Trumped up expectations as reflected in the various surveys continue to fade, and fall in line with the decelerating ‘hard data’:

Highlights

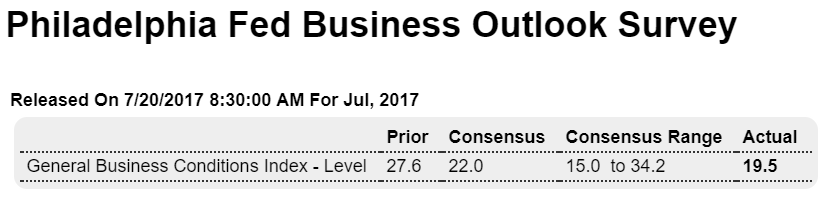

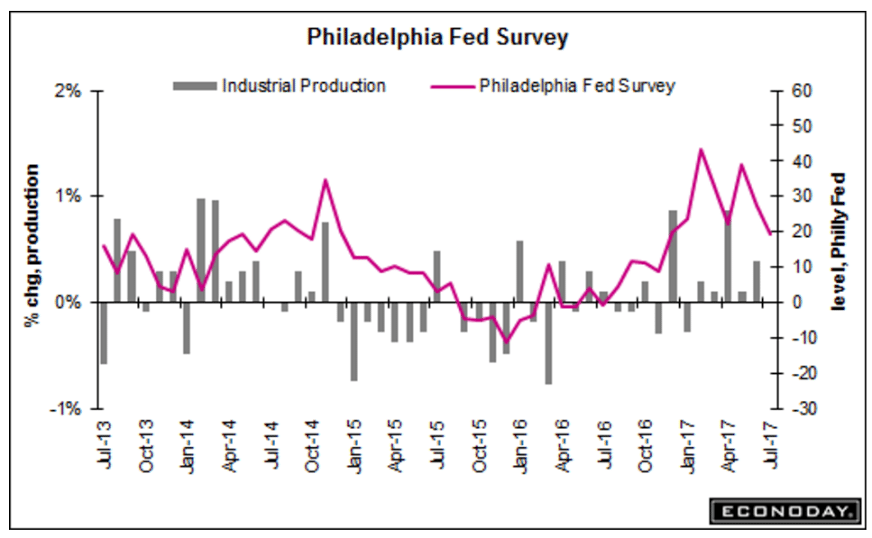

There finally may be cracks appearing in Philly Fed which has, since the election, been signaling break-out strength for the Mid-Atlantic manufacturing sector. The general conditions index looks solid at 19.5, still very strong though down from 27.6 in June and the least robust result since November. But details — which in this report are not reflected in the headline index — are the flattest since late last year.

New orders, at only 2.1, are down more than 20 points in the month for the worst reading since August last year. Unfilled orders show better strength at 7.2 but are still the weakest since December. Employment, at 10.9, is also the softest since December as are selling prices, at 9.0. Shipments, still strong at 12.2, are at the lowest rate of month-to-month growth since September last year with the workweek, still positive at 3.8, the lowest since November.

This report has been a puzzle all along, signaling post-election strength that was not matched at all by the national factory sector where growth has been no better than moderate. Though indications in today’s data still point to growth, they definitely are pointing to slowing which could either signal that this report is falling into line with actual national growth or, possibly, that national growth may be pivoting lower. In any case, this report is based on a small volunteer sample from only one area of the country.

Highlights

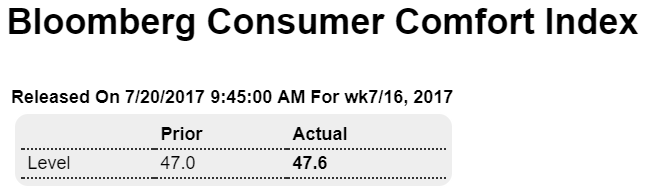

The consumer comfort index, which fell to a post-election low in the prior week, rebounded 6 tenths in the July 16 week to a 47.6 level that is still, however, the lowest since February. Confidence readings appear to be leveling out after their post-election surge.

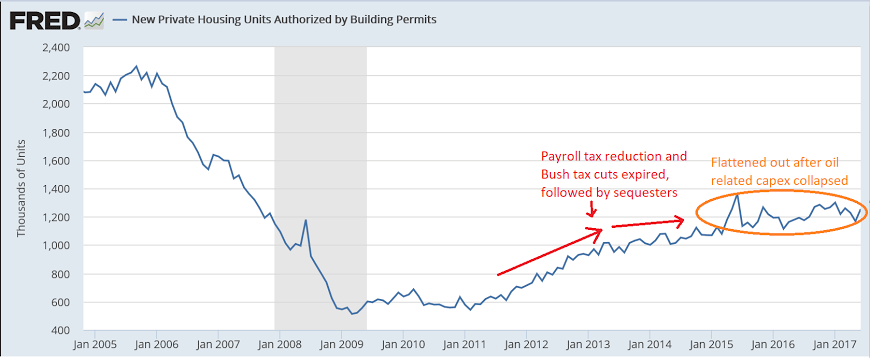

No homes built without permits, so this is the real thing. Note how permits are just over half of what they were at last cycles highs, and how they’ve nearly entirely stopped growing going on 2 years now:

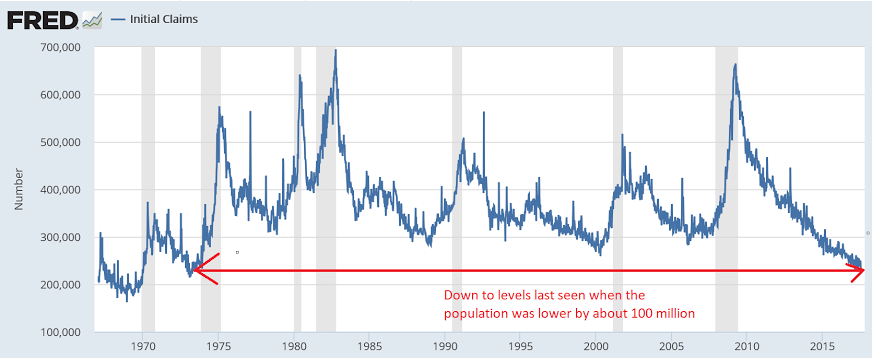

I still suspect it’s all about said benefits having been made much harder to get, especially with states working with employers to help them let people go in a way that denies them benefits which are an expense to both the state and the employer. So I remain cautious about reading this as a sign of economic strength:

The weak euro, which was entirely due to portfolio shifting rather than trade flows, was an inflationary bias that worked to prevent unwanted deflation, and at the same time supported the growth of the trade surplus, which has been supporting positive GDP growth. With the euro now reversing the ECB could find it that much more difficult meeting it’s inflation target, and any reversal of the trade surplus risks negative growth for the entire euro area:

This is not looking constructive: