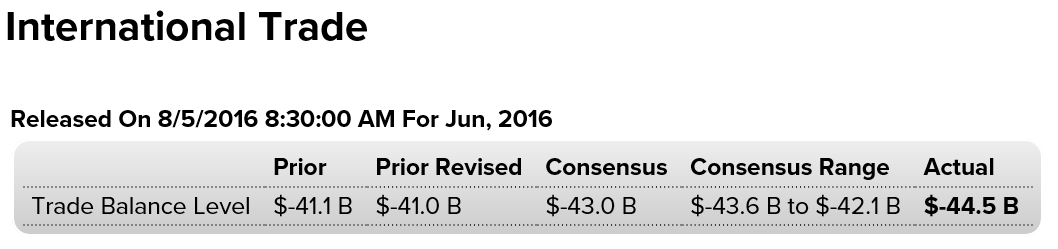

Larger trade deficit than expected for June, lowering Q2 GDP calculations as previously discussed:

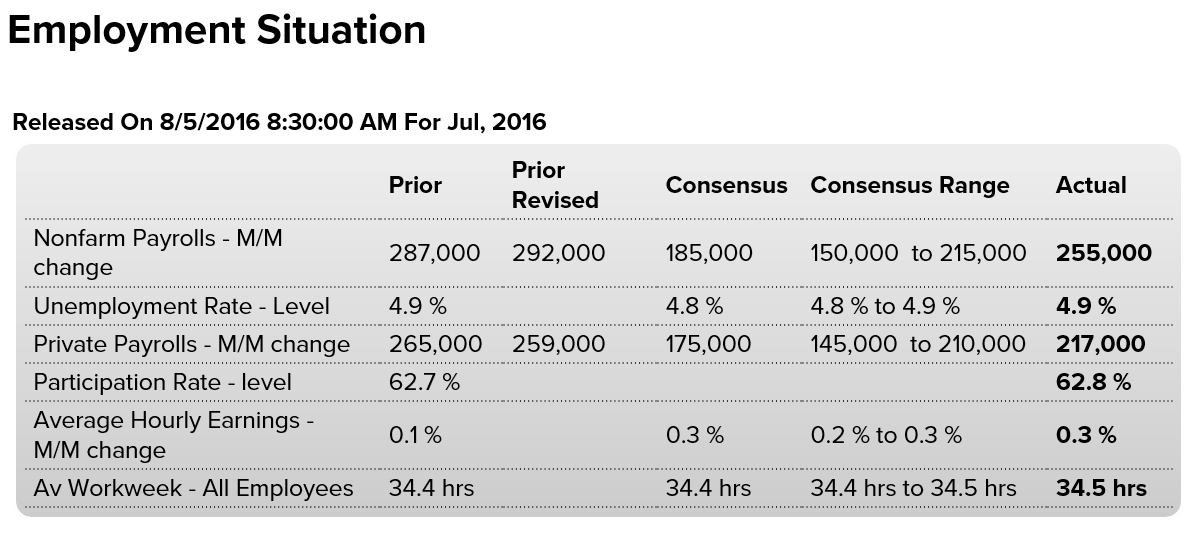

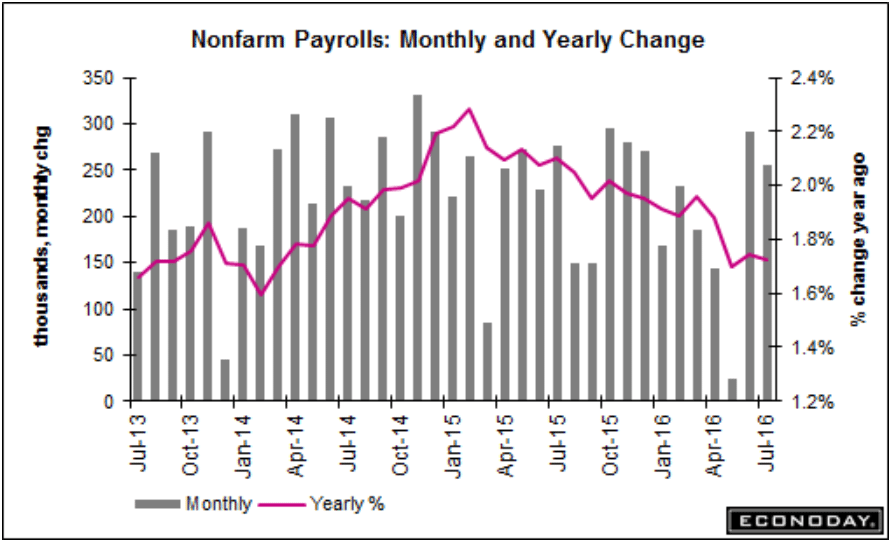

Much better than expected and prior month total payrolls were revised up some with private payrolls revised down. The headline unemployment rate was unchanged, while U6 unemployment, the broader measure, moved up a tenth to 9.7, indicating an unexpectedly large increase in the available labor force. More details later today.

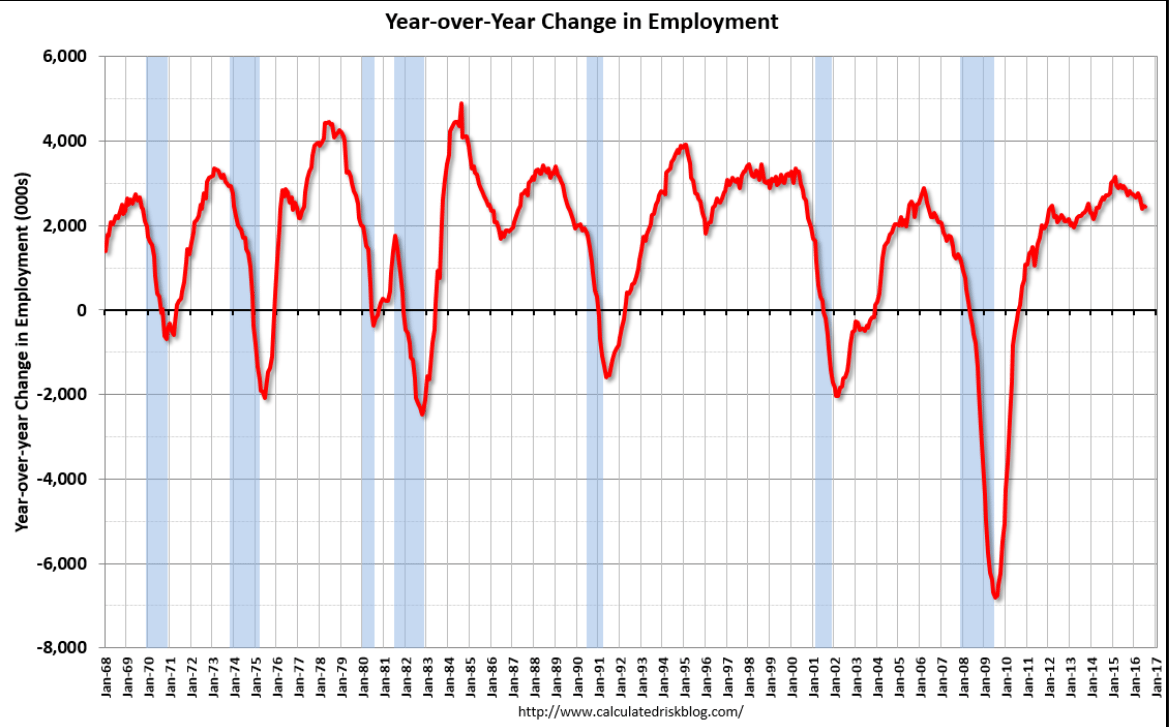

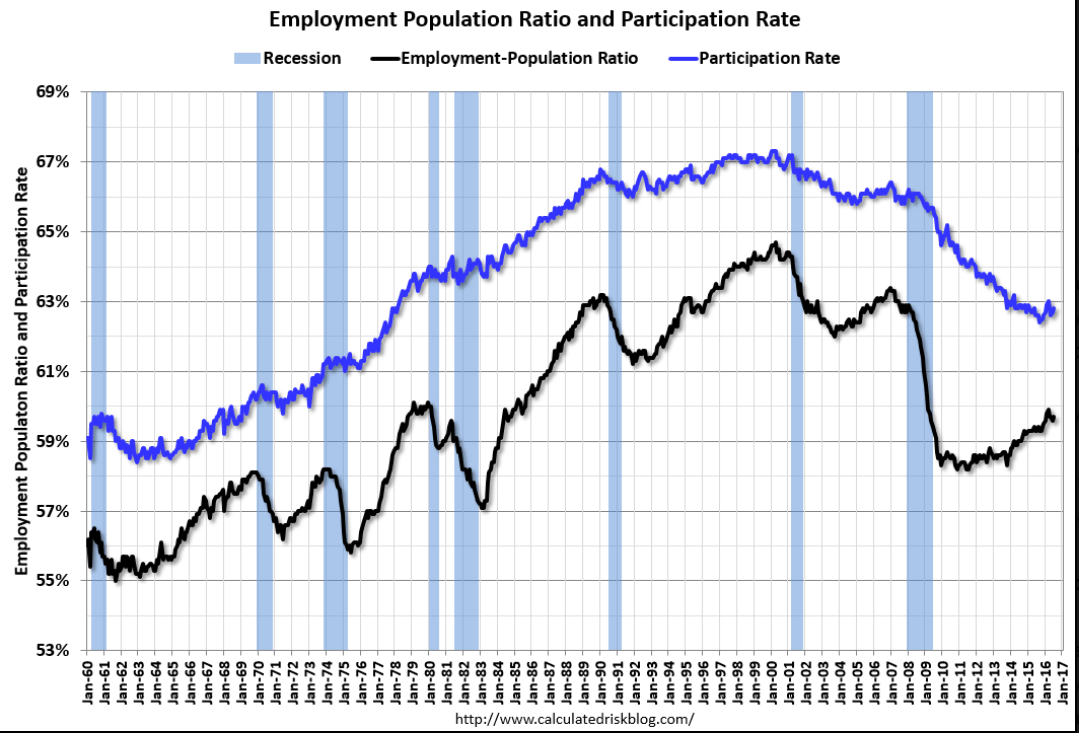

Also, year over year job growth is still decelerating, and, in my humble opinion, enormous ‘slack’ persists:

The headline unemployment rate held steady at 4.9 percent, though a more encompassing measure that includes those not actively looking for work and those working part-time for economic reasons moved up a notch to 9.7 percent.

Hourly wages also moved higher, increasing by 8 cents or an annualized pace of 2.6 percent, while the average work week edged up to 34.5 hours.

Economists had been looking for an increase of 180,000 and a decline of the unemployment rate to 4.8 percent from June’s 4.9 percent. June payroll growth initially was reported at 287,000.

Professional and business services led the way with 70,000 new positions, while health care rose 43,000 and Wall Street jobs increased by 18,000. Leisure and hospitality continued to be a big contributor to job growth, adding 45,000.

Jobs were evenly distributed, with full-time positions growing by 306,000 and part-time adding 150,000.

Previous months’ tallies also gained due to revisions. May’s anemic 11,000 gain got bumped up to 24,000 while the strong June number moved from 287,000 to 292,000.

Sometimes the stock market has a life of it’s own, sometimes, for example, going up for no apparent reason. It’s only later that a reason is discovered, and this time turns out the Swiss National Bank has been buying US stocks in very large quantities as part of its reserve management policy. And to buy that much stock ‘at the market’ means the price has to go up sufficiently to attract that many sellers, which itself can create at ‘top’ when that buying ends:

SNB’s U.S. Equity Holdings Hit Record $61.8 Billion Last Quarter

Interesting mix of orders highlighted:

Germany Factory Orders

German industrial orders unexpectedly fell 0.4 percent month-on-month in June of 2016, following an upwardly revised 0.1 percent rise in May and missing market consensus of a 0.6 percent gain. While domestic demand increased by 0.7 percent, foreign orders dropped by 1.2 percent. New orders from the euro area were down 8.5 percent. In contrast, those from other countries were up by 3.8 percent.