Trumped up expectations largely reversed:

Highlights

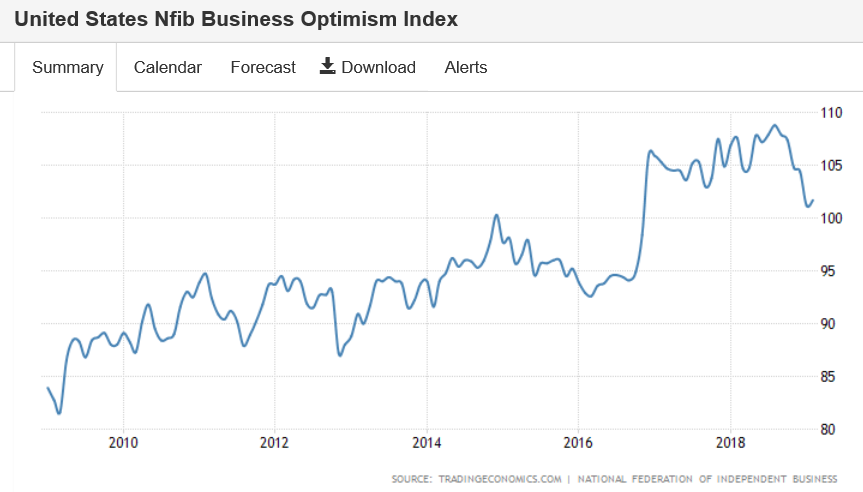

At 101.7, the small business optimism index fell short of expectations in February, recovering only 5 tenths of January’s 3.2 point dip. Econoday’s consensus was looking for 102.5 with the low estimate at 101.8. Employment plans lost ground for a second straight month with a turn lower for earnings trends the biggest negative in the month. One plus is that the he outlook for economy, after dropping sharply in January, did turn positive in the month.

Bank of Japan weighs gloomier view of exports and output

(Nikkei) “We have no choice but to recognize that recent export and production trends are weak,” said a top official at the central bank, a view echoed by other senior officers there. In January, exports dropped 5.2% from the previous month in real terms, according to BOJ data, and the economy ministry’s index of industrial production shrank for a third straight month. The BOJ at its January policy meeting that both exports and industrial production were “on an increasing trend,” but it is considering revising that language during the two-day meeting ending Friday.

Sentiment among large Japanese companies plunges in 1Q 2019

(Nikkei) The Business Survey Index of large companies across all industries stood at minus 1.7 in the first three months of 2019. That is a 6-point drop from the October-December period of 2018. A negative reading means there are more companies that think business conditions are getting worse than there are that think things are improving. The Business Survey Index for Japan’s manufacturing sector, which relies heavily on exports, dropped to minus 7.3 from positive 5.5. Among large companies, the second quarter forecast is minus 0.3, and the period from July to Sep. is plus 5.7.

China’s top property developers see plunging sales in February

(Xinhua) China’s top 100 real estate developers saw a sharp monthly decline in its total sales due to the Spring Festival holiday. The total sales volume of China’s top 100 property developers was down by 22.9 percent month-on-month, and 11 percent year-on-year in February, according to China Real Estate Information Corp (CRIC). Floor area sold by Vanke, China’s housing market giant, plunged 22 percent to 2.47 million square meters, with the sales falling 12 percent to 43.19 billion yuan (around 6.4 billion U.S. dollars) month-on-month.

China car sales drop 17.4% in February to 1.22m units

(Nikkei) Sales of passenger cars fell 17.4% to 1.22 million units in February, China Association of Automobile Manufacturers, or CAAM, said. Sales of passenger cars and commercial vehicles fell 13.8% to 1.48 million units, while commercial vehicles saw an 8% increase during the month. The sales in February were hurt by weak demand during the Chinese New Year, CAAM said. The slump in February marks the eighth straight monthly decline in auto sales. Vehicle sales in China fell 15.8% in January, following a 2.8% decrease last year.

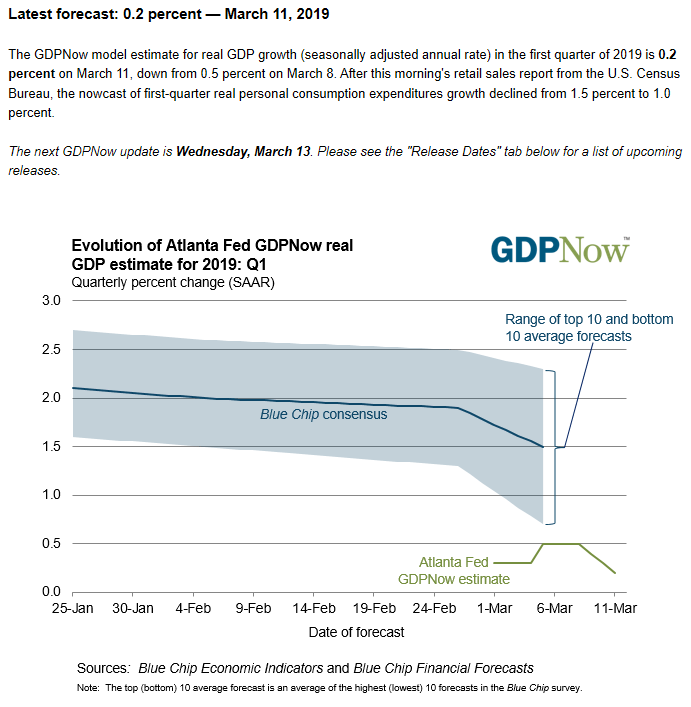

GDP forecasts are low and falling: