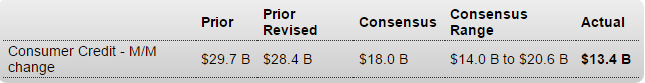

Lower than expected as last month’s higher print reverses.

Remember all the hoopla over last month’s number? And how the consumer was finally spending?

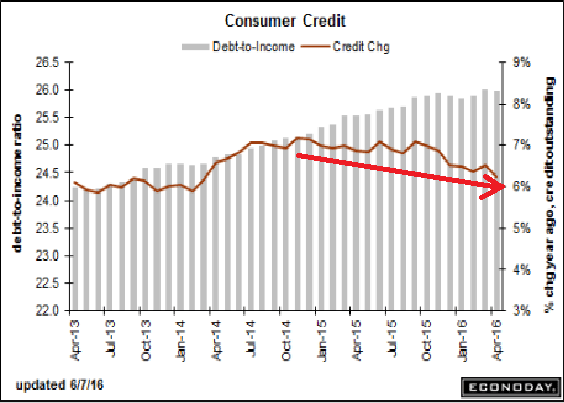

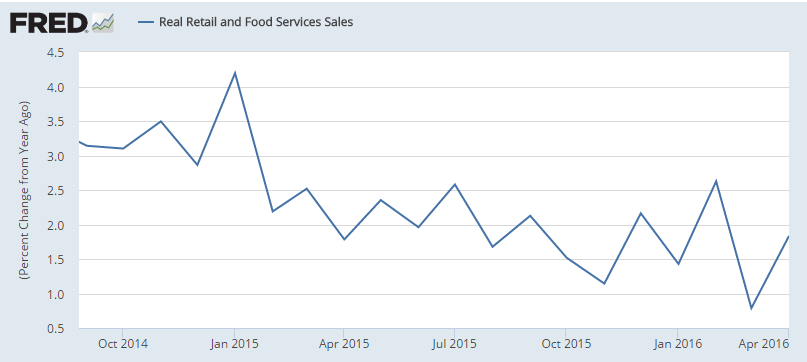

I suspect you’ll hear nothing about how that’s not the case after all, and note how the chart shows it’s been decelerating since the collapse of oil capex:

Consumer Credit

Released On 6/7/2016 3:00:00 PM For Apr, 2016

Highlights

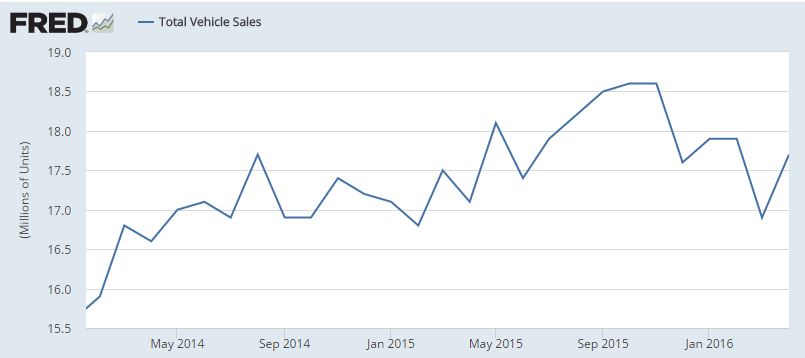

April was a strong month for retail sales but it wasn’t an especially strong one for consumer credit which rose $13.4 billion vs the prior month’s outsized gain of $28.4 billion (revised). Revolving credit, which jumped $10.4 billion in the month before, rose $1.6 billion, which like the headline, is on the soft side of trend. Nonrevolving credit rose $11.8 billion reflecting the month’s strength in vehicle sales as well as once again increases in student borrowing. Instead of borrowing, consumers dipped into their savings to fund their April spending spree as the savings rate, in data included in last week’s personal income & outlays report, fell a very sharp 5 tenths to 5.4 percent. Data on May spending got underway last week with unit vehicle sales which held steady at April’s respectable rate and point to another gain for this report’s non-revolving credit component. May’s retail sales, which are on next week’s calendar, may get more of a boost from revolving credit than from another drawdown in the savings rate.

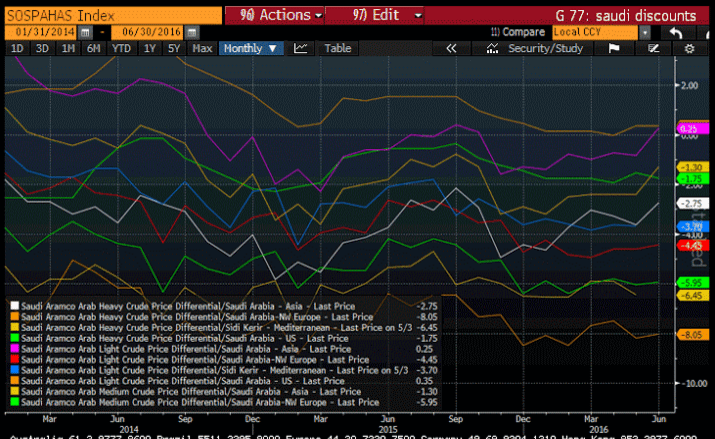

So what else has been decelerating?

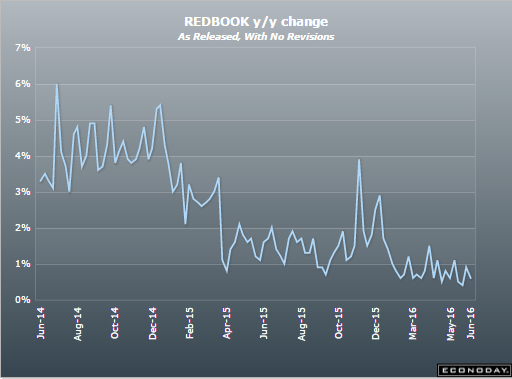

This measure of retail sales:

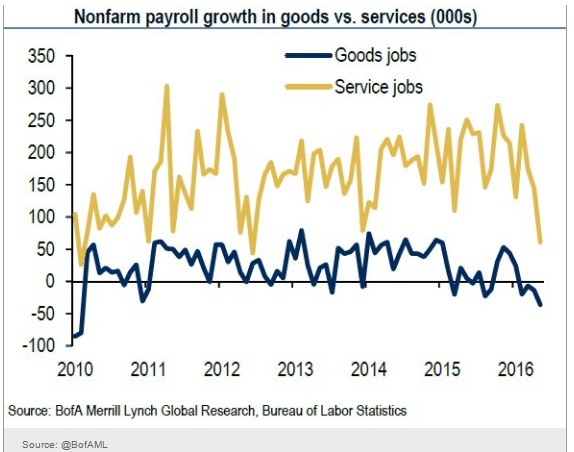

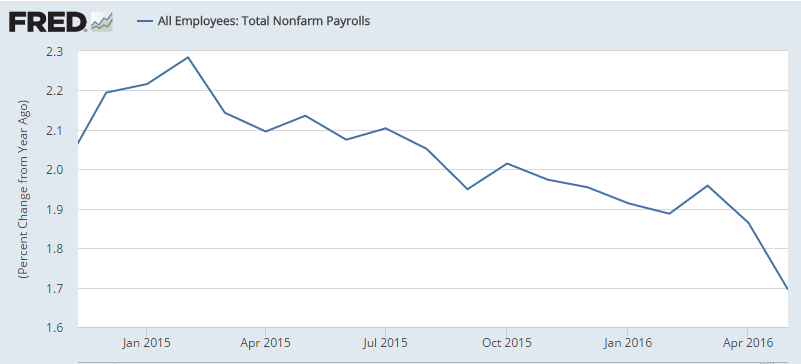

Payroll growth:

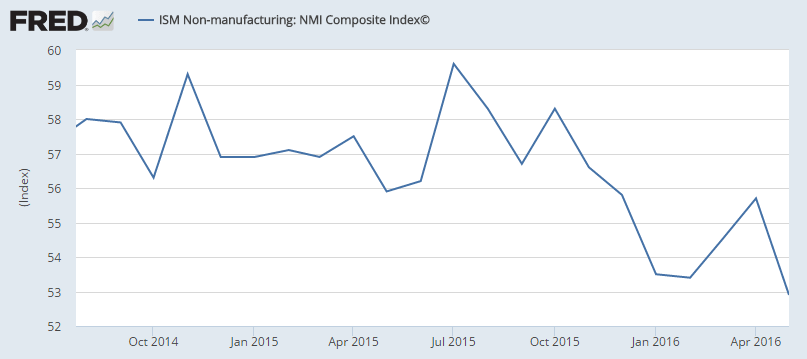

The service sector:

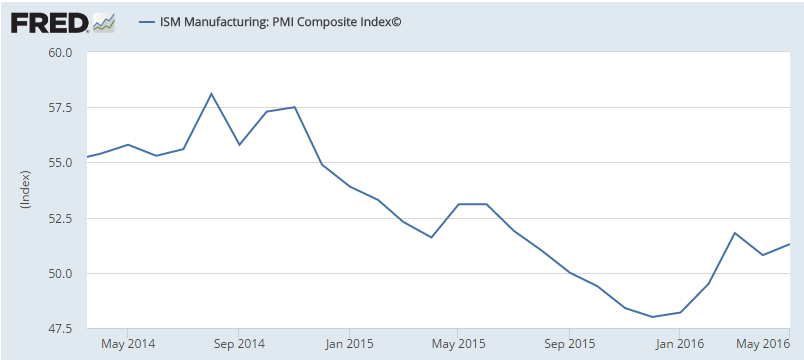

Manufacturing:

