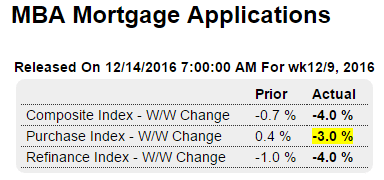

Continues to decline. One less reason for the Fed to hike today…

Highlights

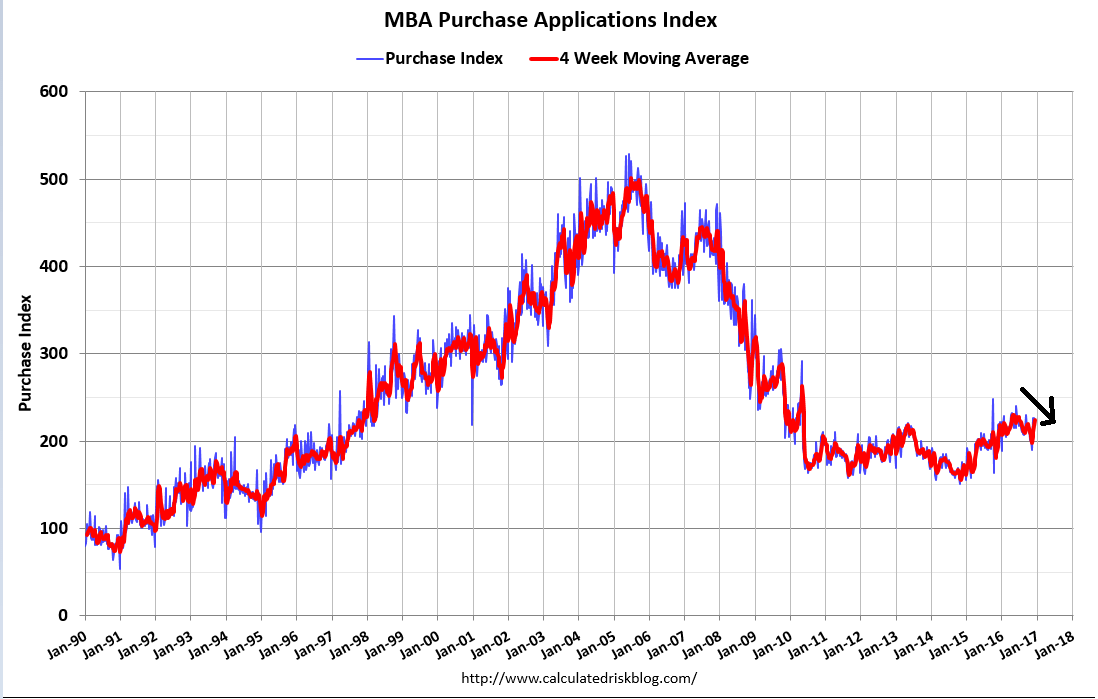

Rising interest rates continue to take their toll on mortgage activity, with purchase applications for home mortgages falling a seasonally adjusted 3.0 percent in the December 9 week, while refinancing applications fell 4.0 percent. The purchase index now stands just 2 percent above its reading a year ago, a 1 percentage point decline from the prior week. Reaching the highest level since October 2014, the average interest rate on 30-year fixed-rate conforming mortgages ($417,000 or less) rose 1 basis point from the prior week to 4.28 percent.

Though it is nearly a foregone conclusion that the Fed will hike the Fed funds target range by 25 basis points today, potential home-buyers and refinancing homeowners will be sensitive to rhetoric explaining the decision for clues about the frequency and magnitude of future rate hikes. Upwardly revised inflation expectations have pushed up mortgage rates by more than 50 basis points since the Presidential election, taking them to a level about 70 basis points higher than the 3-year lows seen in July.

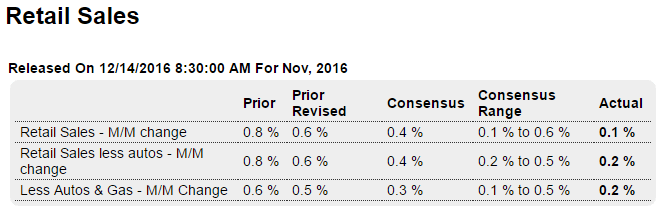

Very low growth and prior month revised down:

Highlights

The details are a little bit better than the retail sales headline for November which could manage only a 0.1 percent gain. Auto sales, which had been very strong in prior months, fell 0.5 percent in the month for the sharpest drop since March. But most other components managed to show gains though only marginal ones with nonstore retailers (ecommerce) and electronics & appliance stores up only 0.1 percent as was the key general merchandise category.

But there is strength in the report as restaurants, up 0.8 percent, posted their best gain since February. This is a discretionary category that points to underlying consumer strength. Furniture and furnishings posted a very strong 0.7 percent gain with building materials and gardening equipment a respectable 0.3 percent. Gains for these two readings are consistent with strength in the housing sector.

Excluding autos, retail sales rose 0.2 percent while excluding both autos and gasoline, the latter not a major factor in the November report, sales also rose 0.2 percent. These are light gains for a month when consumer confidence shot higher, but outside of the monthly swing lower for autos, much of this report is constructive and won’t likely be holding down expectations for the holiday shopping season.

Another bad one:

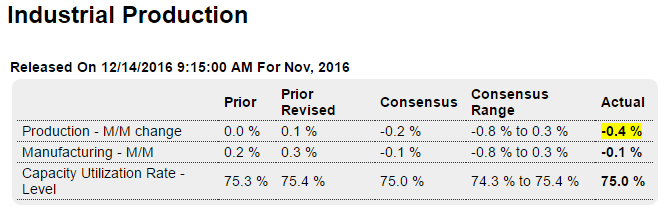

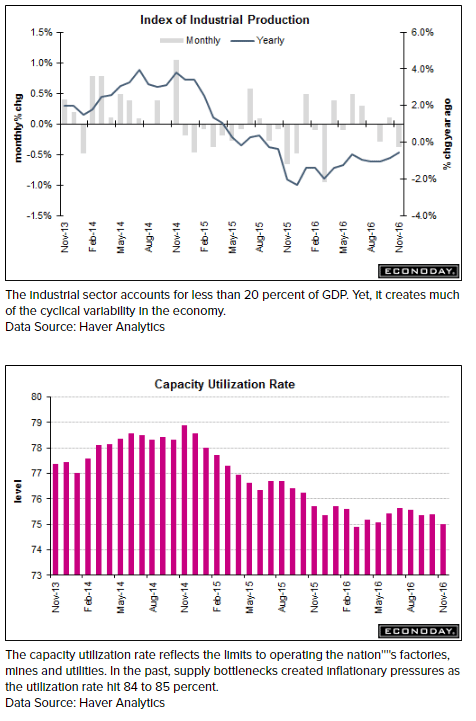

Highlights

Unseasonably warm weather pulled utility output lower and total industrial production along with it which fell 0.4 percent in November. Utility output fell 4.4 percent in the month for the third steep decline in a row. Manufacturing output was soft, down an as-expected 0.1 percent in the month though October is revised 1 tenth higher to a gain of 0.3 percent.

But most of the readings for manufacturing are weak. Motor vehicle production, which had been a leading strength for manufacturing with five straight gains, fell a steep 2.3 percent in the month with assemblies of light trucks going into reverse. Hi-tech goods, also a leading strength, could only manage a 0.1 percent gain. Market groups show a 0.5 percent decline for consumer goods and a 0.3 percent dip for business equipment, the latter once again a disappointment for the business investment and productivity outlooks.

Overshadowed by manufacturing and utilities, mining had a very strong month, up 1.1 percent following October’s 1.9 percent gain. The recent gains for mining have trimmed its year-on-year decline from the high single digits to and mid-single digits, at minus 4.6 percent in the latest data. For comparison, year-on-year manufacturing production is in the plus column but only at 0.1 percent. Utilities are down 1.9 percent with total industrial production down 0.6 percent.

With the dip for manufacturing, today’s report offers the first definitive look at the November factory sector, one that will not be raising fourth-quarter GDP estimates. Advance looks at December’s factory conditions follow tomorrow with the closely watched regional reports from the Philly and New York Feds.

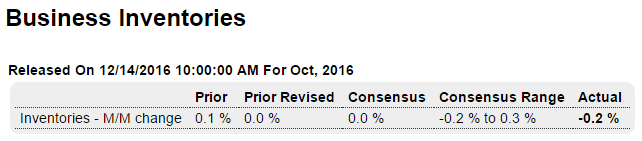

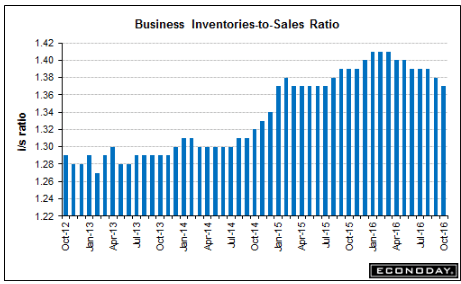

Also not good for GDP as sales are low and inventories are being worked down rather than new goods being produced, and there’s still a long way to go:

Highlights

High levels of unwanted inventories are not an issue for the year-end economy, based on a 0.2 percent decline in business inventories in October along with a 1 tenth downward revision to September which is now unchanged. Looking at components, both retail and wholesale inventories fell 0.4 percent in the month with manufacturing inventories unchanged.

Inventories are best measured against sales which, for business sales overall, rose a very strong 0.8 percent in October to pull the inventory-to-stocks ratio down to 1.37 from 1.38. The strength in sales and lack of inventory build points to the need to rebuild inventories which is a plus for the production and employment outlooks.

Economists chop growth outlook after consumers shop less than expected

By Patti Domm

Dec 14 (CNBC) — Between the miss in retail sales and softer industrial production, JPMorgan chopped its forecast to 1.5 percent GDP growth from 2 percent for the fourth quarter, a disappointment after the third quarter’s 3.2 percent pace.

Goldman Sachs Chief Economist Jan Hatzius said he lowered tracking fourth-quarter GDP to 2 percent from 2.1 percent, and Barclays lowered the tracking pace to 1.8 percent after weaker retail sales and industrial production.

“When the economy is running at 2 percent-ish … portions of the economy are kind of in recession at any point in time. There are cracks. We had some concerns about the strength of imports. Imports of consumer and capital goods are soft. The business spending side still seems quite soft to us. We have concerns auto sales will come down just because the pace is unsustainable,” said Gapen.