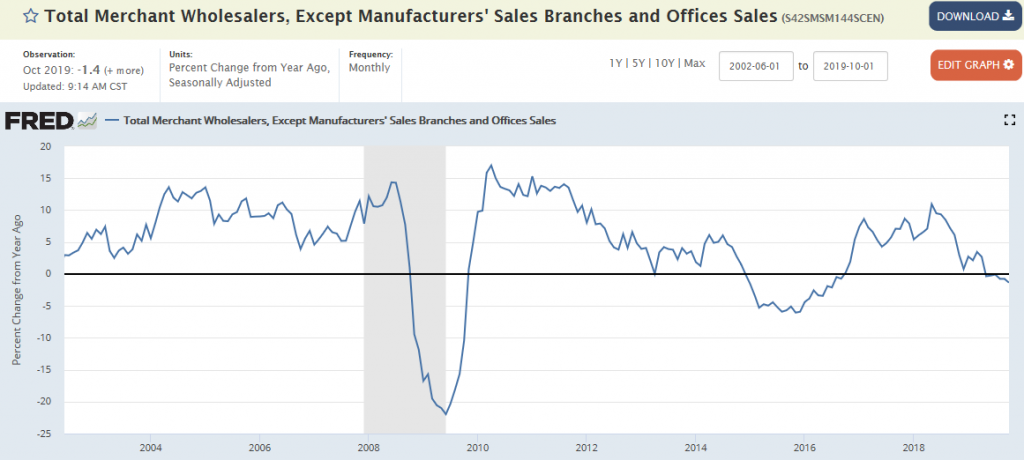

Still in a down draft with additional tariffs scheduled to kick in Dec 15. Decelerating employment growth translates into decelerating personal income growth, etc. etc. etc.

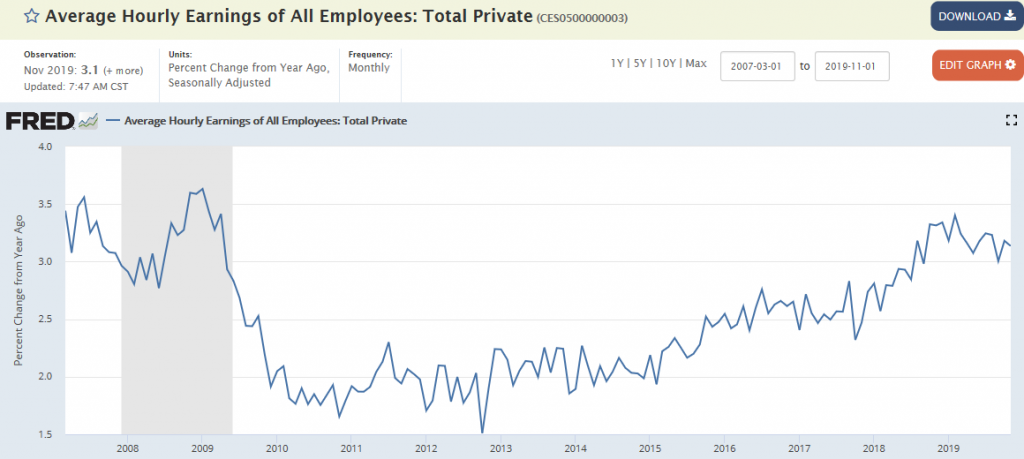

Similar pattern for wages- up some with tax cuts, down with tariffs:

Meanwhile seems the crowd is making a big deal over the larger than expected headline number of data that’s both volatile and subject to large revisions:

The 266,000 jobs added in November is an important number since it defies expectations, at least for one month, that the labor market is slowing down. The report was way better than the 187,000 jobs expected by economists.

The end of the GM strike helped inflate the number, with 41,300 jobs added in motor vehicles and parts, but the overall gain in payrolls was still about 100,000 better than expected by many economists. Manufacturing gained 54,000 overall.

“The bottom line is the labor market is cooking. It clearly says the Fed should not do anything more. The Fed can now sit back on the shelf, not have to worry about having to be pestered about lower rates,” said Ward McCarthy, chief financial economist at Jefferies.

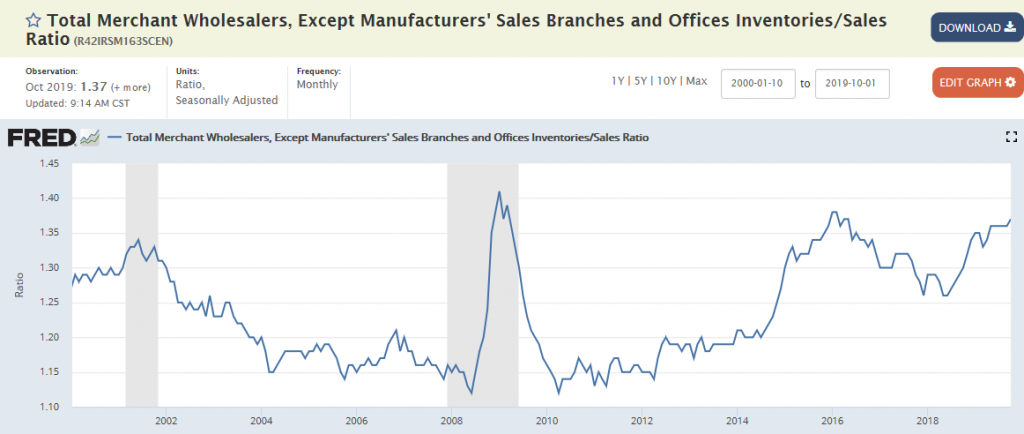

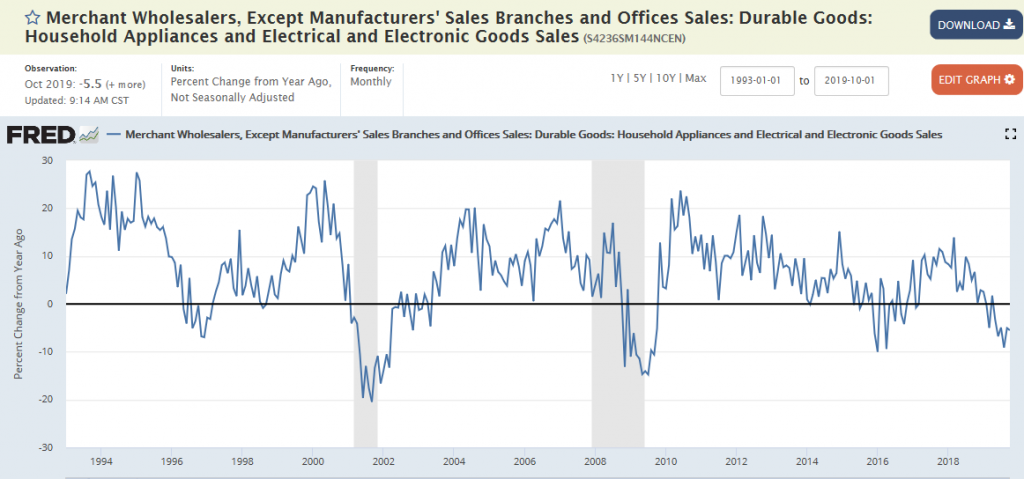

Wholesale inventories are too high and going the wrong direction as sales fail to keep pace and are now in contraction:

This recession could be worse than 08?

;)