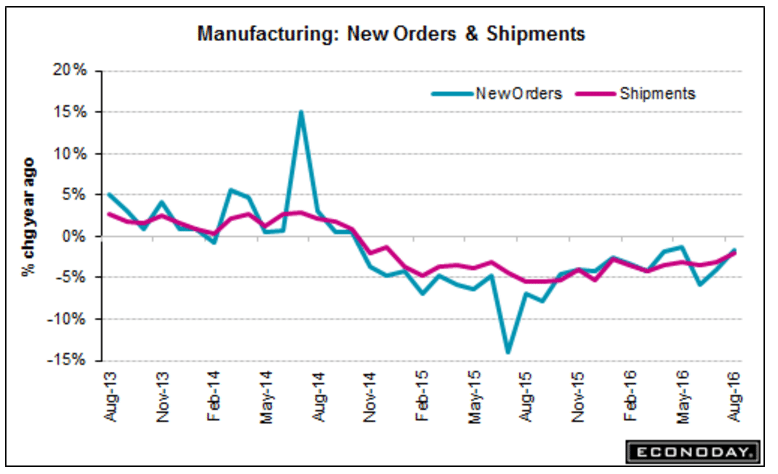

The year over year change not looking so good:

Highlights

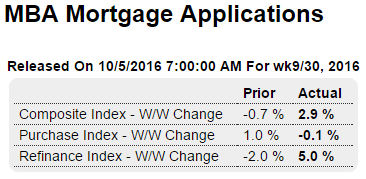

Purchase applications for home mortgages were down just 0.1 percent from the prior week in the September 30 week, but the comparison with the year ago week plunged sharply into deeply negative territory at minus 14 percent. Refinancing applications were up 5.0 percent from the prior week, however, as more mortgage holders seized the opportunity to refinance with lower interest rates. The refinancing share of mortgage activity increased to 63.8 percent, up 1.1 percentage points from a week ago. Mortgage rates fell to the lowest level since July, with the average interest rate on 30-year fixed-rate conforming loans ($417,000 or less) falling 4 basis points to 3.62 percent.

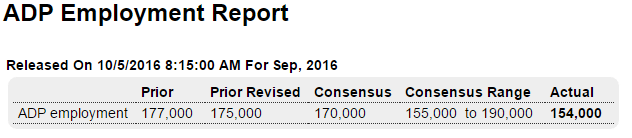

Employment growth continues to decelerate:

Highlights

ADP is looking for significant slowing in employment growth for September, to 154,000 for its private payroll estimate vs a slightly revised 175,000 in August. The Econoday consensus for private payrolls in Friday’s report is 170,000 but today’s ADP result will definitely raise talk of a lower print.

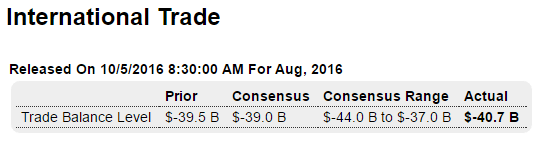

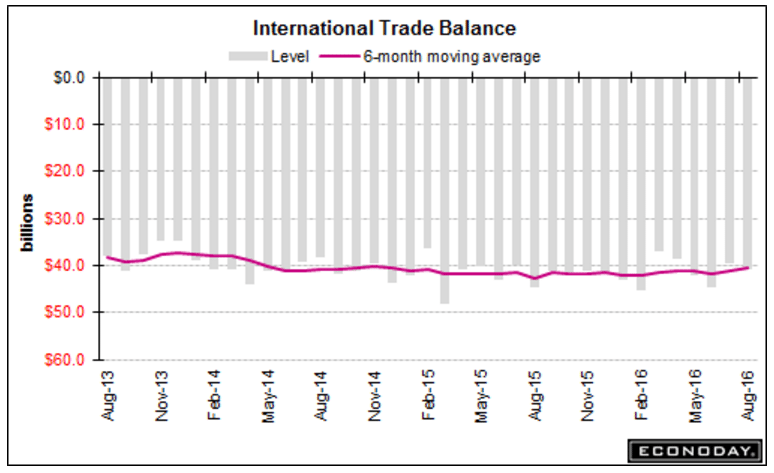

In the old days a drop in oil prices would cause the US trade deficit to decrease. But as previously discussed, this time it didn’t happen. And now with lower US oil production and more oil and product imports, higher prices will increase the trade deficit:

Highlights

The nation’s trade deficit widened by $1.2 billion in August to $40.7 but details are positive. Exports of capital goods, excluding aircraft, actually rose slightly to $37.6 billion while imports of capital goods were up $1.2 billion to $50.2 billion. These results hint at badly needed strength for cross-border business investment. When including aircraft, however, capital goods exports fell $0.7 billion in what is the lowest result in nearly 5 years.

Total exports in August rose 0.8 percent, which is another positive, while imports rose 1.2 percent. The gain for imports is a subtraction in the national accounts but it does point to solid domestic demand, specifically once again for capital goods. The trade gap for goods is unchanged from July at $60.3 billion while the trade surplus for the nation’s services, in what is a superficial negative in the report, fell $1.2 billion to $19.6 billion for the lowest showing since December 2013. But the dip in services reflects $1.2 billion in broadcast payments for the Olympics.

By countries, the gap with China widened by $3.6 billion to $33.9 billion while the gap with the European Union widened by $1.6 billion to $13.9 billion. The gap with Japan edged lower to $6.0 billion.

Today’s results may lower third-quarter GDP estimates but the export reading excluding aircraft is a subtle positive for the economic outlook.

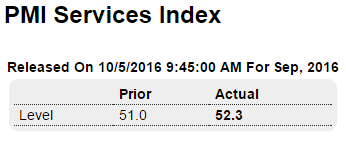

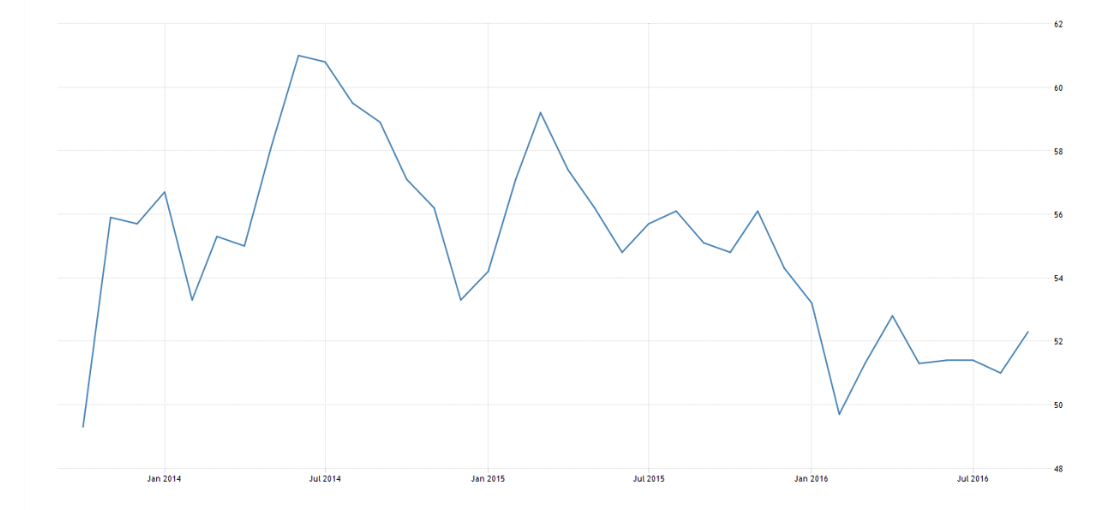

Up a bit but some troubling details:

Highlights

Service sector growth is improving, at least that’s what Markit’s U.S. sample is reporting. The composite index for September is 52.3, up slightly from 51.9 in the month’s flash reading and up solidly from a 5-month low of 51.0 in August. But the composite hides what is disappointing slowing in new orders which are at their weakest growth rate since May. And in a negative indication for Friday’s employment report, hiring slowed to a 3-1/2 low in the month. Reports from Markit, unlike other reports, continue to cite uncertainty over the presidential election as a negative factor. A positive in the report is a third straight build in backlog orders which posted their second best gain since April last year. But another negative is a near recovery low in 12-month optimism. Input costs and selling prices are both very subdued. Watch for the ISM non-manufacturing report later this morning at 10:00 a.m. ET.

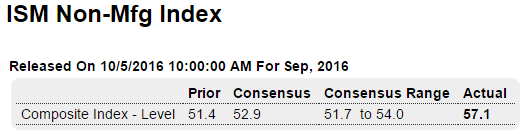

Hard to say what’s going on here! I suppose it can be said that monetary policy is finally kicking in and the good times are back!!!

;)

Highlights

August was a weak month for the ISM non-manufacturing report but not September! The composite index shot up to 57.1 from August’s recovery low of 51.4 which now looks like a very odd outlier for this report which otherwise has been consistently strong this year. And new orders are especially strong, up nearly 9 points to 60.0 which points to brisk activity for other readings in the months ahead. Employment is also a very solid plus in the report, up 6.5 points to 57.2 which is the strongest rate of growth since September last year. This particular reading will help offset some of the disappointment over this morning’s weak estimate from ADP. Service exports are a specific strength of the U.S. economy and this report points to September gains, at 56.5 for the best reading in a year. Business activity is at 60.3, again very strong, with total backlog orders back in the plus column at 52.0. The great bulk of the nation’s economy accelerated sharply at the end of the third quarter, at least based on this report.

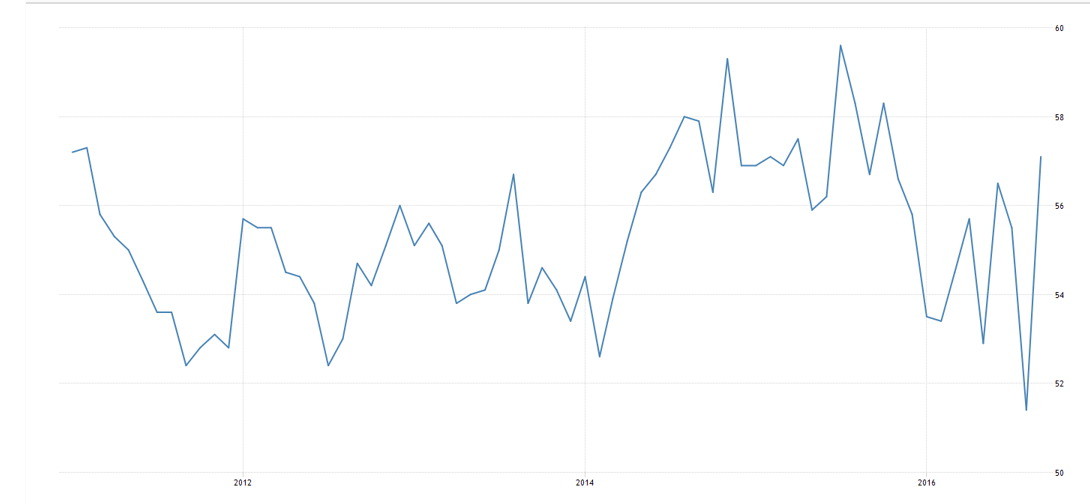

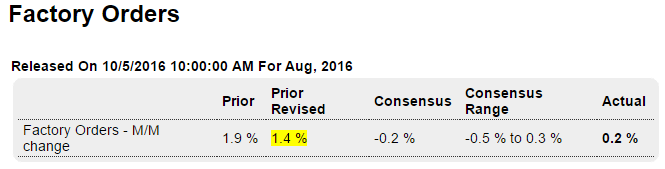

Returning to earth, not looking so good here. August up a bit more than expected but July revised down more than that, and year over year orders remain in contraction:

Highlights

Throw out the headline and look at capital goods. Factory orders in August edged only 0.2 percent higher but core capital good orders (nondefense ex-aircraft) jumped 0.9 percent following very impressive gains of 0.8 percent and 0.5 percent in the prior two months. These results point to a rebound for business investment which otherwise has been depressed this year.

But the new orders for capital goods will take time to fill and in the meantime business is slow as shipments of core capital goods slipped 0.1 percent following a July dip of 0.7 percent. These two readings will hold down nonresidential investment in the third-quarter GDP report, but that’s pretty much ancient history.

Other readings include no change for total shipments, a fractional dip of 0.1 percent in unfilled orders, and a constructive 0.2 percent build in inventories. In sum, this report is a positive for the economic outlook.