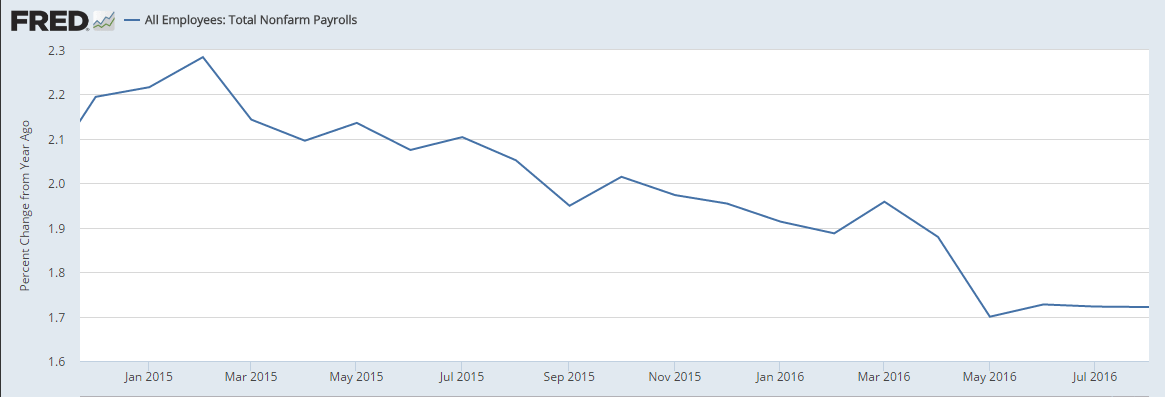

The deceleration of job growth continues since the collapse in oil capex:

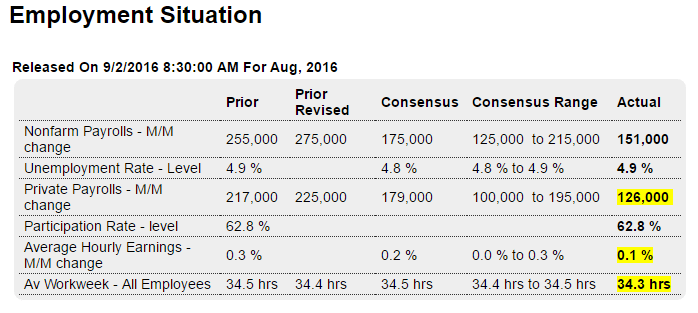

Highlights

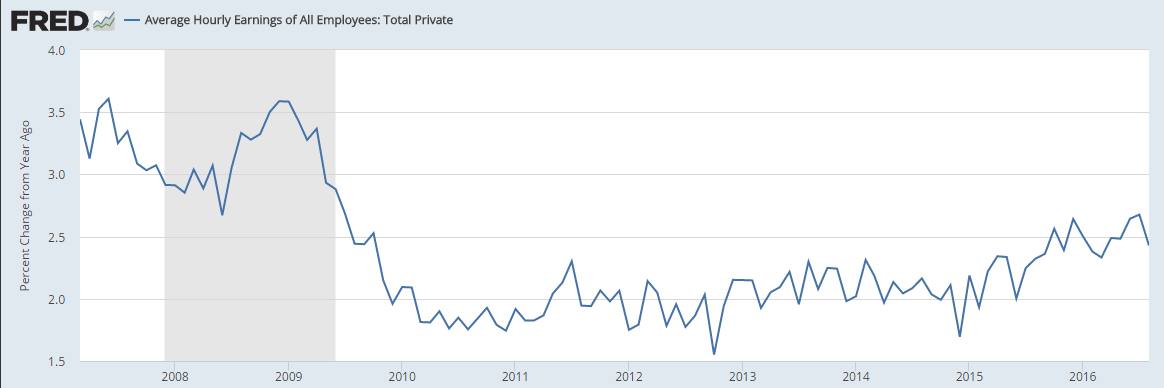

The labor market is solid but maybe isn’t overheating, at least yet. Nonfarm payrolls rose a lower-than-expected 151,000 in August with revisions to July and June at a net minus 1,000. The unemployment rate holds at 4.9 percent with modest increases on both the employment and unemployment side of this reading. Earnings are very soft in this report, up only 0.1 percent in the month for a year-on-year plus 2.4 percent which is down a sizable 3 tenths from July and isn’t pointing to any wage-hike flashpoint. And the workweek is down, at 34.3 hours with July revised 1 tenth lower to 34.4.

Goods producing payrolls are down across the board reflecting weakness in mining, construction and manufacturing. But service sector jobs are once again strong and include further gains for professional & business services as well as a 25,000 increase in government jobs.

There are definitely weak spots in this report though the headline payroll gain of 151,000 is respectable but isn’t high enough to give the hawks the advantage at this month’s FOMC where a rate hike will, at least, be discussed.

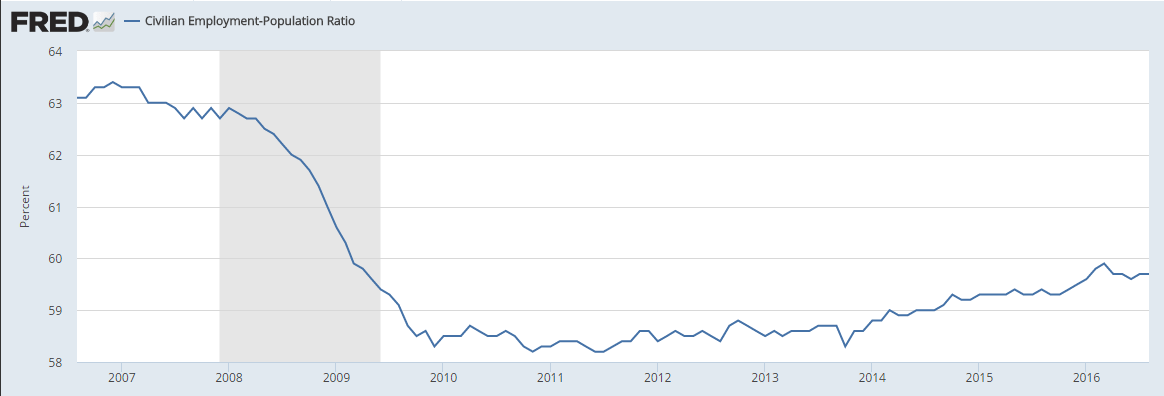

It’s been an ‘L’ shaped recovery, at best:

Wage growth can’t even get back to levels of the last recession:

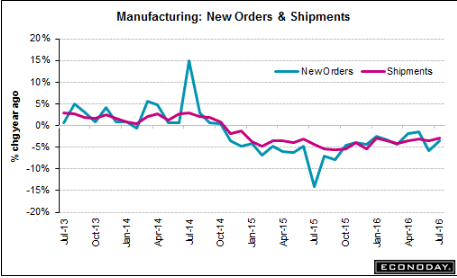

Still in contraction vs last year, and inventories remain far too high:

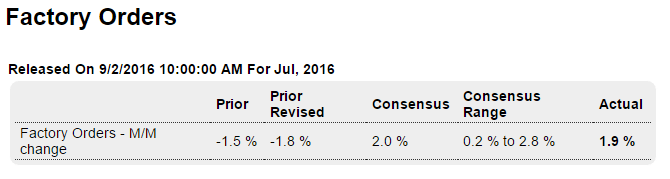

Highlights

The early indications for August are soft to mixed but July was definitely a solid month for the factory sector. After monthly declines of 1.2 and 1.8 percent in May and June, factory orders surged 1.9 percent in July for the best gain since October last year.

Orders for core capital goods (nondefense ex-aircraft) were especially strong in July, up 1.5 percent following June’s 0.5 percent gain in readings that upgrade what has been a very soft outlook for business investment. Aircraft, which is always volatile in this report, is July’s biggest plus, surging 90 percent in the month. But vehicles are a negative in the report, down 0.5 percent.

Other negatives include factory shipments which slipped 0.2 percent and include a 0.5 percent decline in shipments of core capital goods. The latter decline is an immediate negative for the nonresidential fixed investment component of the GDP report though the big order gains in July and June for core capital goods point to future strength for this reading. Factory inventories are stable and lean, edging 0.1 percent higher in the month to keep the inventory-to-shipments ratio unchanged at 1.35.

This report is mostly solid but is a bit dated. This morning’s employment report showed a decline in factory hours which points to a retreat for manufacturing in the next industrial production report, a report which, like factory orders, showed strength in June and July. On net, the factory sector doesn’t look like it will be contributing much to second-half economic growth but it doesn’t look to be a negative either.