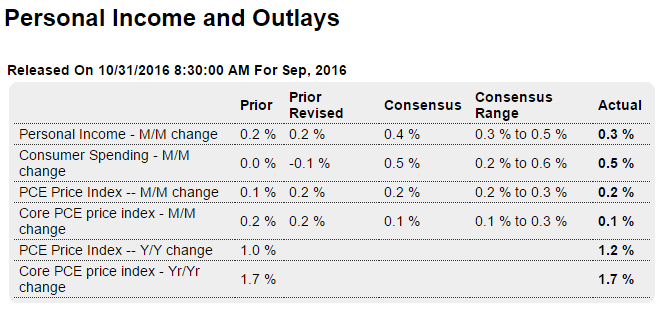

Personal income a bit below expectations, spending met expectations but last month revised down a bit. And the GDP report already had consumer spending way down and less than expected and we already know auto sales are falling behind last year’s totals:

Highlights

Personal income rose a solid but slightly lower-than-expected 0.3 percent in September with the wages & salaries component, which weakened in August, also at plus 0.3 percent. Consumer spending was especially solid in September, up an as-expected 0.5 percent and reflecting the month’s strength in vehicle sales.

Inflation data are mixed to soft. The overall price index rose 0.2 percent with the year-on-year rate at plus 1.2 percent. This is the strongest yearly showing since November 2014 and is 2 tenths closer to the Federal Reserve’s 2 percent target.

Yet the core rate, which excludes food & energy, failed to show much lift, up only 0.1 percent on the month with the year-on-year rate unchanged at 1.7 percent. This rate has been stuck between 1.6 and 1.7 percent all year though is up from 2015’s average of 1.4 percent.

The consumer wasn’t putting September’s increase in income into savings as the savings rate edged 1 tenth lower to what is a still respectable 5.7 percent.

Overall, the consumer ended the third quarter in respectable fashion, pointing to moderate economic momentum going into the fourth quarter.

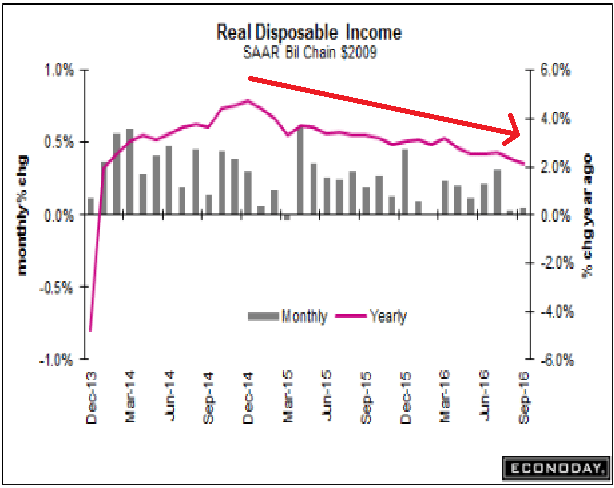

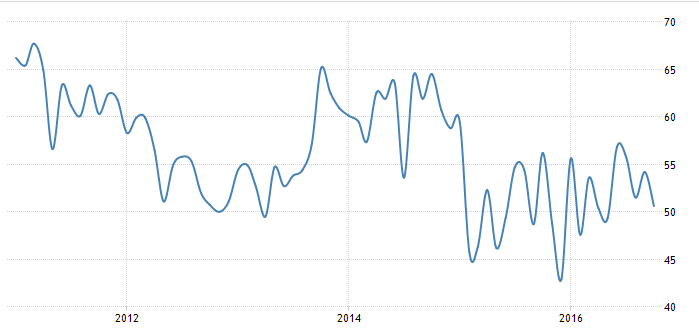

Income growth continues it’s deceleration that began with the collapse in oil capex:

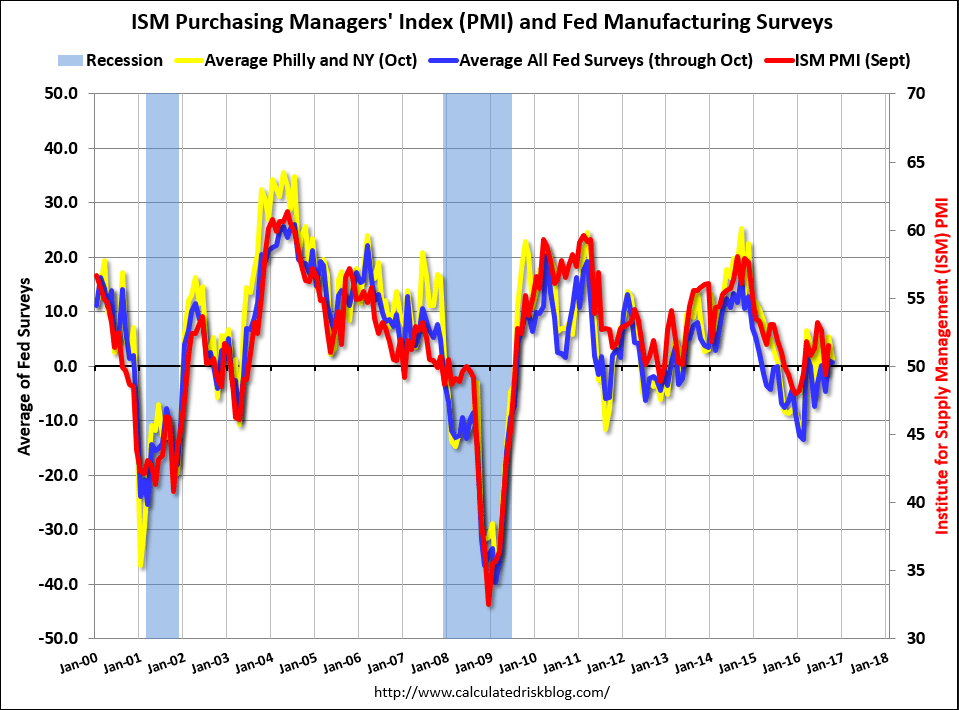

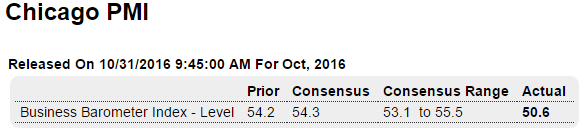

A setback here, as previously discussed was likely:

Highlights

The Chicago PMI has been bumpy all year and is once again for the October report, down 3.6 points at 50.6 to indicate abrupt month-to-month slowing in composite activity. New orders are part of the slowing as is production. Signs of strength come from employment, which is back into the expansion column, and from prices paid which show the most pressure since November 2014. Though uneven and mostly soft, this report points to continued expansion for the area’s economy. The Chicago PMI covers both the manufacturing and nonmanufacturing sectors.

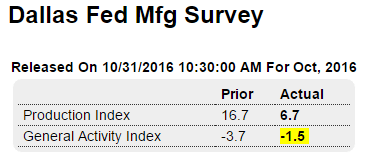

Still in contraction:

United States Dallas Fed Manufacturing Index

The Federal Reserve Bank of Dallas’ general business activity index for manufacturing in Texas rose to -1.5 in October 2016 from -3.7 in September, but below market expectations of 2. The capital expenditures index moved up to 8.7 (from 3.1 in September), reaching its highest reading in nearly two years. In contrast, the production index declined 10 points to 6.7, suggesting output rose but at a slower pace this month; and the capacity utilization and shipments indexes fell notably after spiking last month, coming in at 0.8 (13.5 in September) and 1.9 (20.1 in September), respectively. The employment index came in at 0.2 (2.3 in September), suggesting little change in headcounts, and the hours worked index fell into negative territory (-1.8 from 3.7 in September). Also, the new orders declined to -3.5 from -2.9. Meanwhile, expectations regarding future business conditions improved again with the index of future general business activity posting a fifth positive reading in a row.

Not looking like any meaningful improvement is developing: