Maybe it’s because lower oil prices merely shift income from sellers to buyers, with capex reductions a net loss to all etc. as previously discussed?

Retail Sales

Highlights

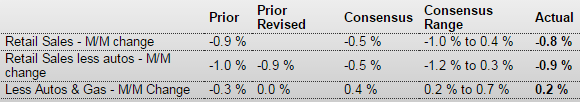

Lower gasoline prices continue to tug down on retail sales. And consumers are not yet putting higher discretionary income into spending on non-gasoline categories of retail sales even as confidence has improved. Retail sales in January fell 0.8 percent after declining an unrevised 0.9 percent in December. Excluding autos, sales decreased 0.9 percent-the same pace of decline as in December. Analysts expected a 0.5 percent decrease. Excluding both autos and gasoline sales rose 0.2 percent after no change in December. Expectations were for a 0.4 percent increase.

The latest retail sales numbers are not consistent with increased discretionary income and higher confidence. One explanation may be that consumers are spending more on services than on “hard” items found in the retail sales report.