Trumped up expectations fading, as weakness in the service sector continues, And if Trump loses today’s health care vote, I expect those expectations to fade that much faster:

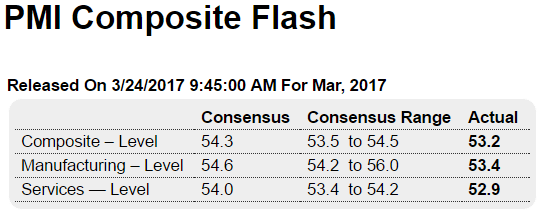

Highlights

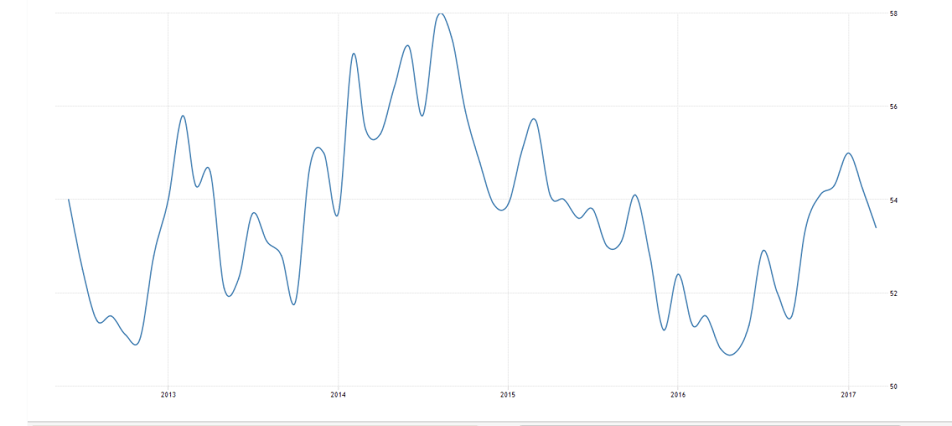

All in the mid-to-low 50s and at 6-month lows, a significant moderation in growth is the signal from Markit Economics’ U.S. diffusion indexes. The composite flash for March is 53.2 which is more than 1 point below the consensus. The manufacturing flash, at 53.4, is also about 1 point below expectations as is the services flash at 52.9.

Respondents are citing customer caution this month and are reporting slowing in employment, especially in the service sector where job creation is at a 3-year low. And in a negative for future hiring, backlog orders are starting to fall. Inventories at manufacturers, in another sign of slowing, are being cut back. Input prices are described as subdued.

The weakness in the manufacturing flash is notable, as it contrasts with extraordinary strength in regional factory reports and also the rival ISM where readings have been in the mid-to-high 50s. The weakness for this report, however, does correspond to mixed readings in hard economic data coming out of Washington.

If the economy does begin to slow, March would be the pivotal month and today’s report will have proven its worth as an advance indicator.

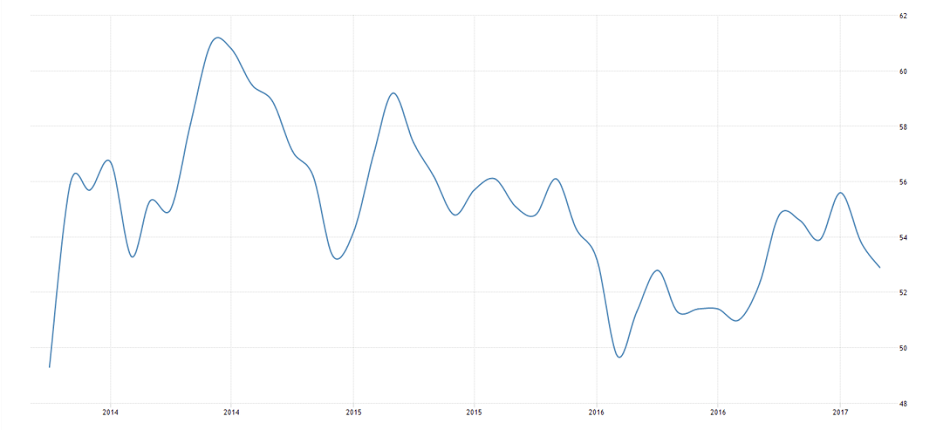

Services:

The Markit flash US services PMI decreased to 52.9 in March of 2017 from 53.8 in February and well below expectations of 54.2. It is the lowest value in six months, as new work was the lowest in 12 months and employment eased. Yet, job creation in March was one of the weakest reported over the past three years. Input cost inflation was relatively subdued.

Manufacturing:

The Markit flash US manufacturing PMI fell to 53.4 in March of 2017 from 54.2 in February and well below expectations of 54.8. It is the lowest reading since October of 2016, mainly due to a slowdown in new orders and lower stocks while input cost inflation picked up.

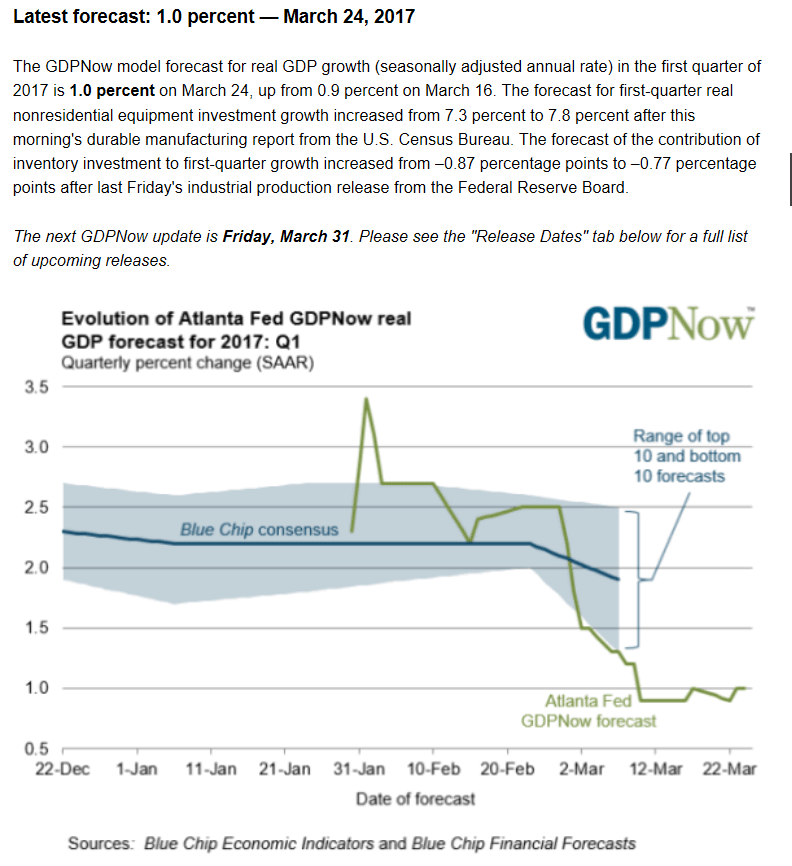

As previously discussed, muddling through with modest growth as weakness has shifted to the service sector:

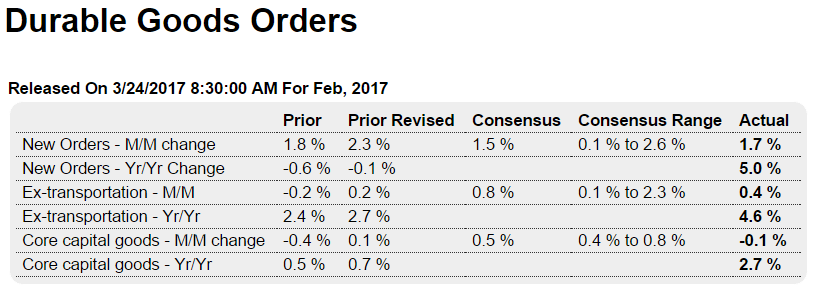

Highlights

Aircraft has been giving a significant boost so far this year to durable goods orders which otherwise are soft. Durable goods orders jumped 1.7 percent in February to beat Econoday’s consensus by 2 tenths. The data include an upward revision to January which now stands at a very strong 2.3 percent. But when excluding transportation equipment, which is where aircraft are tracked, durable orders slow to a 0.4 percent February gain which is well under the 0.8 percent consensus.

The weakest part of the report is perhaps the most important part, that is core capital goods (nondefense ex-aircraft) where orders slipped 0.1 percent in February vs expectations for a 0.5 percent jump and following January’s revised 0.1 percent gain. This points to continued weakness in business investment and eventual trouble for GDP. Yet for the first quarter, core shipments in January and February, which are inputs into GDP, are a net positive, as a 1.0 percent February gain offsets a 0.3 percent January dip. Also unfilled orders for core capital goods are building, up 0.2 percent following gains of 0.5 and 0.4 percent in the two prior months.

Total unfilled orders for durables, however, are unchanged and follow a long string of declines. Inventory growth is modest at 0.2 percent with total shipments up 0.3 percent which keeps the inventory-to-shipments ratio unchanged at a stable 1.61.

Durables activity is improving but the strength has been tied largely to aircraft where sustained month-to-month gains are uncertain. And the strength also does not include new orders for capital goods. The major spikes for advance manufacturing readings have yet to translate to similar gains for government data.

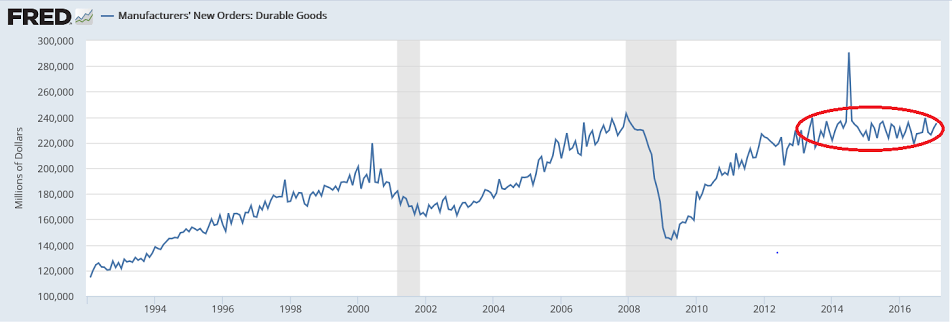

Not much has happened here in quite a while, and the numbers are not inflation adjusted: