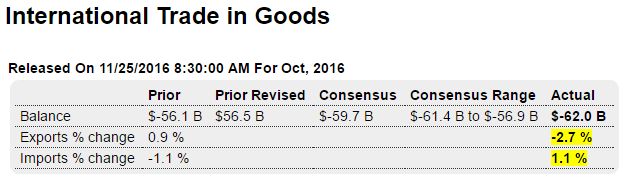

Higher trade deficit than expected, and last month revised higher. And just getting going:

Highlights

The advance international goods deficit widened to $62.0 billion in September from minus $56.5 billion in August. The increase in the deficit was bigger than the anticipated deficit of $59.7 billion. Exports were down 2.7 percent on the month while imports increased 1.1 percent. In August exports increased 0.6 percent while imports declined 1.0 percent.

The biggest decline in exports — 11.8 percent was for foods, feeds & beverages – followed a 12.0 percent decline in August. Industrial supplies, which include petroleum, declined 4.1 percent after increasing 1.5 percent. Capital goods slipped 0.1 percent after increasing a robust 3.7 percent the month before. Consumer goods exports also dropped, declining 5.9 percent after increasing 4.6 percent in August.

On the import side, autos were unchanged on the month after sinking 4.7 percent the month before. However, capital goods imports rebounded 1.9 percent after dropping 3.4 percent. Consumer goods imports were up 3.7 percent after declining 1.7 percent in August. Industrial supplies (including petroleum) were down 1.2 percent and slipping 0.1 percent the month before.

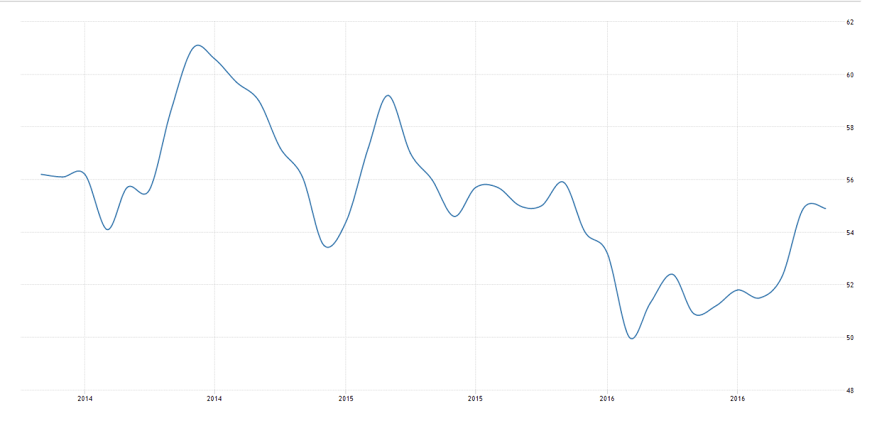

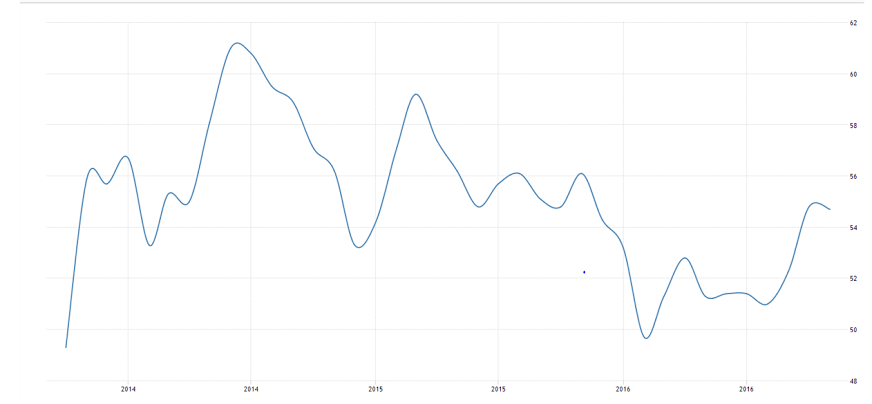

This composite of Services and Manufacturing purchasing manager’s index looked like it might have been moving to higher levels but just rolled over some:

This is just the service sector and looks to me like it’s still working its way lower, as weakness that began in mining and manufacturing due to the oil capex collapse spilled over into the service sector:

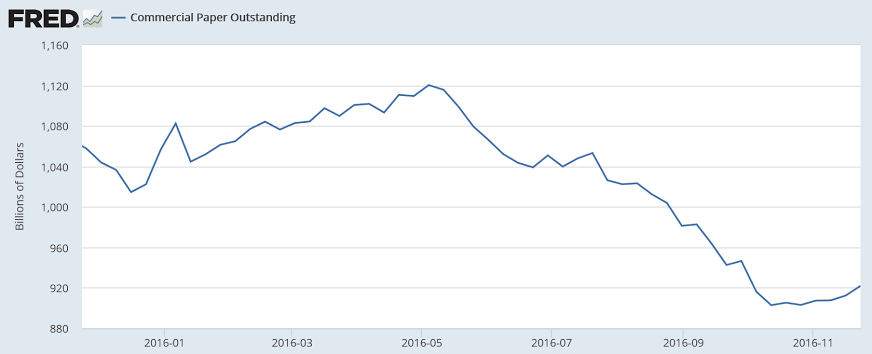

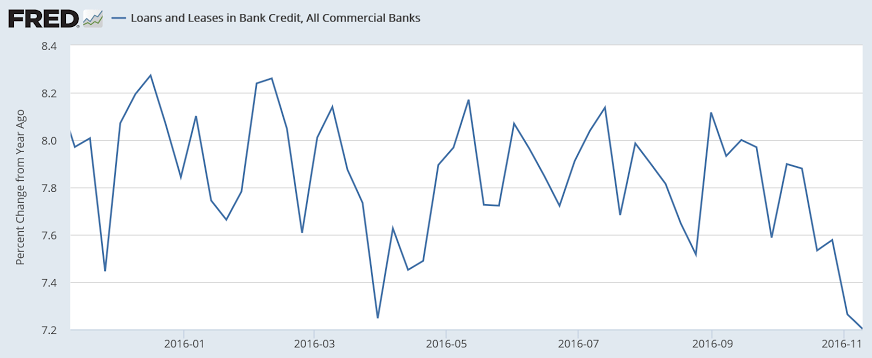

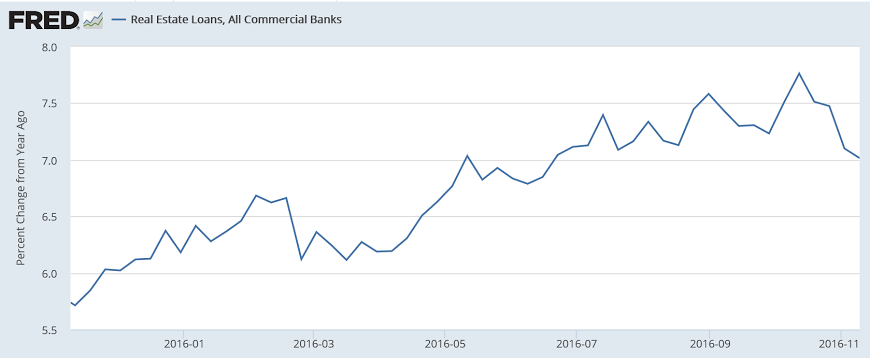

And still looks to me like overall credit growth continues to decelerate:

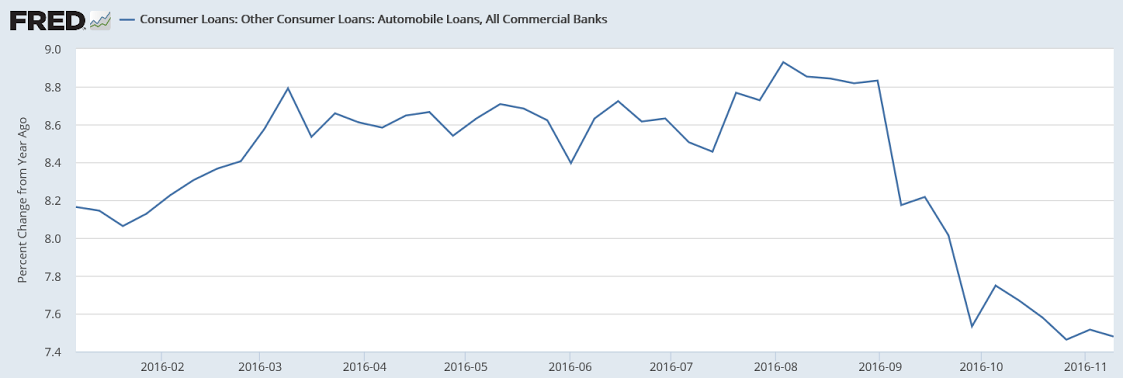

These two are from from 6 days ago:

The drop here is partially due to Dodd/Frank regs: