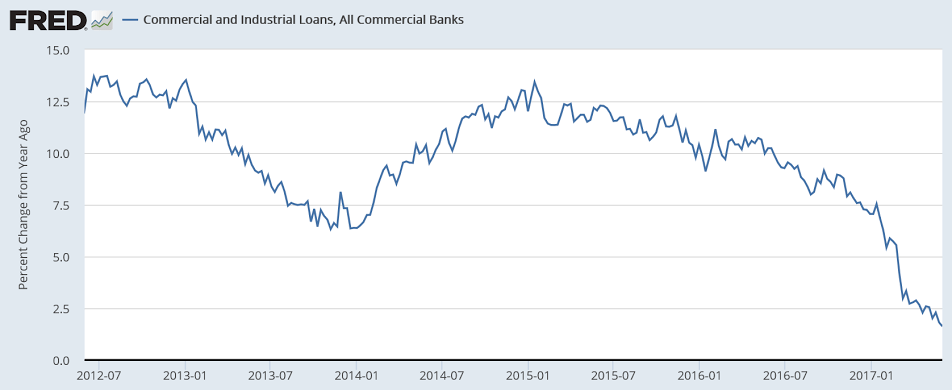

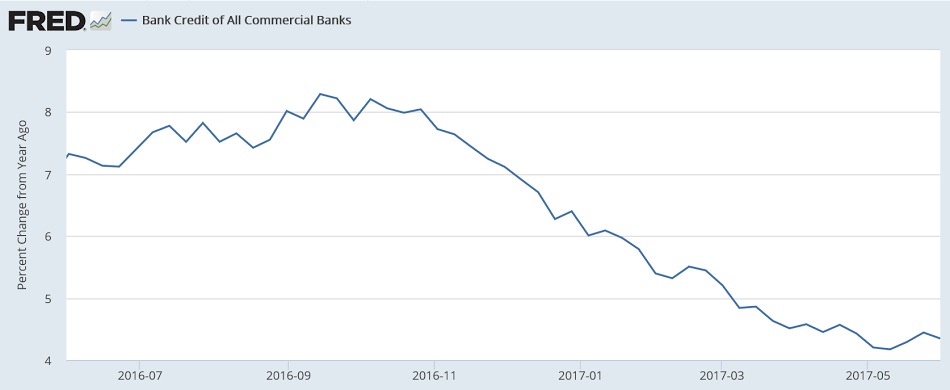

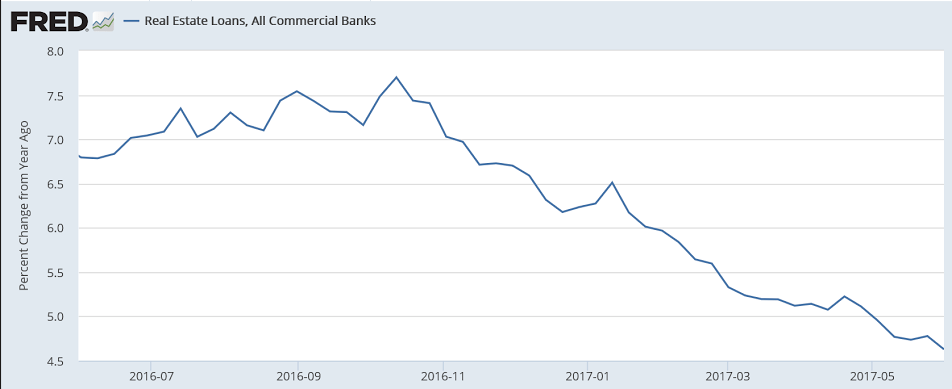

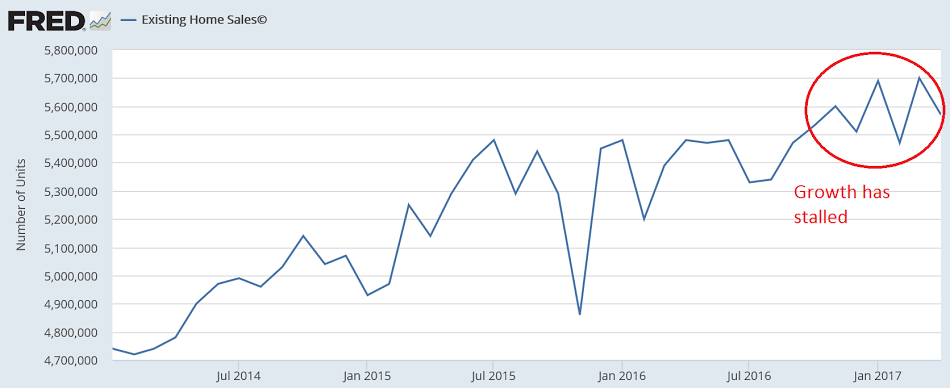

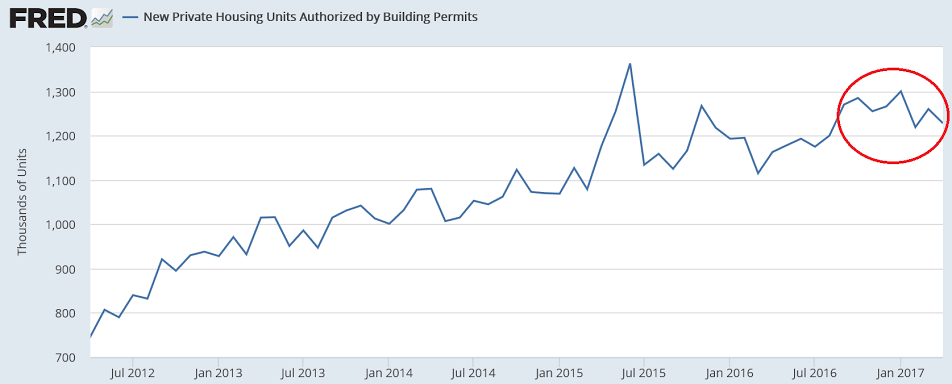

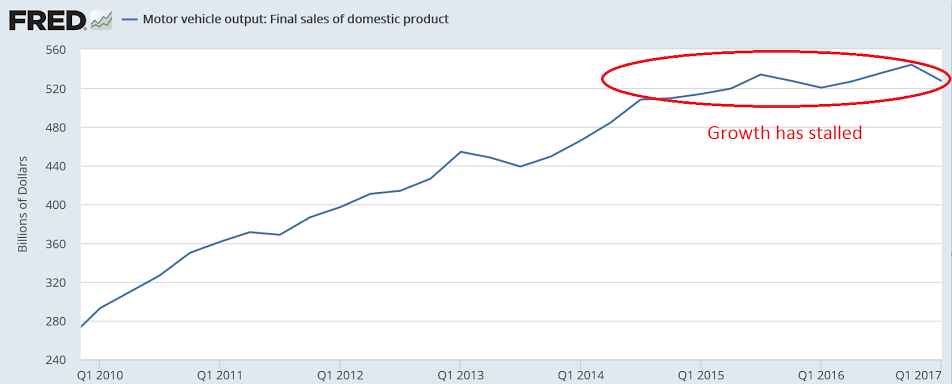

The collapse continues.

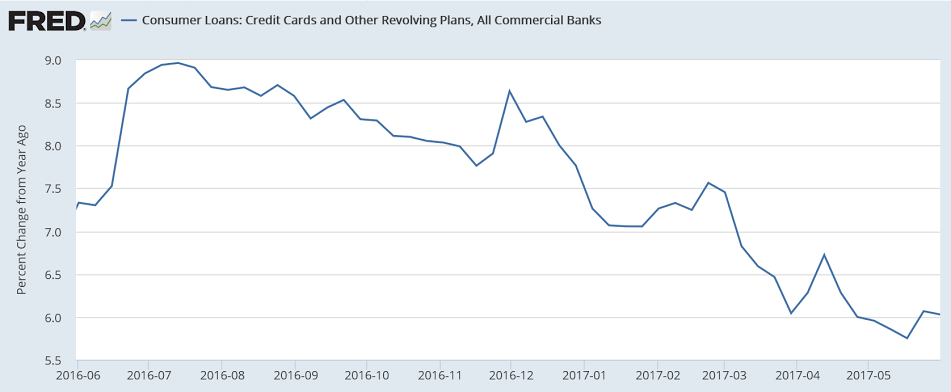

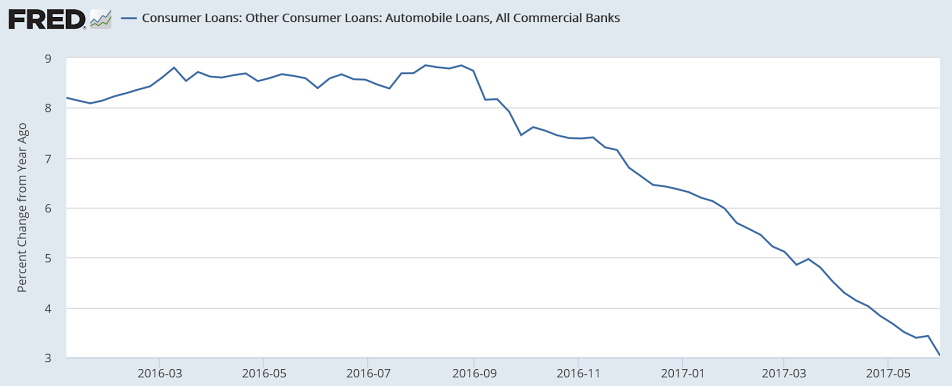

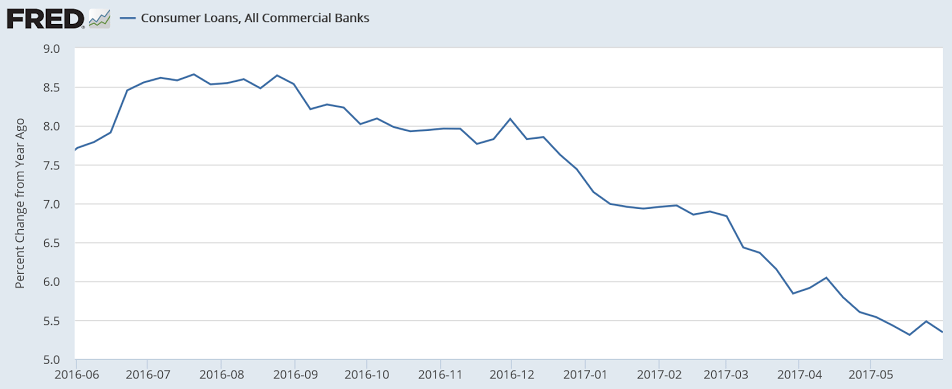

With total bank credit just over $12.5 trillion, it’s about $500 billion less than it would have been had last year’s loan growth continued.

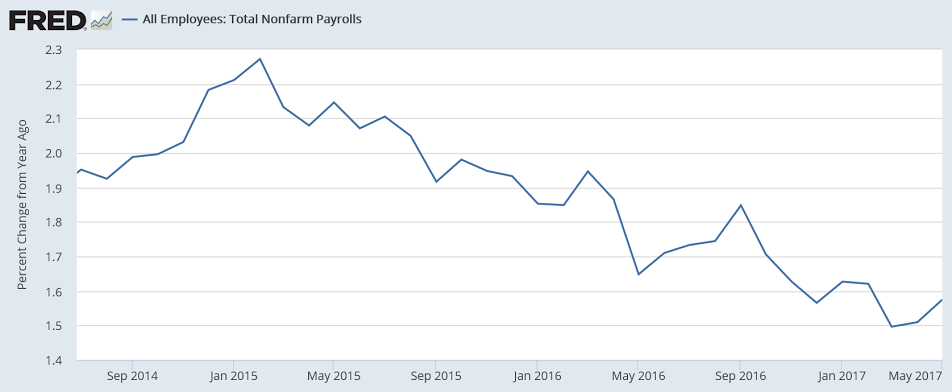

If this lower rate of loan growth continues, and isn’t replaced by some other channel that facilitates agents spending more than their incomes, the implication is that GDP could be a full 2% less than last year, as a substantial portion of bank lending finances purchases of real goods and services:

Looks like another rate hike coming from the Fed next week.

Seems to me the Fed models (not mine) tell them rates work through the credit channels, the idea being a rate hike will slow down credit growth and thereby keep the economy from overheating, etc.

But with credit growth as it is per the above charts, seems they are already decelerating.

So what would be the point of a rate hike?

To make credit growth decelerate even faster?