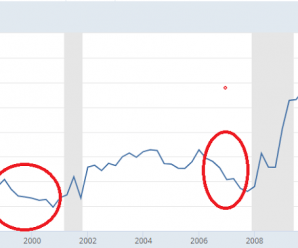

Purchase applications were down again, as housing weakness reflects the drop in the growth of mortgage credit:

Highlights

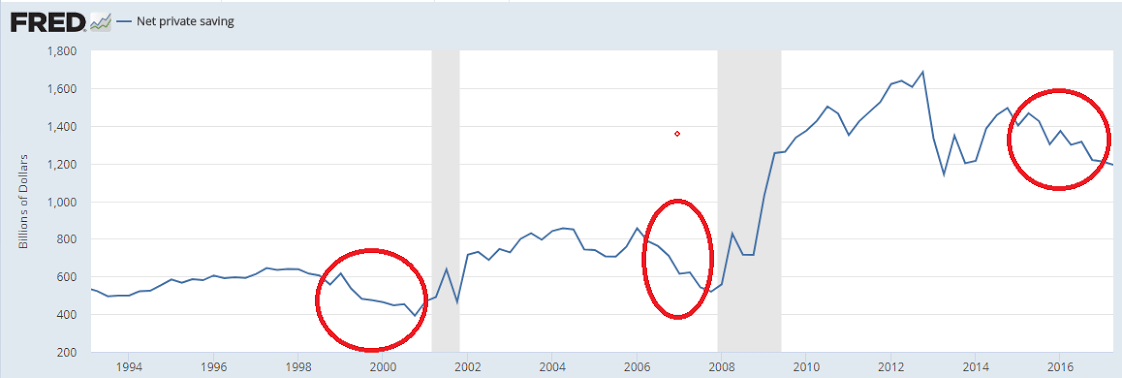

Low mortgage rates are failing to entice home buyers, whose activity declined for the third straight week according to the Mortgage Bankers’ Association. Purchase applications for home mortgages fell a seasonally adjusted 3.0 percent in the August 25 week following 2 percent declines in the two prior weeks. Unadjusted, the purchase index decreased 5 percent from the prior week, taking it to a level only 4 percent higher than in the same week a year ago, well off the 8 plus percent gains seen in previous weeks this year. Applications for refinancing fell 2 percent from the prior week, with the refinance share of mortgage activity rising by 1.2 percentage points to 49.4 percent. The average interest rate on 30-year fixed rate mortgages ($424,100 or less) fell 1 basis point 4.11 percent, the lowest rate since November 2016. Three weeks of falling purchase applications is a worrisome development for the housing market, which may be accelerating its retreat from expansion highs, especially following the evidence of July weakness submitted in last week’s housing data, showing monthly declines in sales for both new and existing homes.

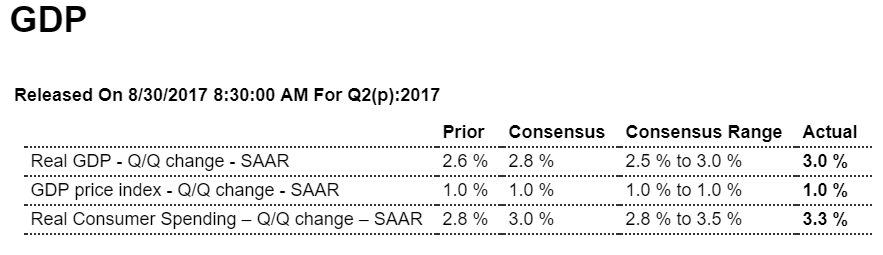

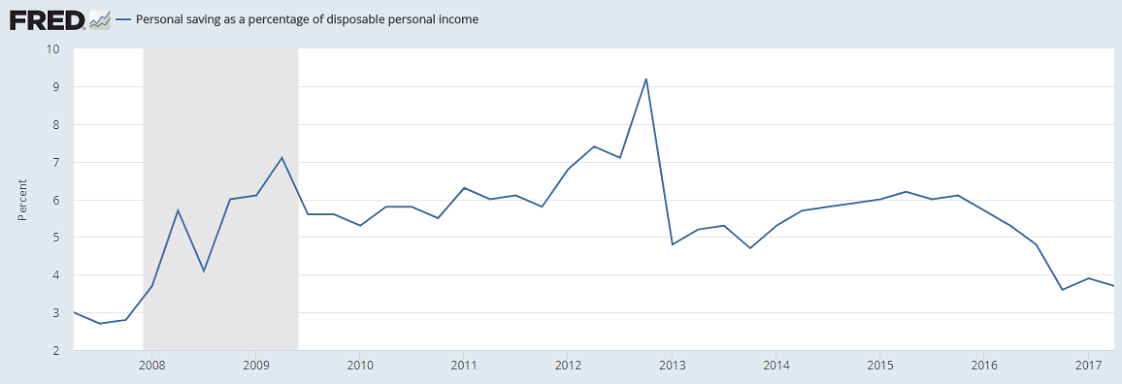

So the question is, how is GDP coming in at 3% while credit growth has collapsed and personal income growth has evaporated as well? A partial answer may be the personal savings rate, which has not only gone down, but total net personal savings seems to have declined as well. This is most likely unsustainable, and likely to very quickly translate into a further substantial decline in personal spending.

Also, prices pressures were very weak, indicating low demand, which seems contradictory. But close examination shows health care premiums for various private plans, which count as personal consumption, were up by 25%, and utility bills were high as well, leaving less for spending on other goods and services:

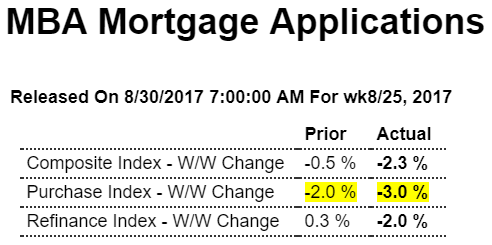

Highlights

The second-quarter proved to be very solid, revised 4 tenths higher in the second estimate to a 3.0 percent annualized rate. And strength is centered where it must be as consumer spending is now at a 3.3 percent rate for a 5 tenths upward revision.

Non-residential investment was also a positive, at a 6.9 percent rate following the prior quarter’s 7.2 percent showing. Residential investment, however, was a drag on the second quarter, at a negative 6.5 percent rate that followed a positive 11.1 percent rate in the first quarter. Government purchases were negative for a second straight quarter, at minus 0.3 percent following a minus 0.6 percent first-quarter showing. Both second-quarter net exports and inventories were slightly positive.

But prices were very weak in the quarter, at a 1.0 percent rate overall and 1.1 percent for the core. Inflation aside, the second quarter marked a solid though not exceptional reversal of the first quarter’s 1.2 percent pace and points to constructive momentum going into the third quarter.

The increased cost of health insurance is a central fact in any discussion of health policy and health delivery. Annual premiums reached $18,142 in 2016 for an average family, up 3 percent from 2015, with workers on average paying $5,277 towards the cost of their coverage.* For those Americans who are fully-covered, these cost realities affect employers, both large and small, plus the “pocket-book impact” on ordinary families. Yet for those buying insurance on an exchange or private market plan for 2017, the average increase before subsidies was a shocking 25 percent. For 2016 among the roughly 85 percent of HealthCare.gov consumers with premium tax credits, the average monthly net premium increased just $4, or 4 percent, from 2015 to 2016, according to an HHS report.

* Figures reported by Kaiser Employer Survey, 9/2016, apply to employer-based insurance.

http://www.ncsl.org/research/health/health-insurance-premiums.aspx

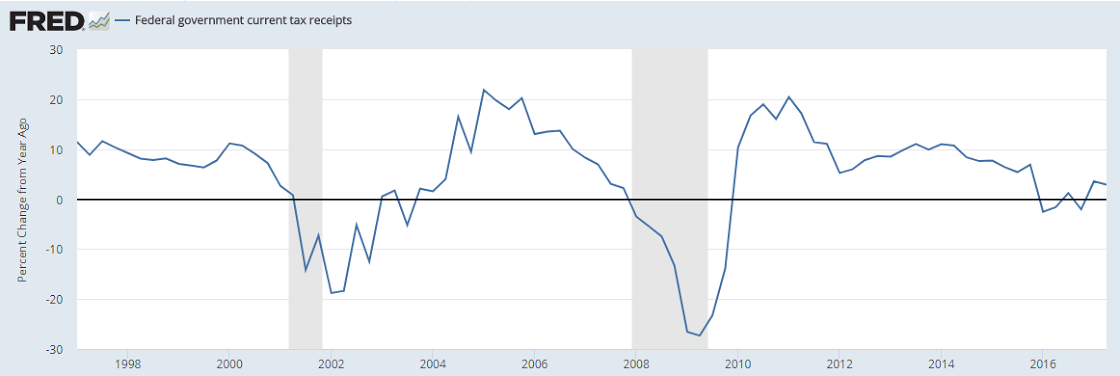

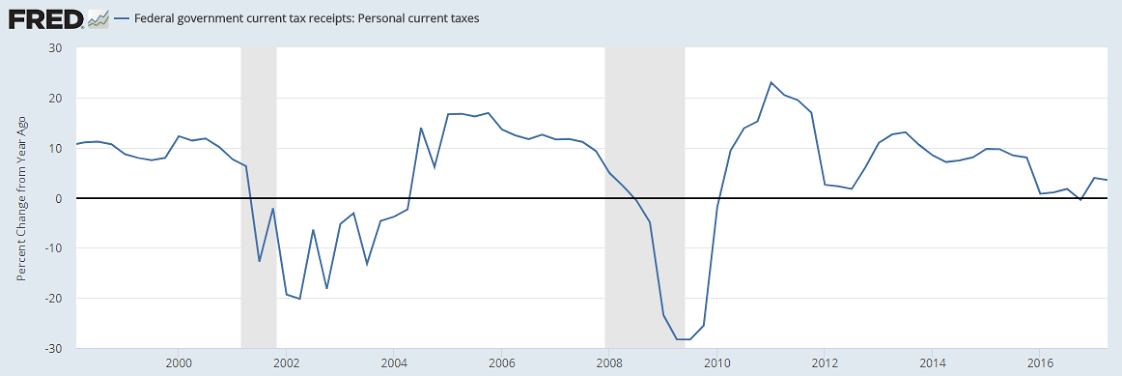

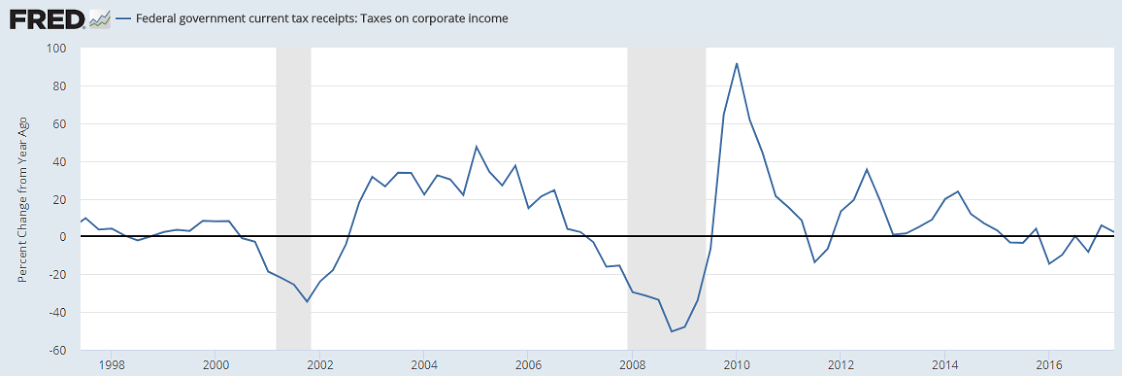

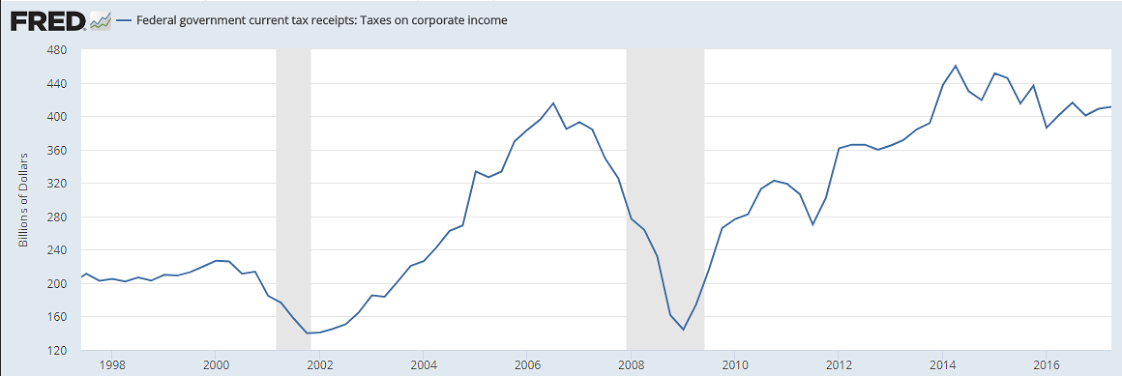

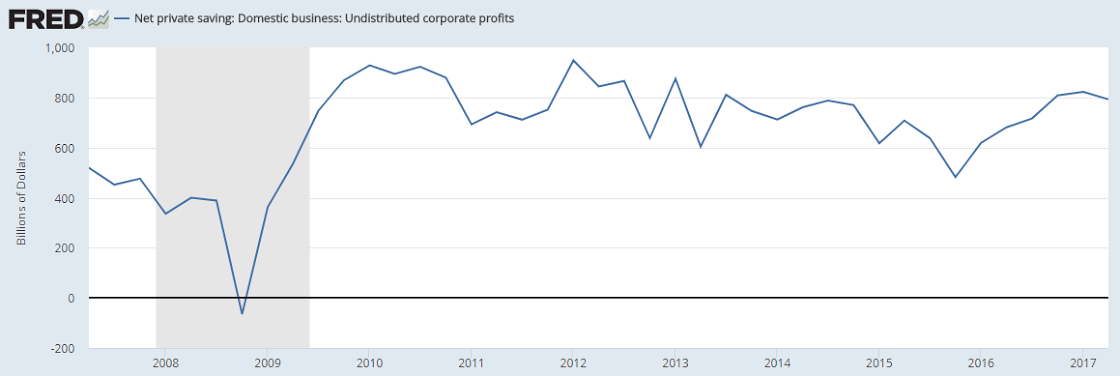

Yes, the growth rate is reasonable, but it’s currently measured from the dip that took place after oil capex collapsed. Total profits are now only back to where they’ve been for quite a while and have most recently flattened out:

Highlights

Corporate profits rose 8.1 percent year-on-year in second-quarter 2017 to an annualized $1.785.9 trillion from $1.652.1 trillion in second-quarter 2016. Profits are after tax without inventory valuation or capital consumption adjustments.

Highlights

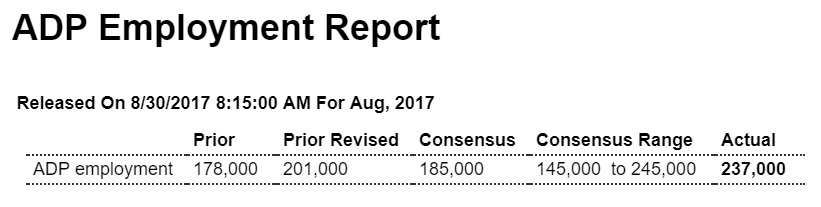

ADP is calling for a 237,000 rise in August private payrolls for Friday’s employment report where Econoday’s consensus is 179,000. ADP’s predictive accuracy has been on-and-off this year with their call for July, at an initial 178,000 which is now revised to 201,000, well below the actual 205,000.

Looks to be slowing as well: