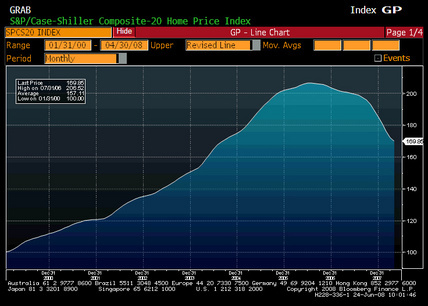

- S&P/CaseShiller Home Price Index (Released 9:00 EST)

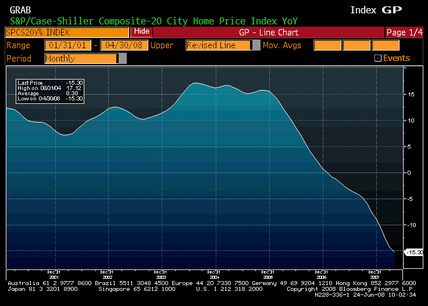

- S&P/CaseShiller Composite 20 YoY (Released 9:00 EST)

- Consumer Confidence (Released 10:00 EST)

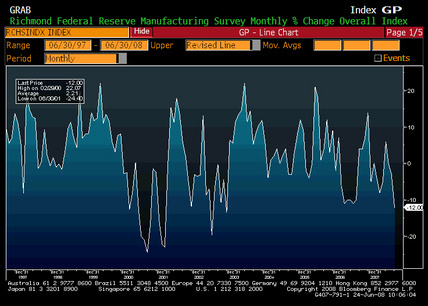

- Richmond Fed Manufacturing Index (Released 10:00 EST)

- House Price Index MoM (Released 10:00 EST)

- ABC Consumer Confidence (Released 18:00 EST)

S&P/Case Shiller Home Price Index (Apr)

| Survey | |

| Actual | 169.9 |

| Prior | 172.2 |

| Revised | 172.2 |

S&P/Case Shiller Composite 20 YoY (Apr)

| Survey | -16.0% |

| Actual | -15.3% |

| Prior | -14.4% |

| Revised | -14.3% |

Karim writes:

- Conf board survey drops to 16yr low, from 58.1 to 50.4

- Current conditions drop 9.7pts and future expectations fall 6.3pts

- 1yr fwd inflation expex unch at 7.7

- All following drop to new cycle lows

- Jobs plentiful less jobs hard to get (-12.2 to -16.4; pretty good leading indicator of unemployment rate)

- Plans to buy auto in next 6mths from 5.1 to 4.8

- Plans to buy a home from 2.4 to 2.2

- Plans for a domestic vacation from 33.4 to 29.6

- Plans for foreign vacation from 8.2 to 7.5

Inflation is biting harder than the lower Fed funds rate is helping.

The Fed has to decide whether a slightly higher Fed funds rate will bring more relief/benefit to consumers on the inflation side than possible additional drag from the interest rate side.

[top][end]

Consumer Confidence (Jun)

| Survey | 56.0 |

| Actual | 50.4 |

| Prior | 57.2 |

| Revised | 58.1 |

Richmond Fed Manufacturing Index (Jun)

| Survey | -5 |

| Actual | -12 |

| Prior | -5 |

| Revised | n/a |

Not looking good.

Weakness and ‘inflation’ continue.

[top][end]

House Price Index MoM (Apr)

| Survey | -0.4% |

| Actual | -0.8% |

| Prior | -0.4% |

| Revised | -0.6% |

Back down, but at least not through the lows.

ABC Consumer Confidence (Jun 22)

| Survey | – |

| Actual | – |

| Prior | -44 |

| Revised | – |

[top]