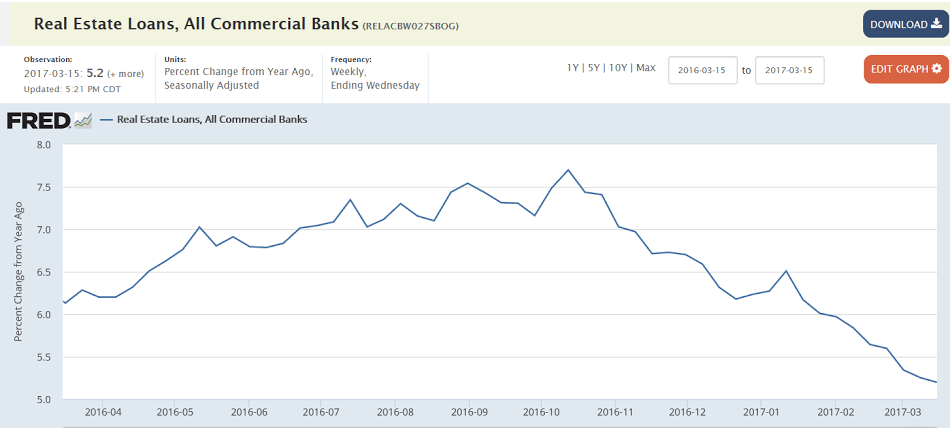

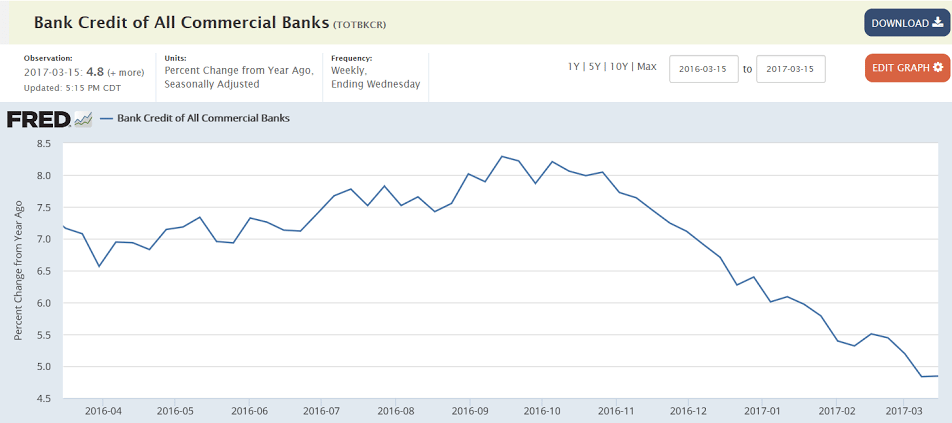

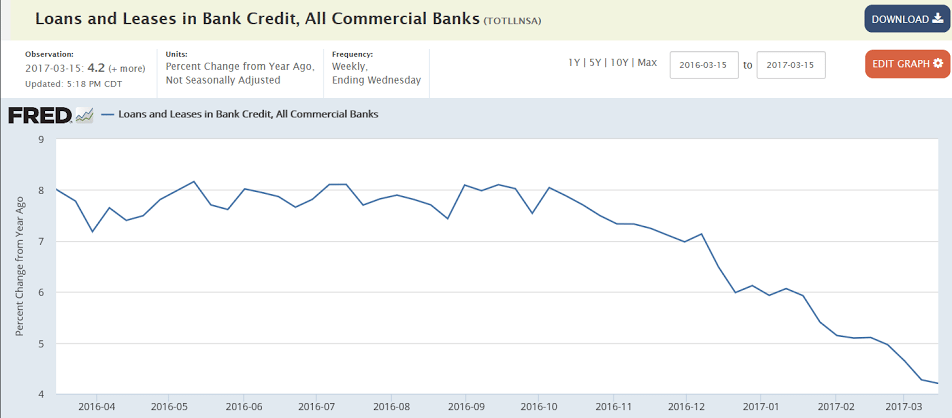

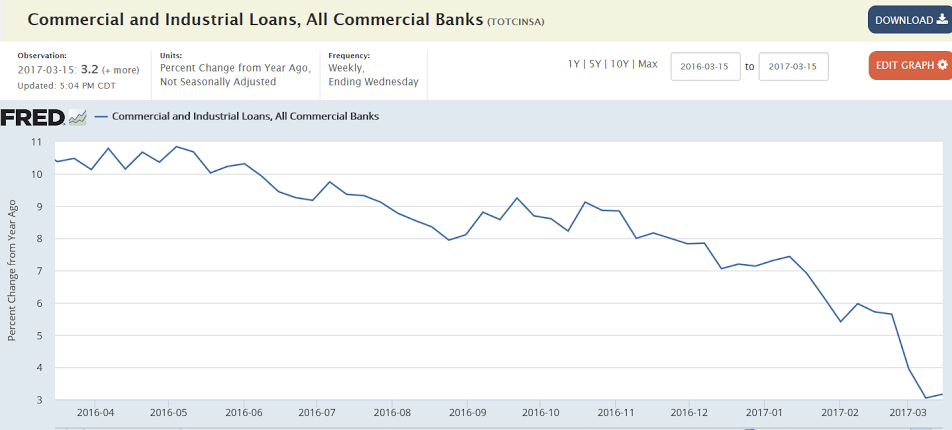

Hard to say the credit collapse is over. And as the causation is “bank loans create bank deposits” that component of the ‘money supply’ is decelerating as well:

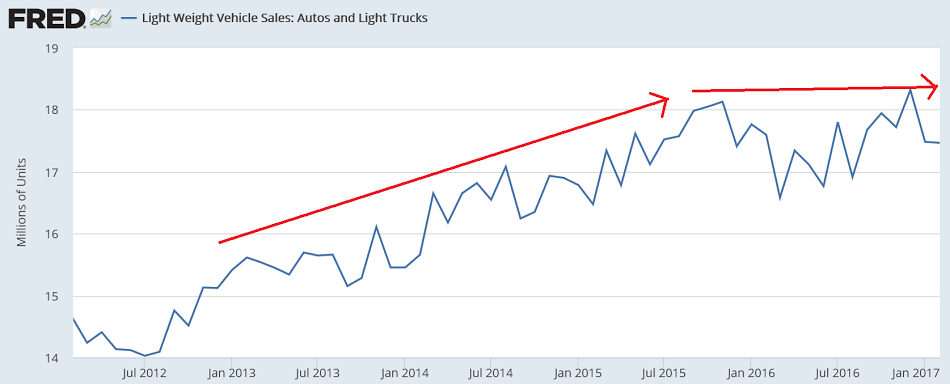

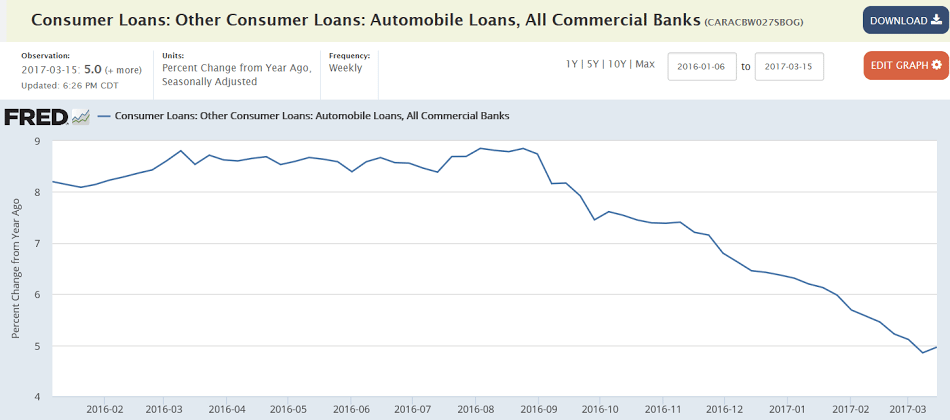

The seasonally adjusted rate of sales continues to work it’s way lower:

From WardsAuto: Forecast: U.S. March Sales to Reach 17-Year High

A WardsAuto forecast calls for U.S. automakers to deliver 1.61 million light vehicles in March, a 17-year high for the month. The forecasted daily sales rate of 59,776 over 27 days is a best-ever March result. This DSR represents a 2.6% improvement from like-2016 (also 27 days). March is anticipated to be the first month in 2017 to outpace prior-year.

The report puts the seasonally adjusted annual rate of sales for the month at 17.2 million units, below the 17.4 million SAAR from the first two months of 2017 combined, but well above the 16.6 million from same-month year-ago. …

Read more at http://www.calculatedriskblog.com/#W3XOqH34aT2gHx1y.99

And just so happens oil capex collapsed towards the end of 2015, about when vehicle sales flattened. This chart is through Feb. The forecasted 17.2 million sales for March are down from Feb’s 17.4 million: