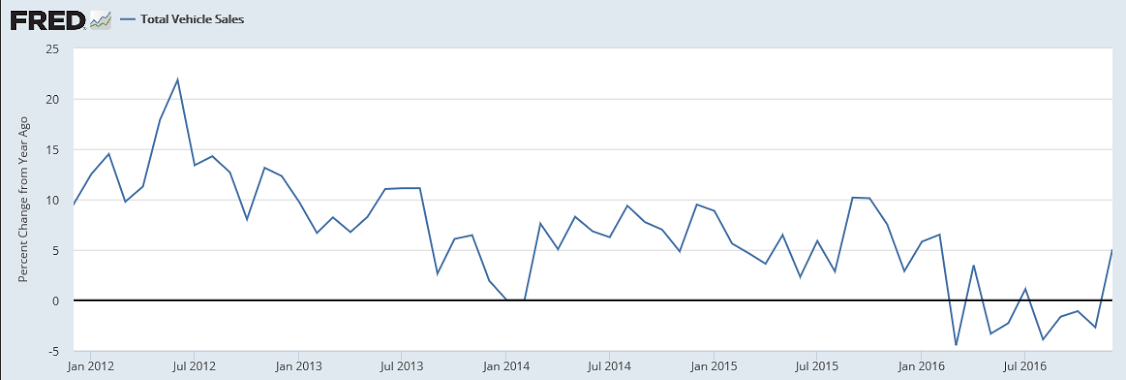

Looks like a weak start for 2017:

From WardsAuto: Forecast: January Forecast Calls for Low Sales, High Inventory

The U.S. automotive industry is expected to a have a slow start in the new year, with January light-vehicle sales down 4.4% from like-2016. … The resulting seasonally adjusted annual rate is 17.0 million units, well below the 18.3 million in the previous month and 17.4 million year-ago.

…

December inventory was 9.2% above same-month 2015, the biggest year-over-year gap since the summer of 2014. Weak sales in January will keep inventory levels high, 16.0% greater than year-ago. A 93-day supply is expected to be available at the end of the month, a major jump from 62 days in December and 77 in January 2016.

emphasis addedRead more at http://www.calculatedriskblog.com/2017/01/vehicle-sales-forecast-sales-around-17.html#tsmvSK1MApIVDcKE.99

The positive, surprise zig up last month is now forecast to zag back down into negative territory, as previously discussed:

The federal deficit remains far to small meaning the deceleration of the growth of output and employment we’ve seen over the last two years is likely to continue. That said, looks to me like tax revenues will continue to decline over the course of the next year due to earnings and employment weakness and therefore the federal deficit will be larger than this forecast indicates:

U.S. deficit forecast to shrink in 2017 but climb over next decade (Reuters) The CBO projected the deficit to fall slightly to $559 billion in fiscal year 2017, which ends on Sept. 30, compared to $587 billion a year earlier, and it was seen lower still in 2018 at $487 billion. After that, according to the CBO, deficits are expected to grow steadily over the next decade to $1.4 trillion by fiscal 2027. The CBO forecast that $8.6 trillion will be added to the federal debt over the next 10 years. The CBO also forecast U.S. real gross domestic product growth in calendar year 2017 at 2.3 percent, slowing to 2 percent in 2018.

As previously discussed, spending cuts are contractionary/deflationary, and far more potent than the proposed tax cuts:

Conservatives Try to Shape Donald Trump’s Budget Priorities (WSJ) President Donald Trump is expected to release next month the outlines of his first budget that will then be fleshed out later in March or April. Budget experts tasked to oversee the transition at OMB have been using pieces of a budget blueprint advanced by the Heritage Foundation. Altogether, the Heritage plan offers about $97 billion in discretionary spending cuts for the current year, equal to about 8% of discretionary spending and 2% of total spending. It proposed even larger cuts to automatic spending programs, including entitlements, for a combined $10.5 trillion in savings over a decade, or around 20% of all government spending.

More euro friendly news here:

Germany raises growth forecast for 2017 exports, imports (Reuters) Germany expects both exports and imports to grow faster this year than previously forecast, a government source told Reuters on Tuesday, providing an optimistic outlook despite fears of protectionism under U.S. President Donald Trump. The source in the right-left ruling coalition said the government expected exports to grow 2.8 percent in 2017, up from a previous forecast of 2.1 percent. Imports are forecast to grow by 3.8 percent, up from a previous estimate of 3 percent.

Yen friendly news here:

Japan exports up for first time in 15 months, U.S. protectionism poses risks (Reuters) Ministry of Finance data showed on Wednesday that exports rose 5.4 percent year-on-year in December. It followed an annual 0.4 percent decline in November. Shipments in terms of volume also rose 8.4 percent from a year earlier. In December, the value of exports to the United States rose 1.3 percent year-on-year. Exports to China rose 12.5 percent in December to 1.3 trillion yen ($11.44 billion). The data showed Imports fell 2.6 percent in the year to December, resulting in a trade surplus of 641.4 billion yen.