Bad:

Highlights

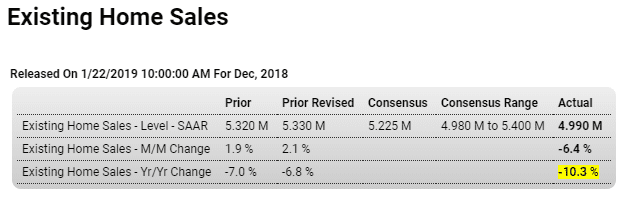

Mortgage rates began to move down in December but it wasn’t soon enough to help the month’s resales. Existing home sales fell a sharper-than-expected 6.4 percent to a 4.990 million annualized rate that is the lowest in more than three years and barely makes Econoday’s consensus range.

Weakness across the board is a fair description of the results with single-family sales down 5.5 percent to a 4.450 million rate and condo sales down 12.9 percent to 540,000. The weakest region in the data is the Midwest at an 11.2 percent decline with the West showing the least weakness at minus 1.9 percent.

For buyers, the bad news includes less selection as supply on the market fell 10.9 percent to 1.550 million units for sales. Relative to sales, supply is at 3.7 months vs 3.9 months in the prior month.

For sellers, the bad news includes a 1.4 percent decline in the median price to $253,600. And relative to sales, prices appear rich as the year-on-year median shows a gain of 2.9 percent vs what is a 10.3 percent decline in year-on-year sales.

Mortgage rates peaked in November and are since down about 40 basis points for 30-year fixed mortgages to roughly 4.75 percent. This move is very likely to help sales in January which will also get a comparison lift from what turned out to be a very weak December. The housing sector may have ended a soft 2018 on a down note but the outlook for 2019 — as long as the labor market stays healthy and rates hold steady — may well be positive.

Global trade collapse in progress:

Japan’s trade falls into red for 1st time in 3 years

(Kyodo) Japan logged a goods trade deficit of 1.20 trillion yen ($11 billion) in 2018. Imports rose 9.7 percent from a year earlier to 82.69 trillion yen, outpacing a 4.1 percent increase in exports to 81.49 trillion yen. Crude oil imports surged 24.5 percent to 8.91 trillion yen last year. By region, Japan ran a deficit of 3.28 trillion yen against China. Against all of Asia, Japan saw a surplus of 5.54 trillion yen. Japan had a surplus of 6.45 trillion yen against the United States. With Europe, Japan logged a deficit of 487.5 billion yen. For December, Japan logged a goods trade deficit of 55.3 billion yen. Exports fell 3.8 percent while imports grew 1.9 percent.

China’s plans to dominate hi-tech sector with ‘Made in China 2025’ plan hit a stumbling block as US trade war takes its toll

(SCMP) Beijing’s push to dominate hi-tech industries in the next decade under the “Made in China 2025” plan has been hit by the US trade war with a number of advanced manufacturing sectors experiencing weakening demand. Production of industrial robots fell by 12.1 per cent in December from a year earlier after a drop of 7.0 per cent in November. Growth in the new-energy car sector slowed to 15.5 per cent in December from 24.6 per cent in November. Production of integrated circuits also fell by 2.1 per cent in December, although an improvement from November’s decline of 7 per cent.

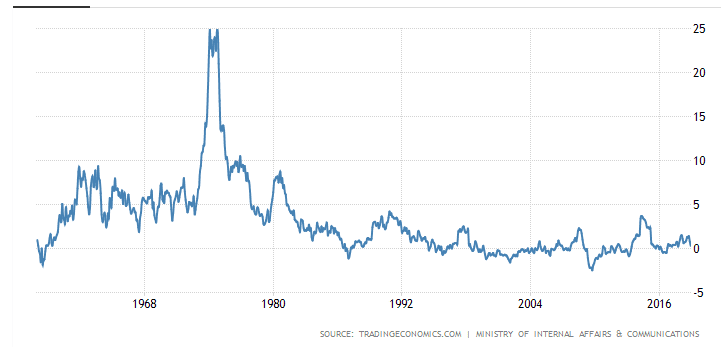

0 rate policy for decades, massive quantitative easing, 10 year rate pegged at 0%- maybe central banks can’t create inflation???

Who would’ve thought… ;)