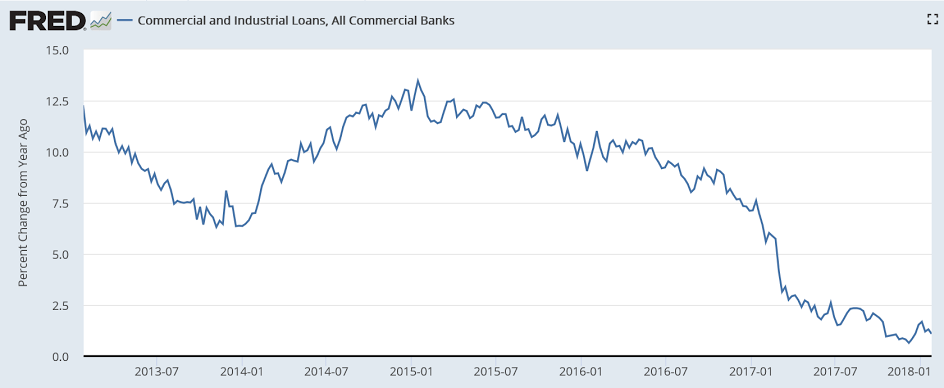

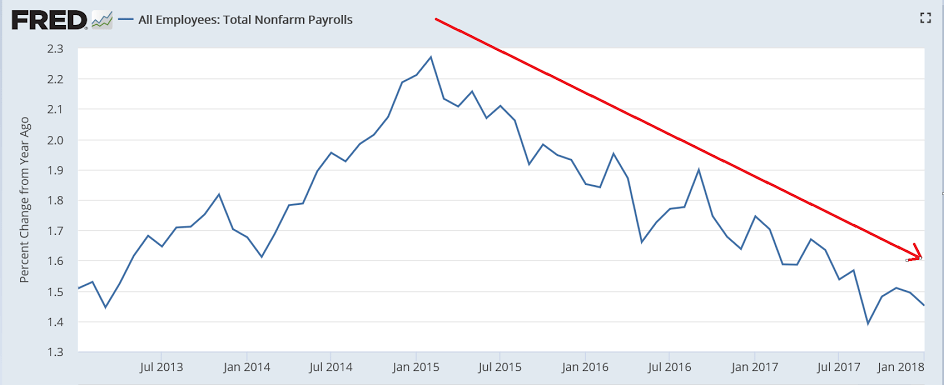

Note how the year over year growth rate continues it’s 3 year decline, and is in ‘stall speed’ with no sign of reversal. And last I heard a .1 change in the work week hours is equal to about 100,000 jobs, so the .2 drop last month offsets the 200,000 new jobs:

Highlights

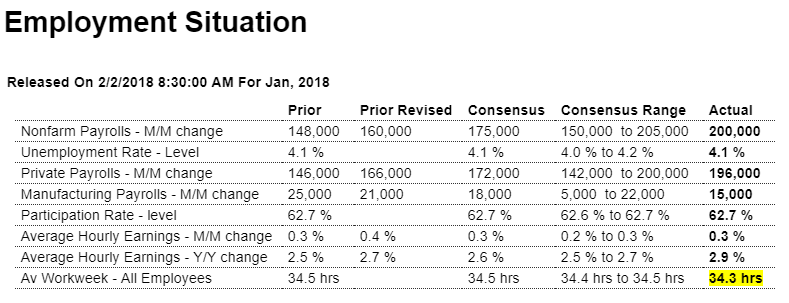

A very solid employment report for January, one however tinged with a hint of weakness, is led by a 200,000 gain in nonfarm payrolls. This is 25,000 above Econoday’s consensus and near the high estimate. The unemployment rate is steady at a very low 4.1 percent but it’s average hourly earnings that take the headlines: up a noticeable 0.3 percent with December revised 1 tenth higher to a 0.4 percent increase that joins September 2017 as an unusually strong month. The year-on-year rate for earnings is 2.9 percent which is the best of the recovery and which follows an upwardly revised 2.7 percent this last December.

Now the weakness which is the average workweek, which for all private-sector employees fell to 34.3 hours from 34.5. Weekly manufacturing hours are also down, 0.3 percent lower on the aggregate index which points to yet another disappointment for the manufacturing component of the industrial production report. The weakness in hours apparently isn’t tied to the month’s brief government shutdown as the Labor Department said the shutdown had “no discernible effect” on the data.

But strength is really the message and illustrated in payroll growth including very solid gains of 15,000 for manufacturing and another standout month for construction at 36,000. Retail trade shows a 15,000 bounce higher with professional & business services up 23,000. Temporary help and government both show small gains.

The fall in the workweek could be the first tangible confirmation of what the Federal Reserve’s Beige Book has been warning, that lack of available workers is holding down the expansion. But the gains in average hourly earnings are clear and certainly underscore the FOMC’s language that points to improvement in inflation and rising interest rates this year. Note that today’s report includes routine benchmark revisions to the establishment survey.

Yes, there’s been some recent volatility, but I don’t yet read this as a sign of anything else yet.

And in any case it’s still very low historically, real disposable personal income growth has been near 0, and with the wage share of GDP at or near record lows, seems to me wage growth is more likely

to lower today’s near record profit margins a bit, rather than force prices higher, and also that

the only way wages can grow is for wages to grow?

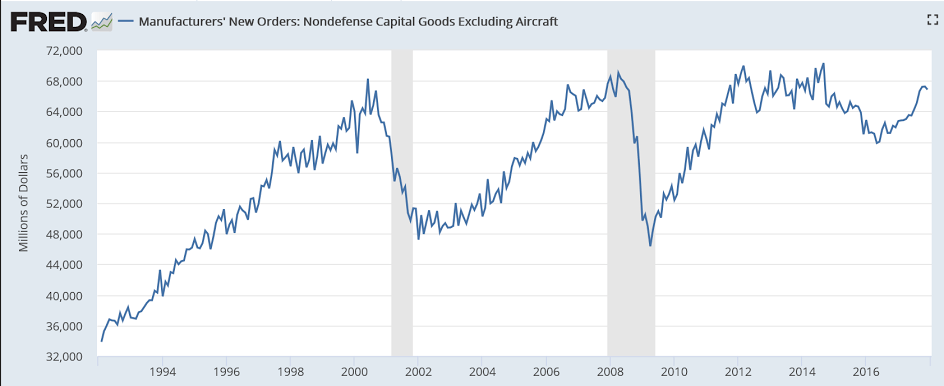

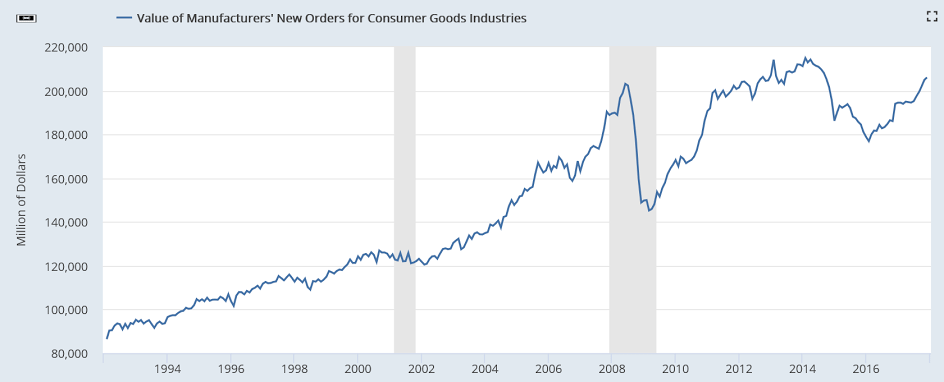

Yes, orders have picked up, but they haven’t even gotten back to levels of 3 years ago

and these numbers are not inflation adjusted:

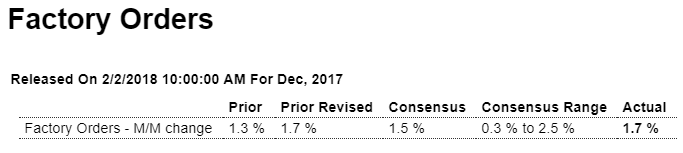

Highlights

Downward revisions to capital goods shipments offset to a degree the strong 1.7 percent headline gain for December factory orders. Shipments of nondefense capital goods excluding aircraft, which will be inputs into the second estimate for fourth-quarter GDP, are revised 2 tenths lower in December to a still solid 0.4 percent gain and 1 tenth lower for November to a 0.3 percent increase. This will pull down what was a solid showing for nonresidential fixed investment in last week’s first estimate for fourth-quarter GDP.

Other data in today’s report include a 1 tenth downward revision in December durable orders to a still very strong gain of 2.8 percent and an initial reading of plus 0.7 percent for nondurable orders led by petroleum and coal products.

Orders on the durables side are led once again by civilian aircraft but also include good showings for vehicles, primary metals, fabrications, and machinery. But orders for core capital goods, like shipments, are revised lower, down 0.6 percent in December and up only 0.1 percent in November both of which point to a slow start for 2018 business investment.

Nevertheless, today’s report is consistent with a factory sector that, despite mixed signals like the capital goods data or the dip in manufacturing hours in this morning’s employment report, is probably accelerating into the new year. This is underscored by year-on-year growth for durable orders which has been sloping higher, to 11.5 percent in December from 8.7 percent in November.

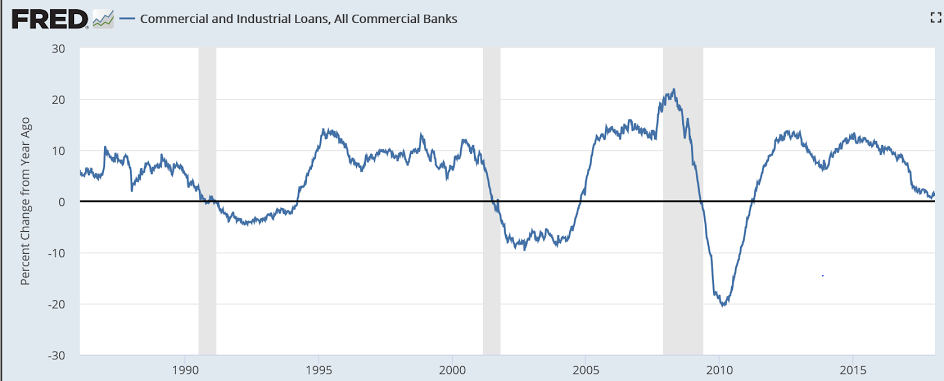

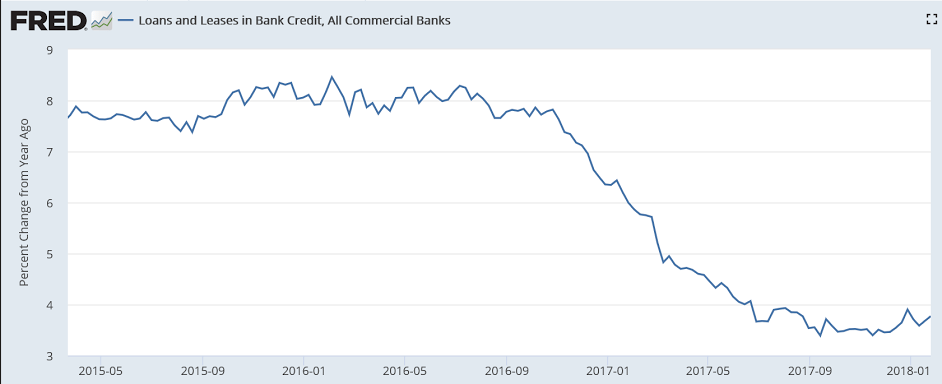

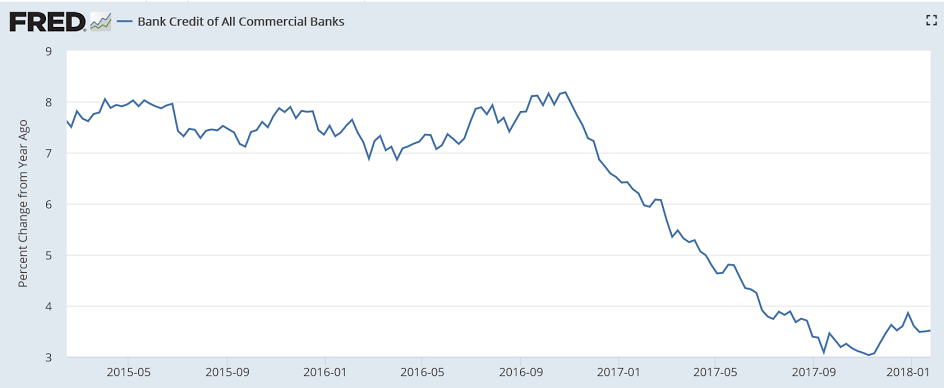

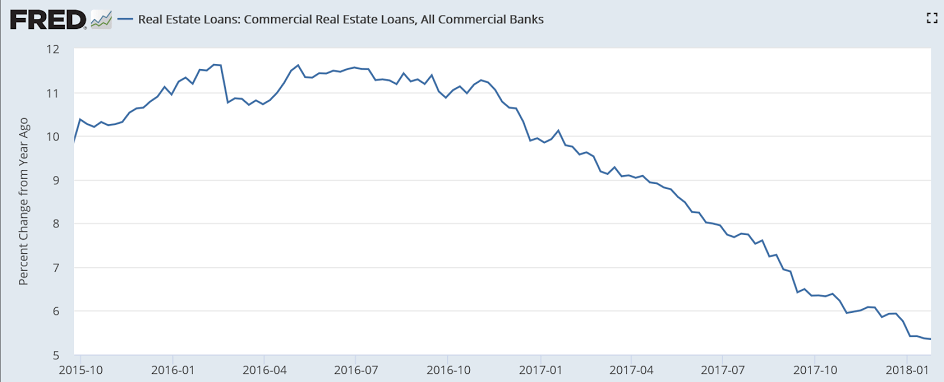

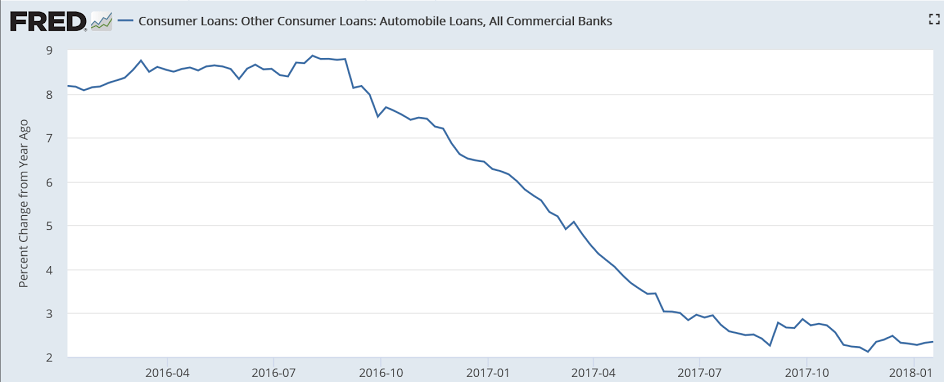

Still no signs of a pickup, and as bank loans create bank deposits, this represents a dramatic reduction in growth of that component of what is casually called the ‘money supply’: