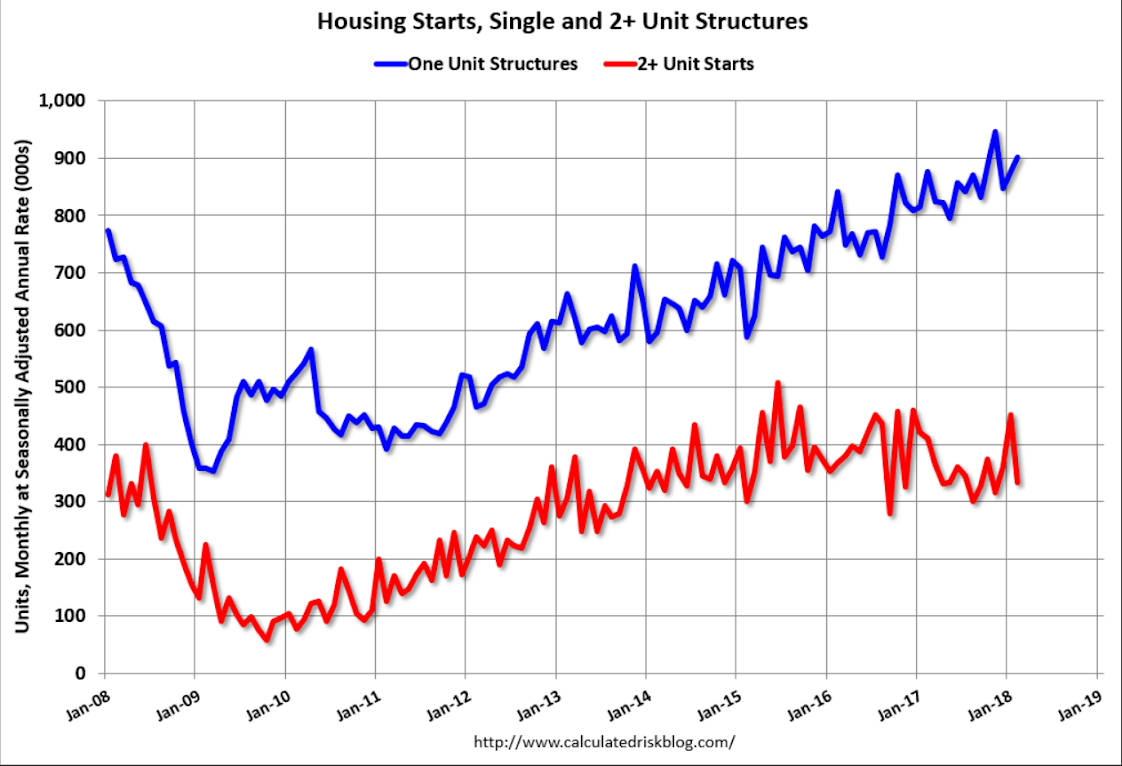

As previously discussed, the spike in multi family reported in Jan has reversed in Feb:

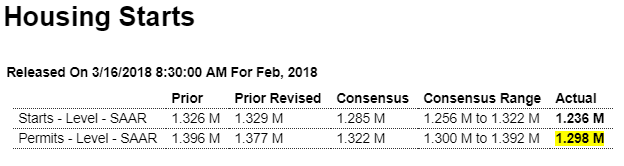

Highlights

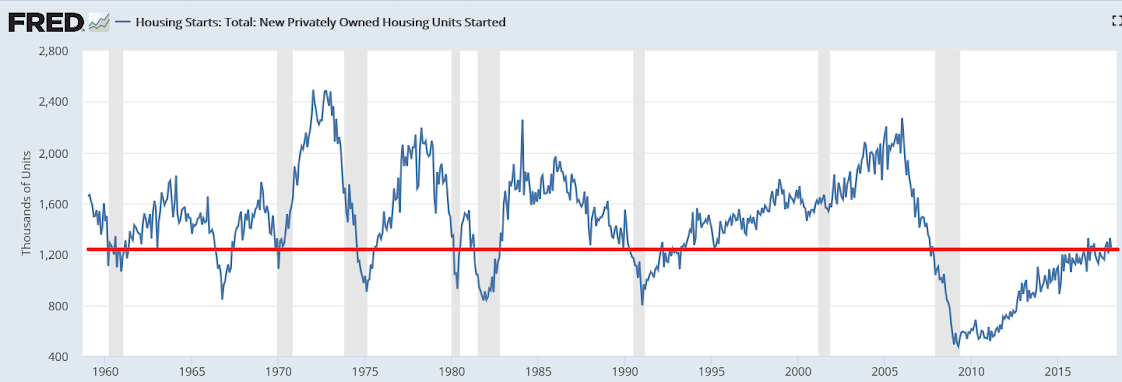

Home sales turned lower in January as did housing starts and permits in February, and noticeably so. Housing starts fell 7.0 percent in the month to a much lower-than-expected annualized rate of 1.236 million while building permits fell 5.7 percent to 1.298 million which is also much lower than expected.

Single-family homes are the key component in this report and permits fell 0.6 percent to an 872,000 rate. Year-on-year growth remains in the mid-single digits but is now under 5 percent at 4.6 percent. In a positive, single-family starts, which are key to restocking the new home market, rose 2.9 percent to a 902,000 rate which is up 2.9 percent from this time last year. And single-family completions rose 3.0 percent in the month to 895,000 and will offer immediate supply to the market.

Multi-family permits fell 14.8 percent but at a 426,000 rate are still up 10.6 percent year-on-year. Starts, however, fell 26.1 percent to 334,000 and are down a yearly 18.7 percent. Completions here are also positive, up 19.4 percent to a 424,000 rate.

Besides completions, another positive is homes under construction, up fractionally to 1.115 million which is a new expansion high. But the bulk of this report is unexpectedly soft and confirms that the housing sector, despite strong year-end momentum and a very strong jobs market, opened 2018 on the defense, getting no help from rising mortgage rates which are at 4 year highs.

Up to the lows of 1960…

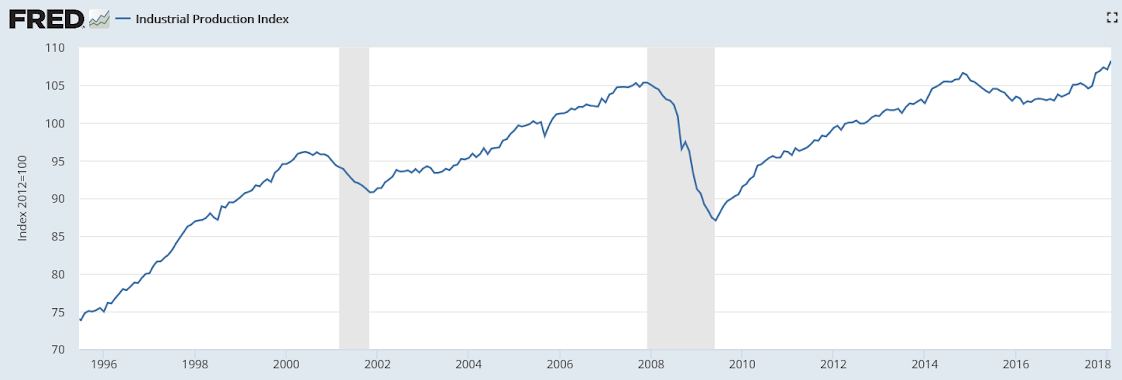

Chugging along at modest rates of growth, and up only 3% from 2008 peak: