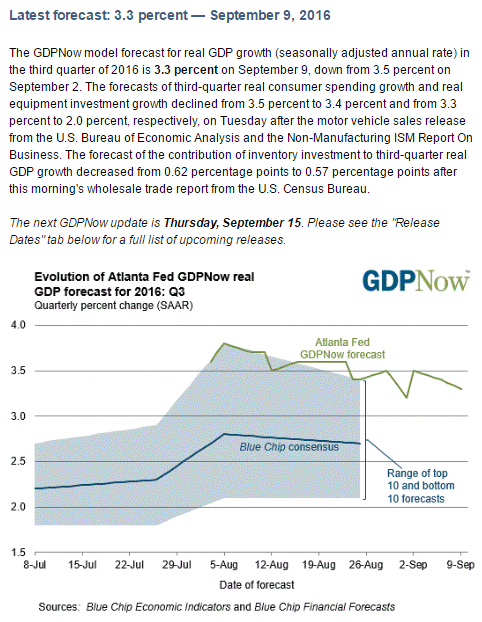

As previously discussed, this ‘nowcast’ is working its way lower as more data is released, much like it did last quarter. Still to come are weaker retail sales due to weakening car sales, weaker residential investment due to weakening housing permits, more inventory reductions due to weaker sales, and generally weaker consumption as employment growth continues to decelerate. And I also suspect the trade deficit to resume it’s climb as exports continue to weaken and the import bill increases:

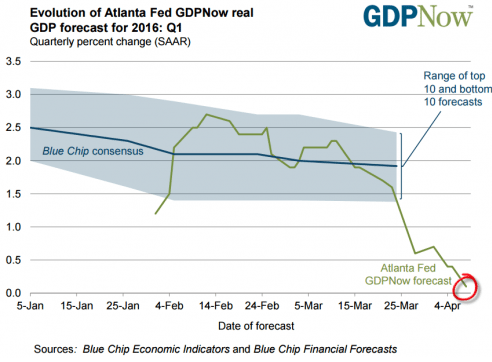

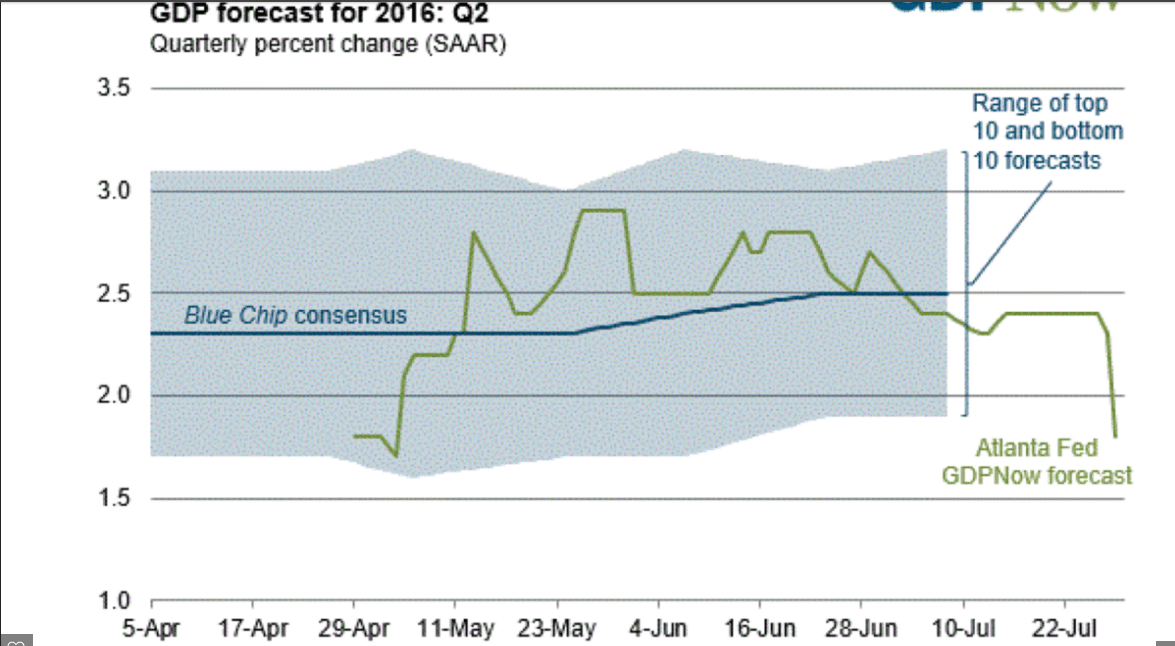

Note the progression of the q1 and q2 nowcasts:

Rick Davis commentary on the Q2 GDP report:

As mentioned above, real per-capita annual disposable income was revised upward $101 in this report (and is now up $151 from the prior quarter), and the household savings rates was also revised upward. Although the household savings rate was revised upward in this report, it is still down from the prior quarter — and most of the increased quarter-to-quarter consumer spending came from that decreased savings rate. It remains important to keep this line item in perspective. Real per-capita annual disposable income is up only +6.32% in aggregate since the second quarter of 2008 — a meager annualized +0.77% growth rate over the past 32 quarters. The key items in this report:

All things not consumer either weakened or remained in contraction. Consumer spending growth improved yet again, with most of that coming from savings. All of the reported growth disappears when a third party deflator (the BLS CPI-U) is applied to the data.

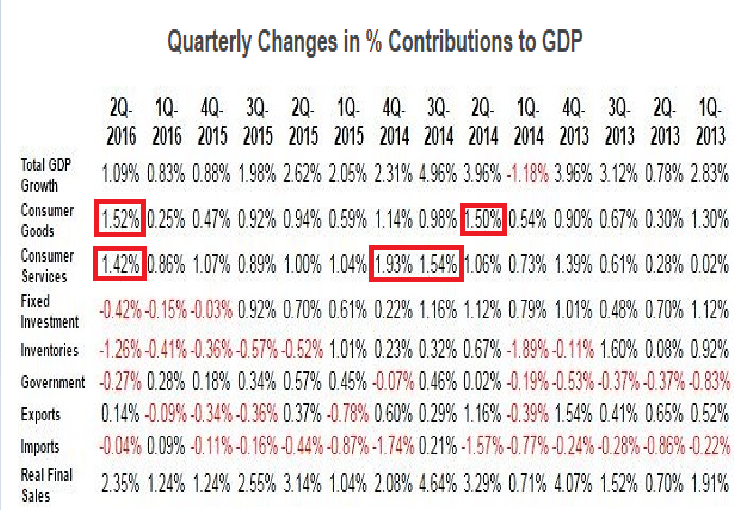

Note that the consumption numbers outlined tend to revert:

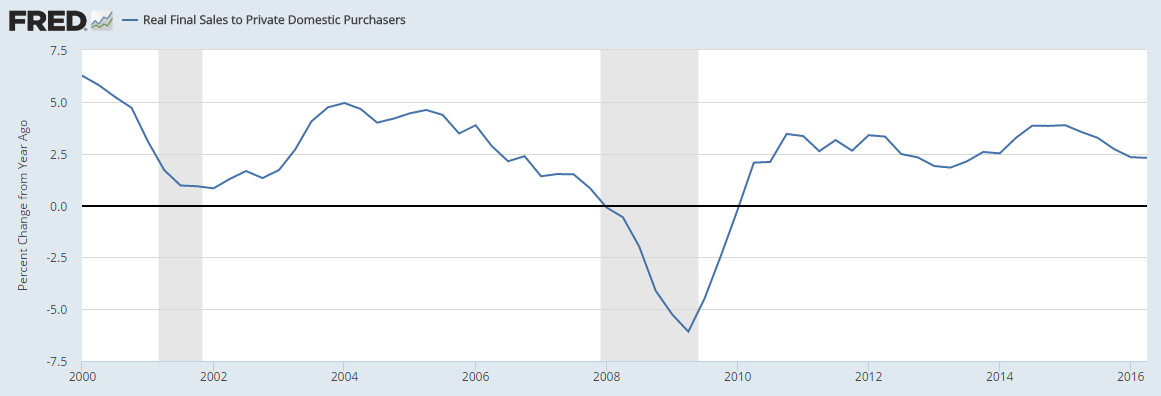

Consumption, like most everything else, has been decelerating ever since the collapse in oil related capital expenditures at the end of 2014, and is already very low vs prior cycles. And, at least so far, I have no reason to expect this general deceleration not to continue: