So the savings rate puzzle, where consumption was exceeding income, has now been reconciled with large upward revisions in personal income. And looks like the credit expansion that supplied the income and drove the spending was from non-residents. The next monthly consumption and income releases will bring it all up to date:

Highlights

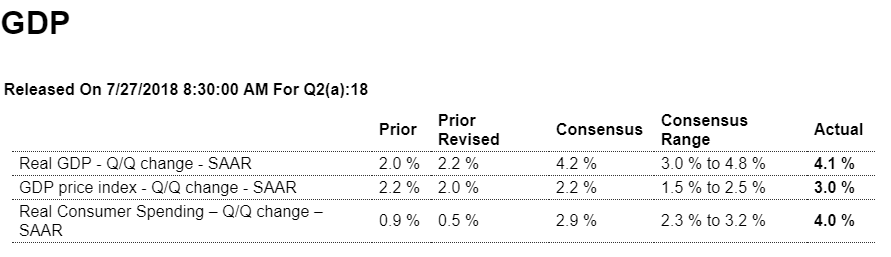

Leading a report that speaks to the risk of overheating, consumer spending drove GDP significantly higher in the second quarter, to a 4.1 percent annualized rate which, however, just misses Econoday’s consensus for 4.2 percent. Consumer spending rose at a very strong 4.0 percent rate in the quarter to contribute 2.7 points of the total rate with spending on services contributing 1.5 points. Spending on goods, split roughly evenly between durables and nondurables, contributed 0.6 points.

Net exports were the next biggest contributor, adding 1.1 points and reflecting strong improvement in exports that offset a slight increase in imports. Nonresidential fixed investment contributed 1.0 point to the quarter led by structures and intellectual property with equipment only slightly positive. Government purchases were also a positive contributor at 0.4 points.

Inventories are another major story in this report, falling $27.9 billion for a 1.0 point subtraction from GDP. When excluding inventories (final sales), GDP came in at 5.1 percent. And the pull lower from inventories is actually a positive for the economy, as inventories are too low and need to be rebuilt which should be a positive for third-quarter GDP. Residential investment proved only marginally negative in the second quarter.

To top this very strong report off are price pressures as the GDP price index came in at a very hot 3.0 percent, vs 2.0 percent in the first quarter and exceeding Econoday’s consensus range by 5 tenths. And the core, which excludes food and also energy prices which have been high, shows similar pressure, at 2.7 percent vs the first quarter’s 2.4 percent.

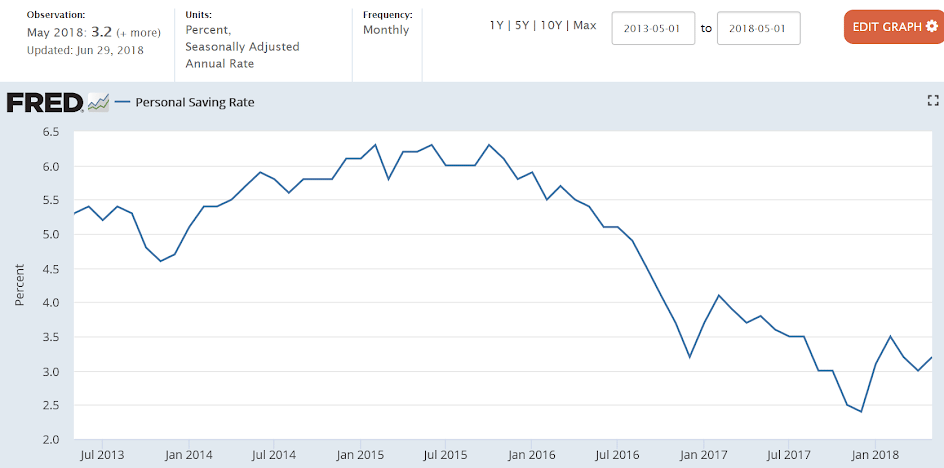

Overheating would appear to be a danger for the economy right now, consistent with the array of regional and private economic data where delivery delays, input costs and even price pass through are at or near record highs. Today’s report includes benchmark revisions including a 2 tenths upgrade to first-quarter GDP which now stands 2.2 percent. Also of note, the savings rate for 2017 is revised much higher to 6.7 percent from 3.4 percent.

Beneath the Surface, a Solid Economy With Room to Run

(WSJ) Exclude the volatile categories of net exports, inventories and government and the Q2 GDP result is 4.3% growth. Over the past year, it’s up 3.2%. Even without the tax cut the consumer would be in great shape. Wage growth remains subdued, but so many people are finding jobs that incomes are rising briskly. Friday’sreport disclosed that wages and self-employed income were much higher in recent years than previously thought. The saving rate instead of sliding to around 3% stands at 6.8%, in line with its average since 2012. The expansion now looks to be in its late middle age, not old age.

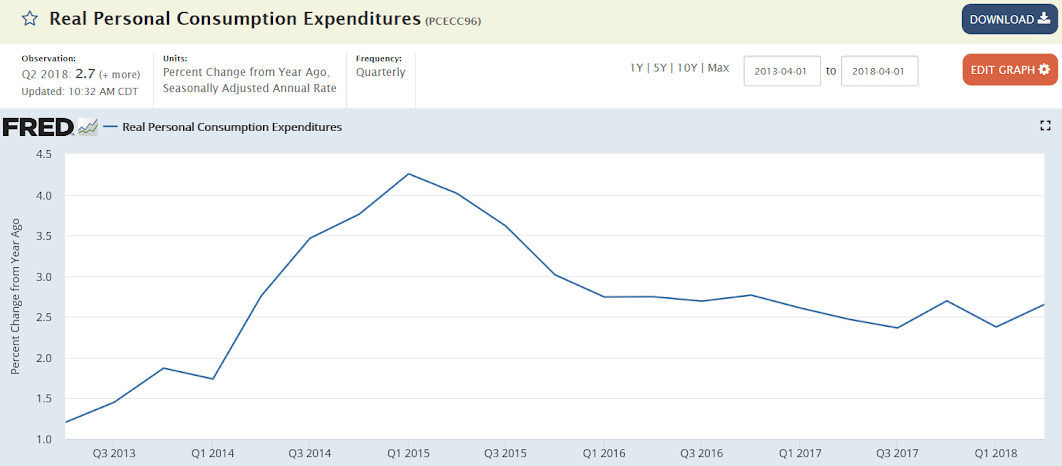

This is the quarterly data, just released, that shows a 4% gain for the quarter:

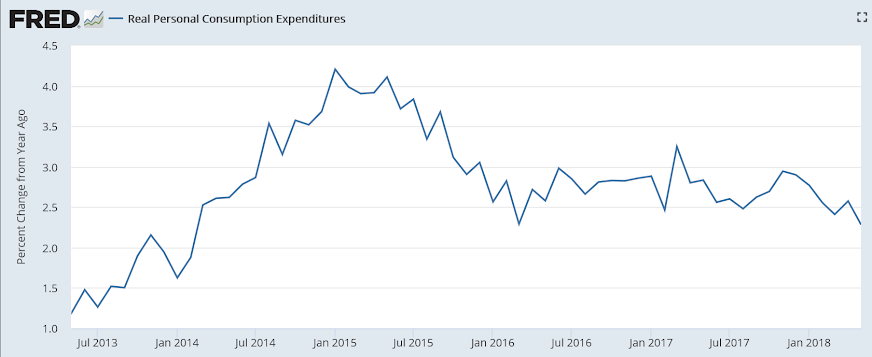

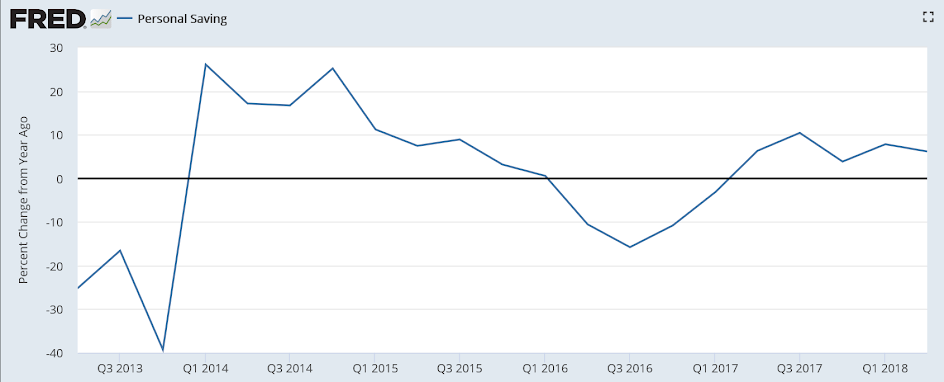

This is from the monthly data- paints a similar but somewhat picture:

This monthly report came out before the revisions:

Today’s quarterly numbers were from the new revised data:

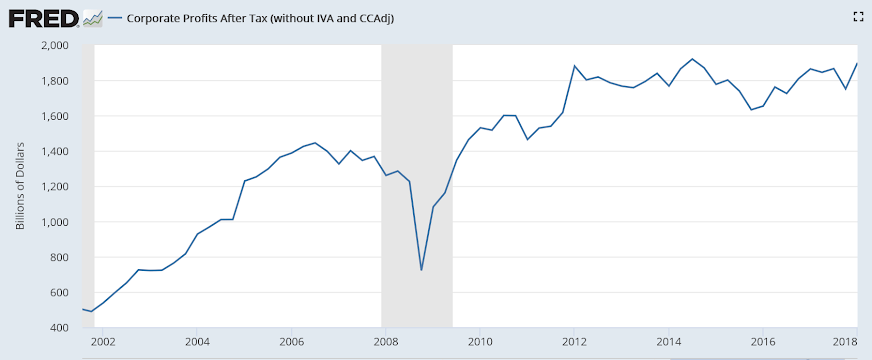

And Fed profits paid to Treasury are no longer in the corporate profit series, slowing reported profit growth:

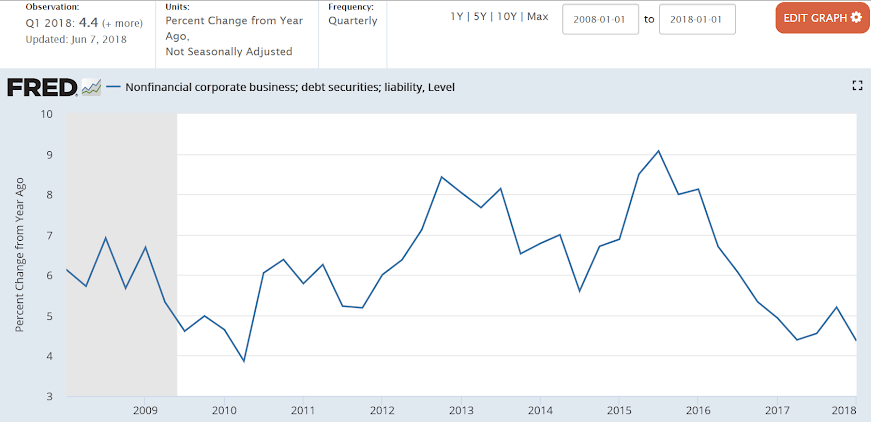

Corporate debt growth continues to decelerate:

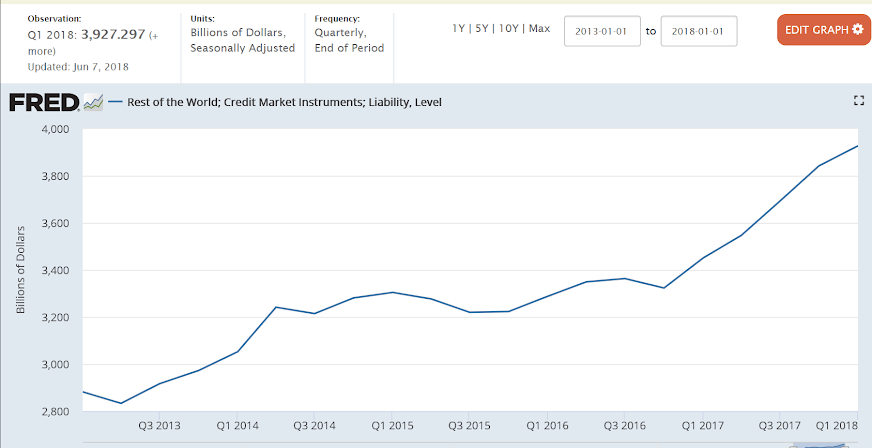

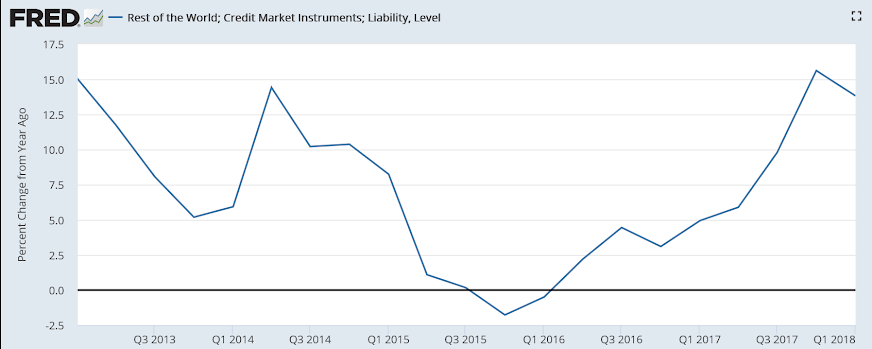

But credit expansion for the rest of world has been accelerating since the presidential election. I don’t have a narrative for that, but seems large enough to explain where the income and spending originated:

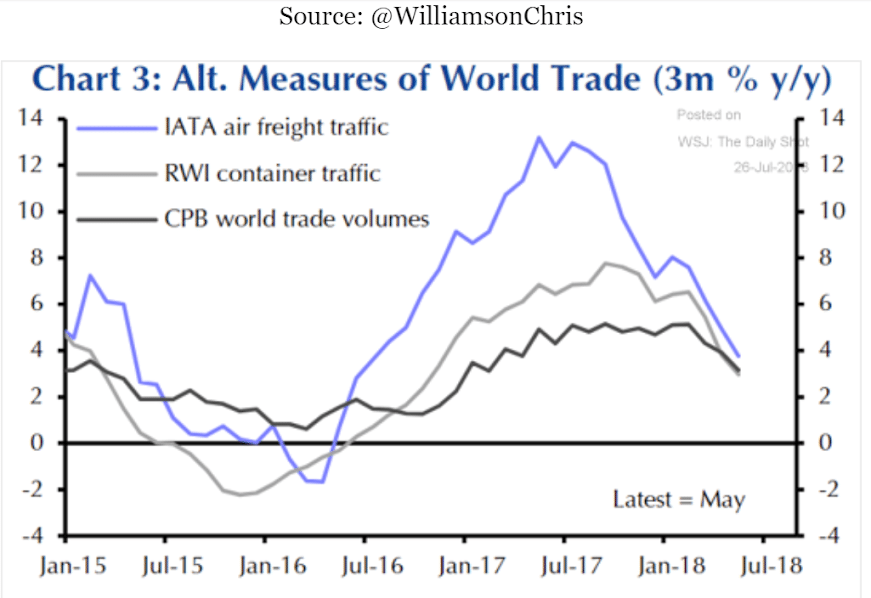

Someone else now reads it the way I do- growth has been decelerating since the end of 2014 when oil capex collapsed:

Indications Are The Economy Will Slow With Or Without A Trade War

According to Lakshman Achuthan, Co-Founder & Chief Operations Officer of ECRI

Contrary to the notion of a “strengthening” economy, consumer spending growth has fallen to a 4 ¼-year low, as personal income growth continues to undershoot spending growth.

The consumer — which makes up about 70% of the economy — is getting hit with a six-year highs in inflation, so real wages are actually lower than a year ago.