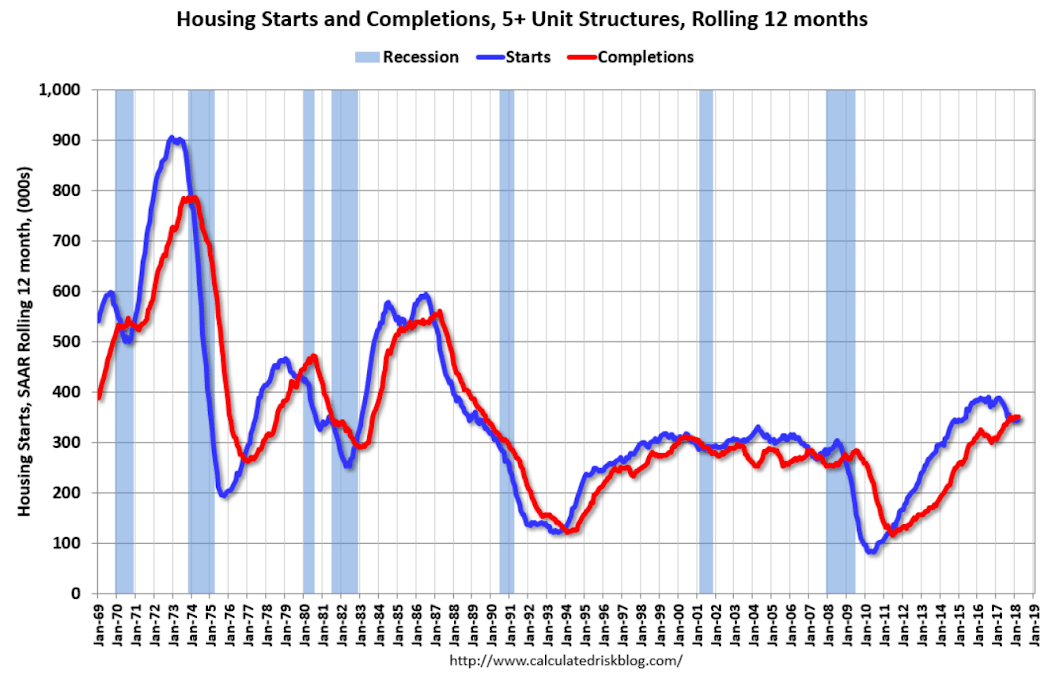

Must be some tax thing driving multifamily last month:

Highlights

The residential construction business had a very strong March: housing starts easily topped Econoday’s high estimate at a 1.319 million annualized rate while permits came in just shy of the top estimate at a very strong 1.354 million.

Multi-family units are the standout in the March report. Starts for this group rose 14.4 percent in the month to a 452,000 rate with permits 19.0 percent higher at 514,000. Single-family units are soft with starts down 3.7 percent to an 867,000 rate and with permits down 5.5 percent to an 840,000 rate in a result offset by a large upward revision to February.

One clear negative, perhaps tied to weather, is a slowing in completions which fell 5.1 percent to 1.217 million. This is not good news for a housing market starved of supply.

Housing had an uneven start to the year with March sales results still to be posted. Sales side, residential investment looks to be a positive contributor to first-quarter GDP as housing construction ended the quarter with visible momentum going into the second quarter.

Chugging along at modest rates of growth, back to the highs of several years ago: