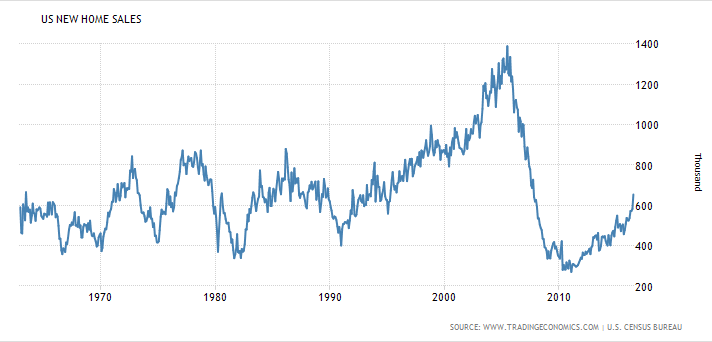

Still extremely depressed:

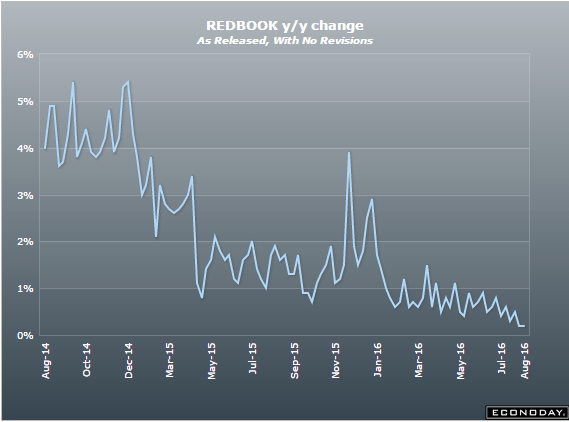

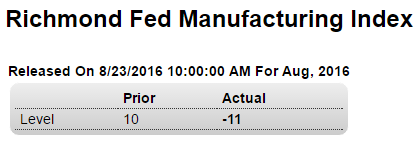

Down and well below expectations:

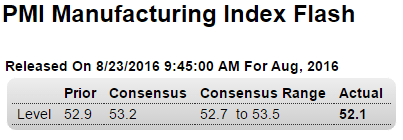

Highlights

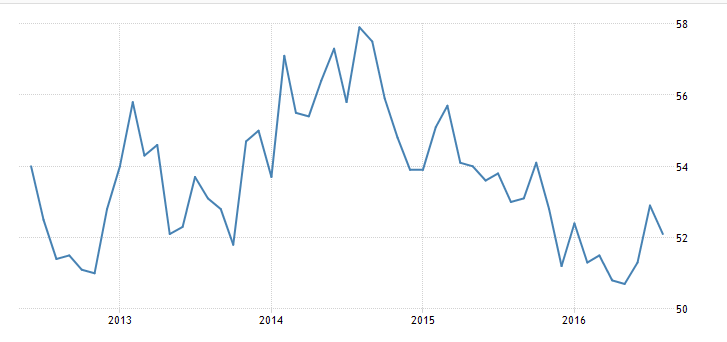

Weakness in orders and employment were unfortunate themes of last week’s Empire State and Philly Fed reports and likewise headline the manufacturing PMI report. The PMI, which is based on a nationwide sample of manufacturers, slowed by 8 tenths in the August flash to 52.1, a reading only modestly above breakeven 50 to indicate no more than limited expansion in composite activity.Output is the month’s best strength but one that won’t last very long if orders remain soft. The sample is cutting back on inventories this month which, like the slowing in employment, hints at caution over the business outlook. Price trends are stagnant in yet another sign of softness in demand. One positive in the report is strength in export orders which, after a long run of weak readings, is suddenly near a 2-year high.

Exports aside, the strength in this report is limited and does not point to second-half strength for manufacturing.

Bad:

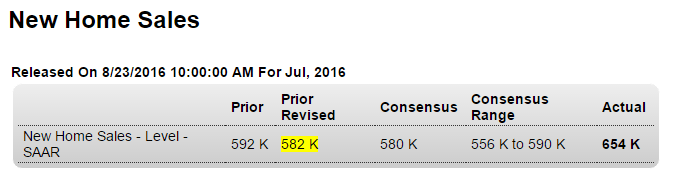

Strong sales, higher than expected, but in any case no homes get built or sold without permits which remain weak, so expect ‘corrections’ with future releases: