Full size image

Highlights

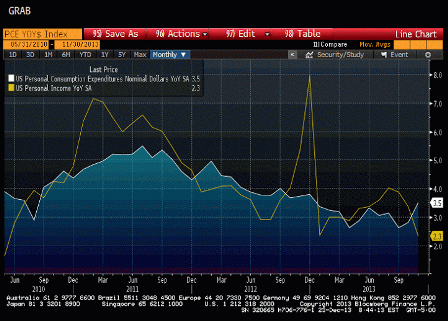

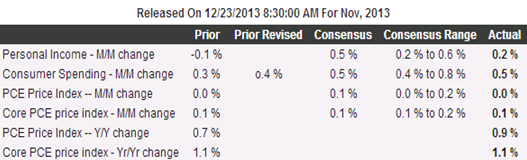

November was an uncertain month for the consumer in terms of sentiment. But in terms of hard numbers, it was a good month. Personal income rebounded 0.2 percent, following a 0.1 percent dip in October. But the important wages and salaries component improved to a 0.4 percent gain in November after rising 0.1 percent the month before.

Spending also accelerated a bit, jumping 0.5 percent after a 0.4 percent boost in October. No surprise, the latest gain was led by durables (largely motor vehicles) up 1.9 percent, following a 1.0 percent increase in October. Nondurable declined 0.4 percent after a 0.4 percent decrease in October. Lower gasoline prices likely played a role in November. Services jumped 0.6 in November, following a 0.3 percent rise the prior month.

Employment and Productivity

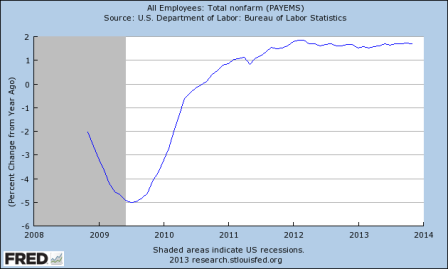

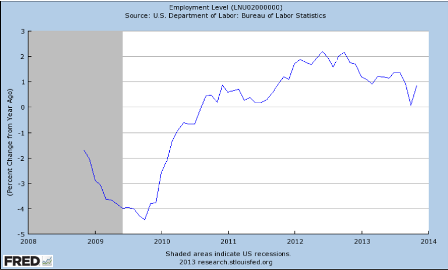

The Non Farm Payroll chart shows employment growth of about 1.7%. The Household survey has been indicating less than 1%.

And while the Payroll chart is arguably the far more reliable indicator because it’s far larger with about 145,000 businesses reporting, vs a survey of 60,000 households, and is actual reports vs survey questions. Also, the household survey is just about how many people are working, while the payroll survey is the number of jobs, even if one person is holding down more than one job.

But with year over year real GDP growth of about 2%, the Payroll report is implying near 0 productivity increases, while the household survey is implying and overall productivity gain of over 1%.

Full size image

Full size image