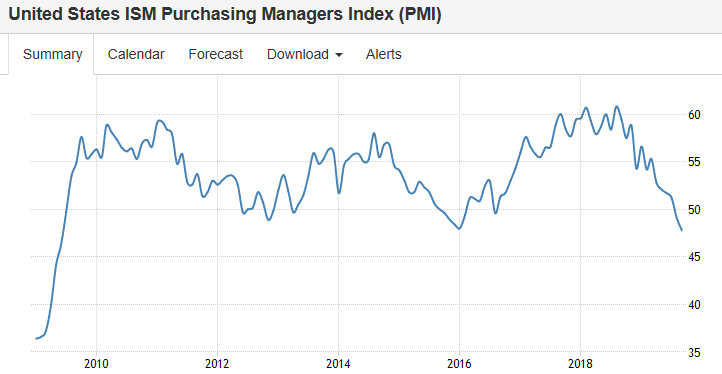

The deceleration that’s been going on all year due to the tariffs seems to finally be getting some media attention after US manufacturing reports that it’s in contraction. Something like the 10th plague…

Highlights

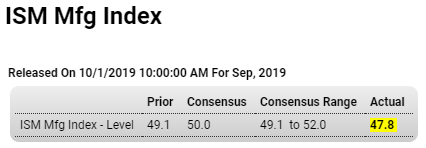

Contraction in export orders is severe and is pulling composite activity for ISM manufacturing’s sample under water. September’s 47.8 headline is more than 1 point under Econoday’s consensus which is significant, since nearly all forecasters take a stab at this report. And bleeding at a troubled rate are new export orders which at 41.0 posted their the third straight month of contraction that echoes the very substantial contraction being suffered by the PMI manufacturing sample in Germany right now.

Total new orders in September’s report are at 47.3 and also well below break even 50 to indicate outright monthly contraction. Backlog orders at 45.1 have been in contraction for this sample since May, and evaporating backlogs are not a positive signal for employment which at 46.3 is under 50, and well under 50, for a second straight month and is pointing to trouble for factory payrolls in Friday’s employment report. Suffering from a downturn in new orders and a lack of backlogs to work down, production is also under 50 for a second straight month, at 47.3.

Other details include flat price pressures for inputs, contraction in inventories, and improvement in delivery times — all consistent with a sample that is sinking. This report is very closely watched, whether among policy makers or among US manufacturers themselves who frequently cite it in their own statements and forecasts. Slowing in global trade has hit this sample hard and confirms the concerns at the Federal Reserve which started its move to rate cuts in July citing the risk that slowing global demand would specifically hurt US manufacturers. Today’s report will build expectations for now that the Fed, despite its own internal divisions, is likely to cut rates at least one more time this year.

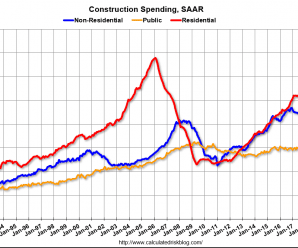

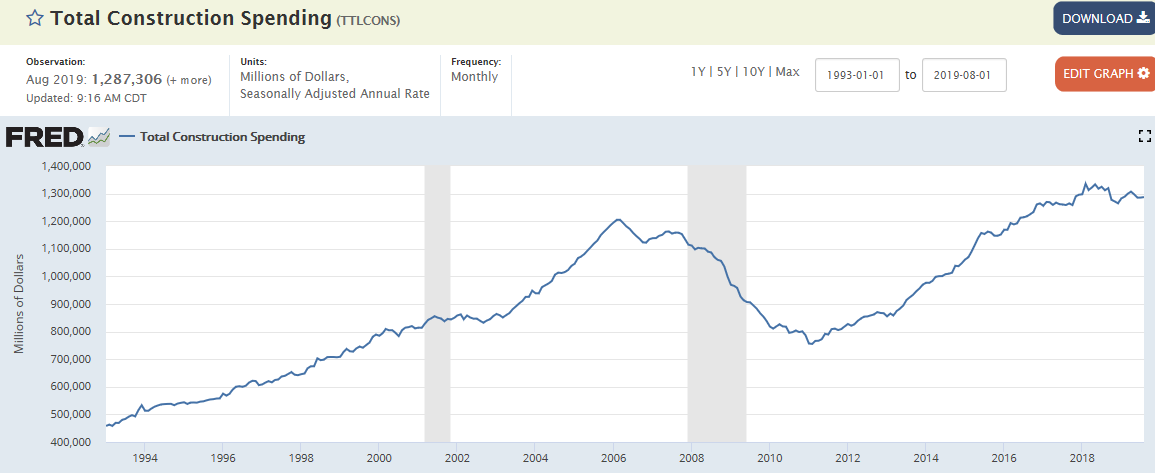

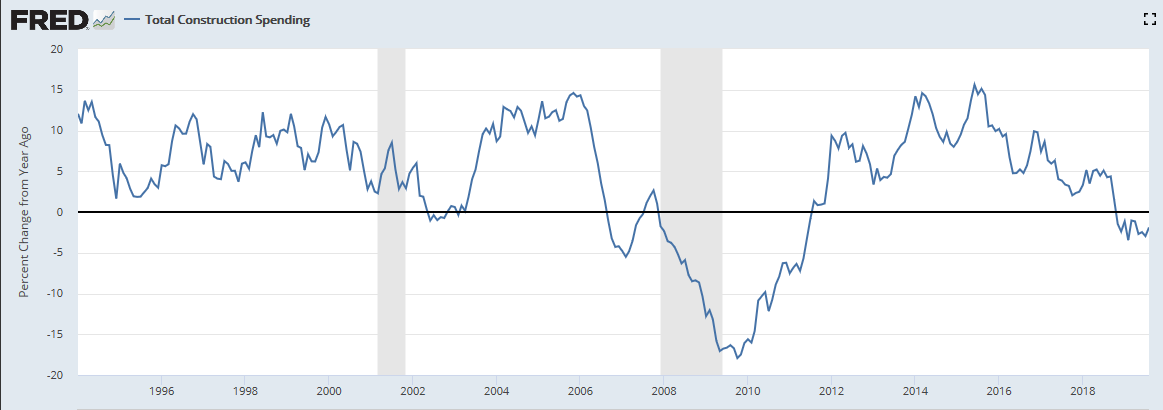

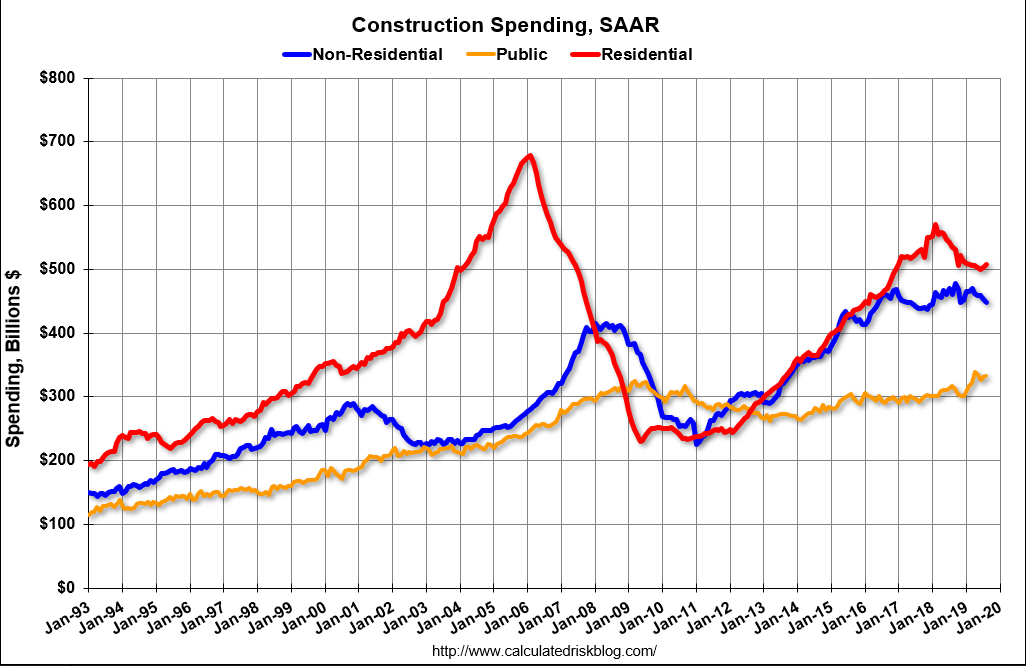

Rolled over and heading south. And adjusted for inflation still way below prior cycle peak:

The President has the interest rate thing backwards, of course, but so does the Fed, and pretty much everyone else, as markets anticipate more fed rate cuts in response to the weak economic data: