So for every agent that spent less than its income, another must have spent more than its income, or the output would not have been sold. It’s an ex poste identity for any currency.

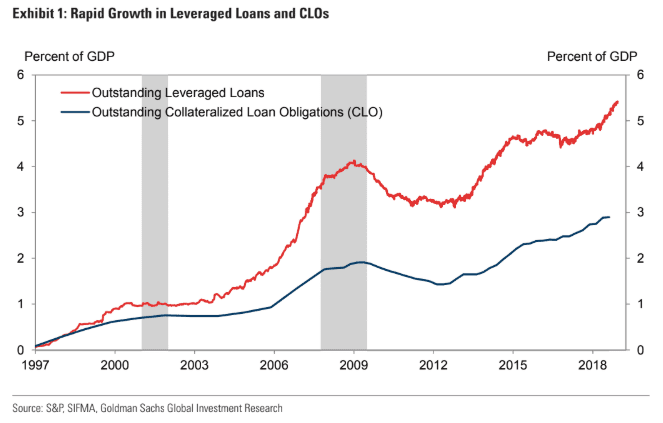

That means that as bank lending decelerated, assuming ‘savings desires’ are generally constant, either some other means of borrowing to spend was accelerating, or else GDP would not have

been growing. Leveraged loans may be part of how the economy has been supported the last few years?

As previously discussed, and contrary to popular expectations, ‘repatriation’ has been of no macro economic consequence (much like QE):

U.S. Current-Account Deficit Widened in Third Quarter

(WSJ) The overall current-account deficit climbed to a seasonally adjusted $124.8 billion in the third quarter, up from $101.2 billion in the second quarter. The new tax law passed last year was intended to encourage U.S. firms to repatriate cash they had stockpiled offshore. In 2017, the year before the new law went into effect, there was a quarterly average of about $40 billion in dividends and withdrawal payments back to the U.S. each quarter. This quarter, companies brought back $92.72 billion, down from $183.7 billion in the second quarter and $294.86 billion in the first quarter. In recent quarters, companies have earned about $130 billion abroad.

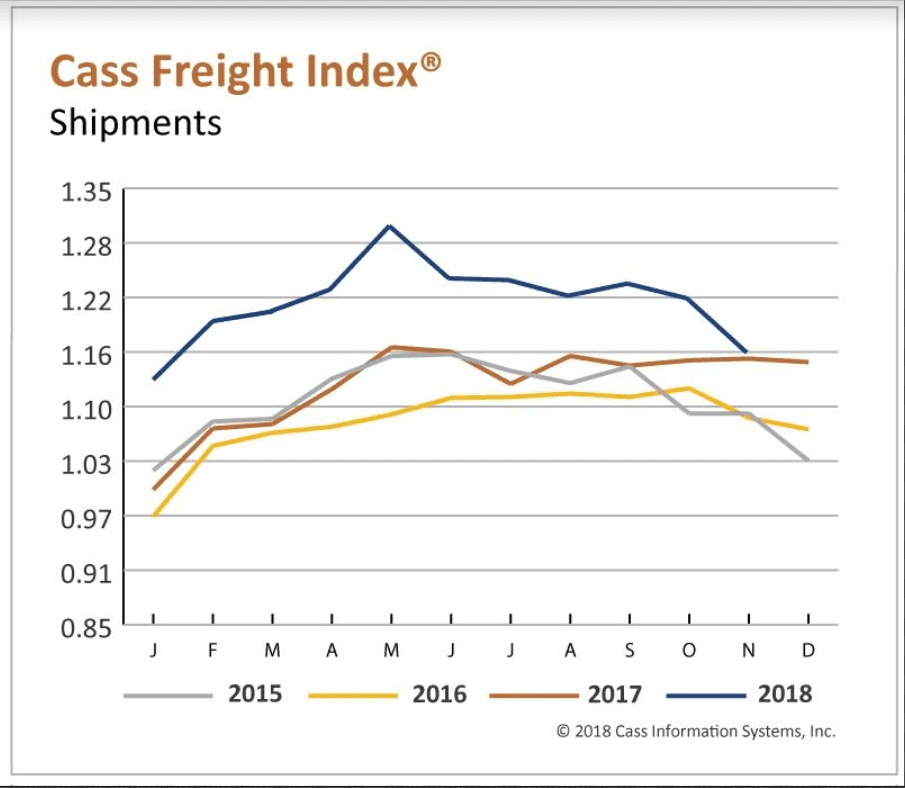

Shipments slowing: