Can’t be making Tariff Man happy:

Highlights

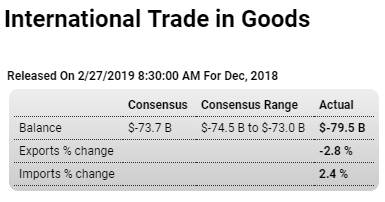

The effects of cross-border trade actions have been difficult to pinpoint in the national economic data but outlines may be appearing in goods trade. The nation’s goods deficit swelled to a much larger-than-expected $79.5 billion in December as exports fell 2.8 percent in the month to $135.7 billion following 0.9 percent contraction in November. Agricultural exports, a focused area with China, fell 1.9 percent in the month and are down 5.5 percent year-on-year. The yearly rate for total exports is now in the negative column at minus 0.3 percent.

Adding to the downward trade pull from exports is a 2.4 percent rise in imports to $215.2 billion which are up 3.2 percent on the year. Here consumer goods are a sensitive area and are up 4.4 percent in the month to $55.5 billion though the year-on-year increase is modest at 0.9 percent. Imports of capital goods have also been climbing, up 4.9 percent on the year, but in contrast to consumer goods these goods represent business investment and will help future productivity.

For the quarterly GDP contribution, the goods deficit ran a monthly average of $75.7 billion in the fourth quarter vs $74.7 billion in the third quarter. Though this does point to another quarterly drag from trade, services for December have yet to be reported and based on U.S. strength here may yet pull the quarter even. Next Wednesday’s international trade report for December will post the services numbers as well as bilateral country data that are not published with this report.

Bad:

Highlights

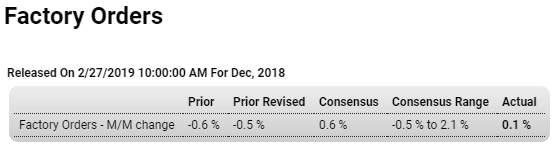

Factory orders have significantly missed Econoday’s consensus for a second straight month, inching only 0.1 percent higher in December vs expectations for a 0.6 percent climb. In November when expectations were looking for a small gain, orders fell an initial 0.6 percent which is now revised to a 0.5 percent decline. October orders narrowly missed expectations, falling 2.1 percent against expectations for 2.0 percent.

The split between the report’s two main components shows a 1.0 percent dip for nondurable goods — the new data in today’s report where weakness is tied to both petroleum and coal as well as beverages — and a 1.2 percent rise for durable orders which is unchanged from last week’s advance report for this component.

But the gain for durable goods was skewed, as it often is, by a clump of aircraft orders in the month. Vehicles were also strong and when excluding these and aircraft as well as all other transportation equipment, orders fell 0.6 percent in December following a 1.3 percent drop in November.

A glaring weakness in December and November orders are sharp 1.0 percent and 1.1 percent declines for core capital goods orders (nondefense ex-aircraft). This is telling evidence that business investment is down which in turn may well betray a downturn in business confidence. And there’s an important revision in today’s report that will be trimming back estimates for nonresidential investment in tomorrow’s fourth-quarter GDP report as December shipments for this series, initially at a 0.5 percent gain in last week’s advance report, are now revised to no change. November stands at a 0.2 percent decrease for core shipments.

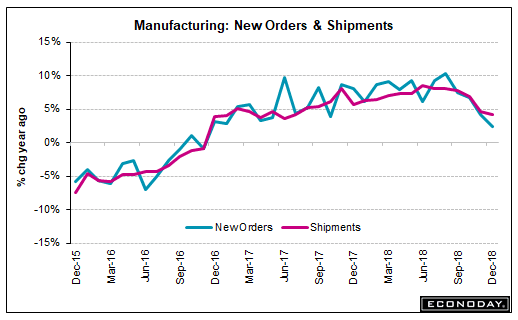

The third quarter was not strong for the factory sector notwithstanding, however, the 0.8 percent auto-related surge in December manufacturing production (previously released as part of the industrial production report). Manufacturing is disproportionately exposed to global demand and sector’s slump is a convincing reflection of general slowing in foreign economies, something that the Federal Reserve underscored as a key reason for its January downshift to neutral monetary policy.

Still trending down and down vs last year: