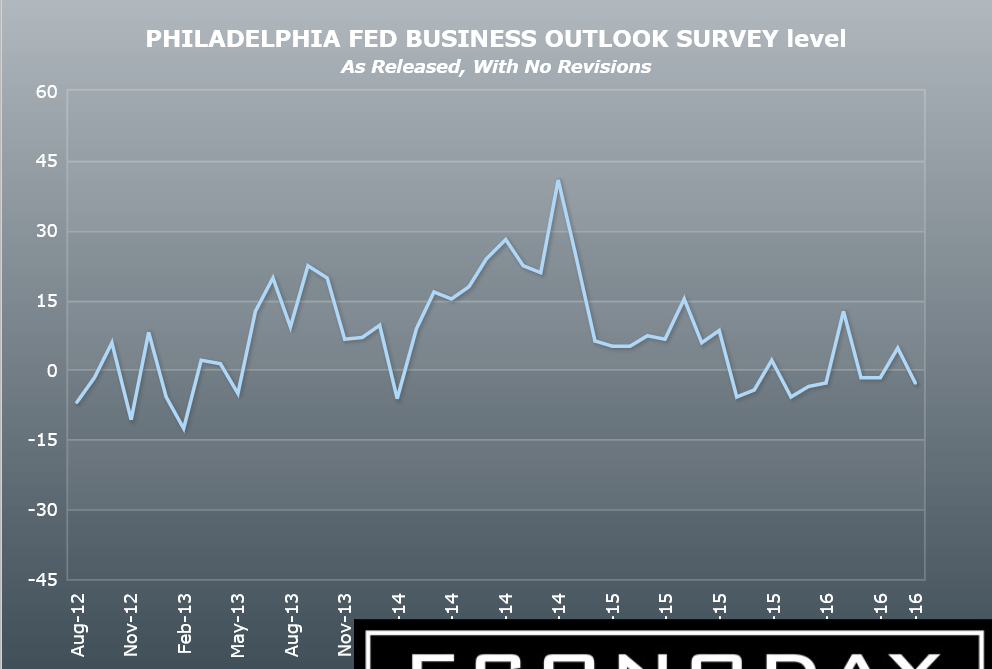

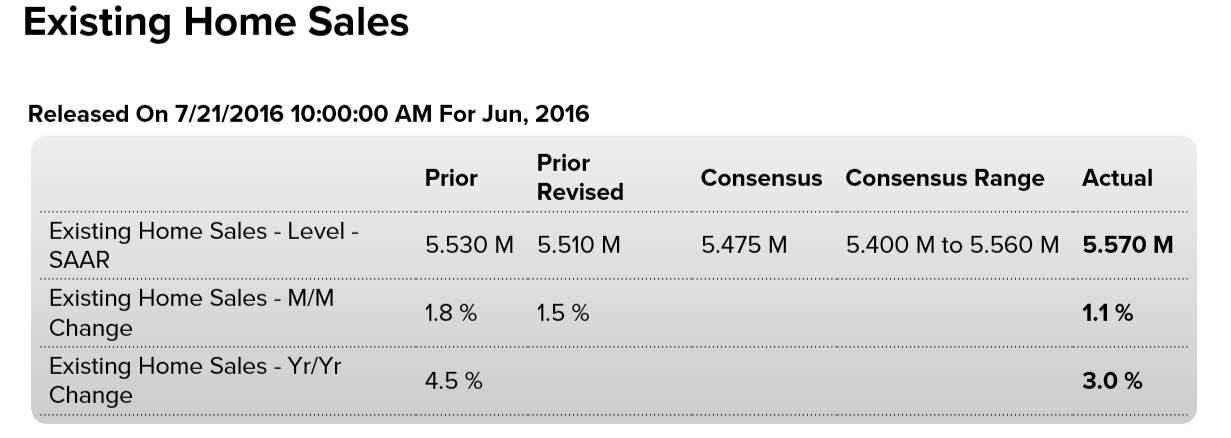

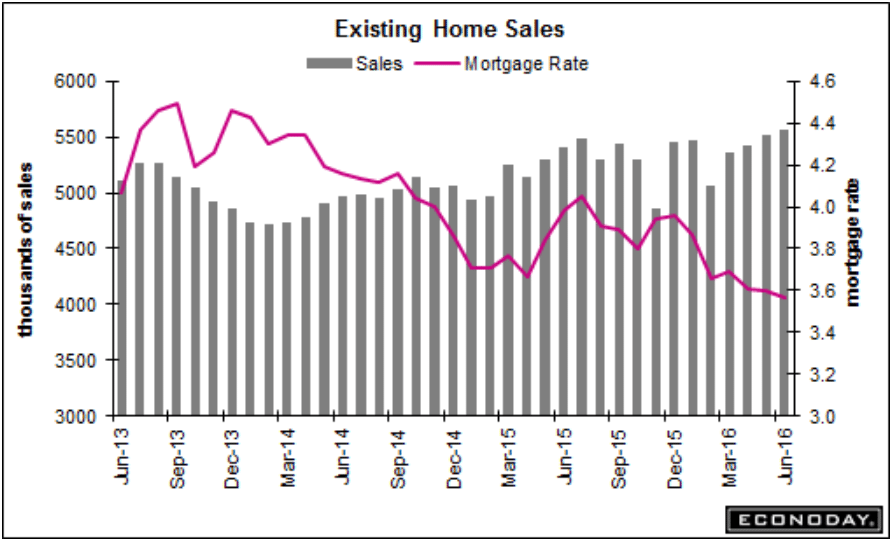

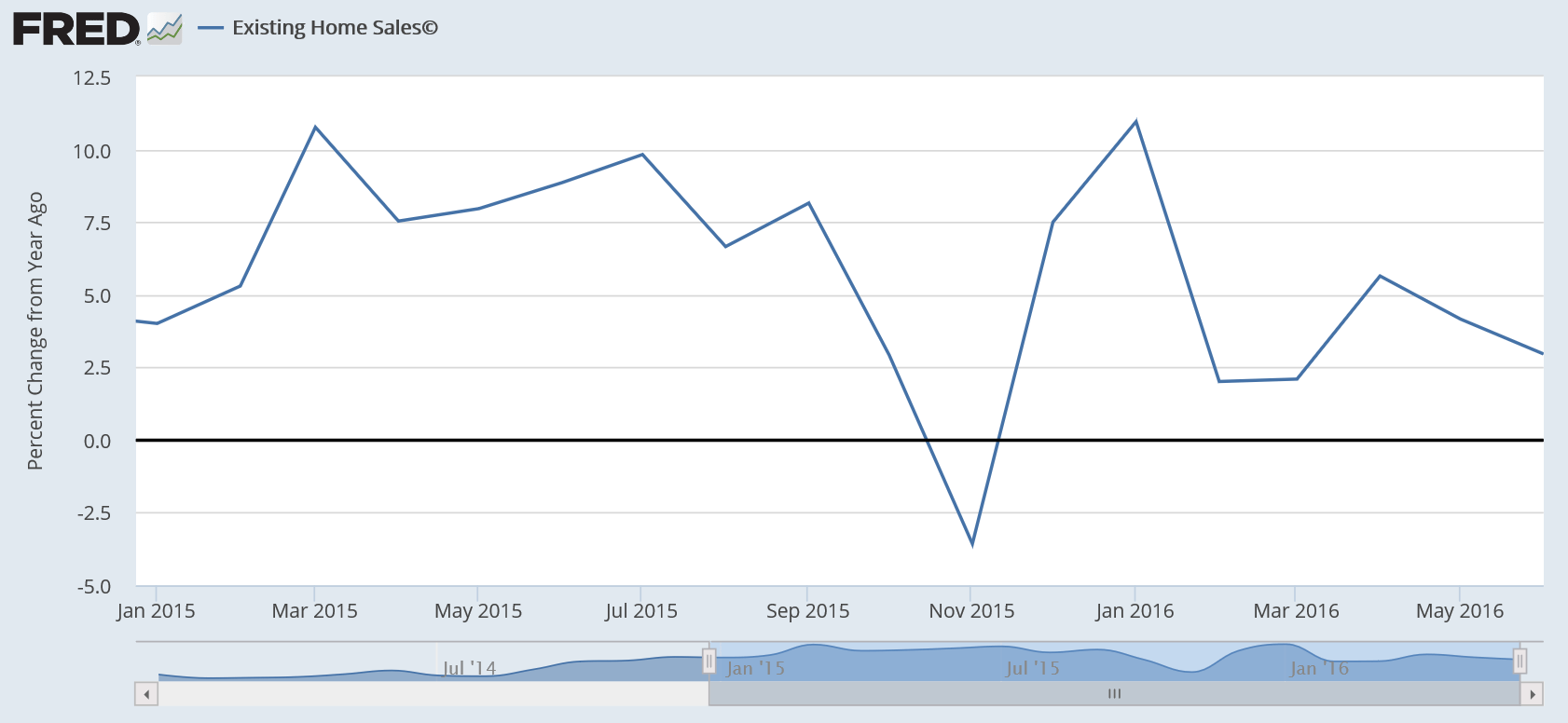

A bit better than expected for the month, but the year over year rate declined:

This NY state revenue report is few weeks old:

http://www.rockinst.org/pdf/government_finance/state_revenue_report/2016-06-30-SRR_103_final.pdf

Highlights:State tax revenue growth slowed significantly in the second half of 2015 and, according to preliminary data, early in 2016. Yearover-year growth was 1.9 percent in the fourth quarter of 2015. Personal income tax revenue growth slowed to 5.1 percent on a year-over-year basis. Growth was weak in sales tax collections, at 2.1 percent, and motor fuels tax at 3.5 percent. Corporate income taxes declined by 9.2 percent. Preliminary figures for the first quarter of 2016 indicate further weakening in state tax collections, at 1.9 percent. Personal income tax growth slowed to 2.3 percent. Preliminary data for April 2016 indicate large declines in personal income tax collections, likely caused by the volatility in the stock market. States project weak growth in tax collections in 2017. The median forecast of income tax and sales tax growth is at 4.0 and 3.8 percent, respectively.

Hamptons real estate sales slump 21 percent

http://www.cnbc.com/2016/07/21/hamptons-real-estate-sales-slump-21-percent.html