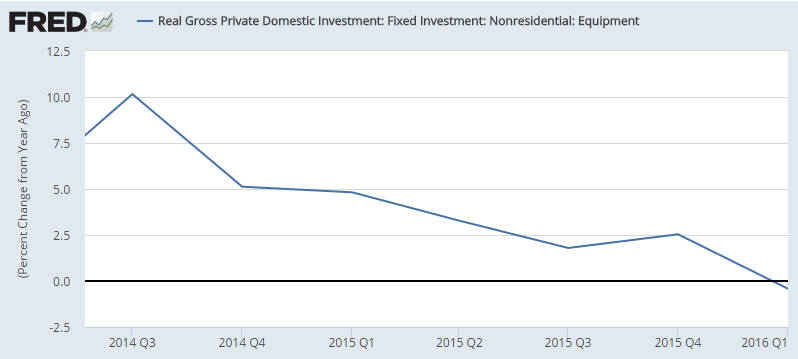

Investment:

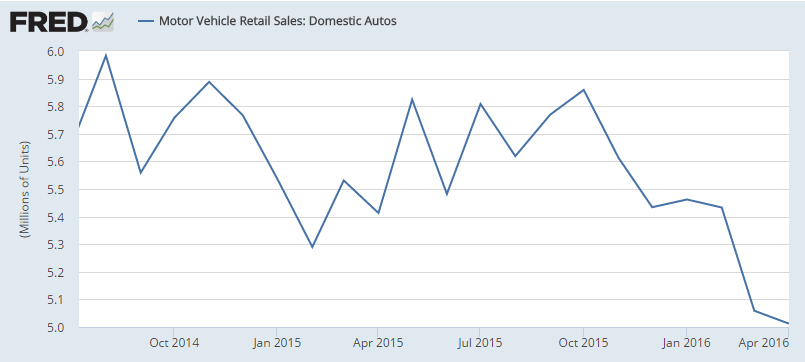

Car sales:

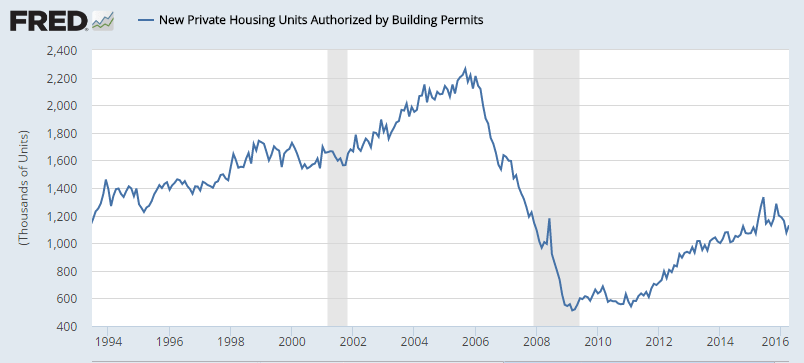

Housing (nothing is built without a prior permit):

Retail sales:

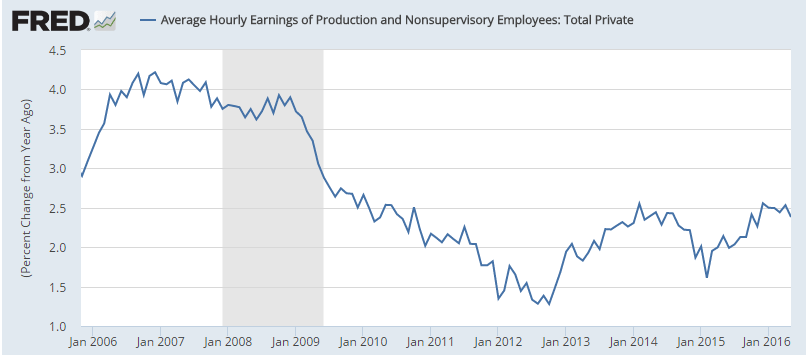

This measure of wage growth just turned down from already low levels:

So what’s behind a looming Fed rate increase?

Higher rates are designed to first remove accommodation of interest sensitive sectors, the largest being investment, including housing, and cars, yet they are all decelerating, as are the employment index.

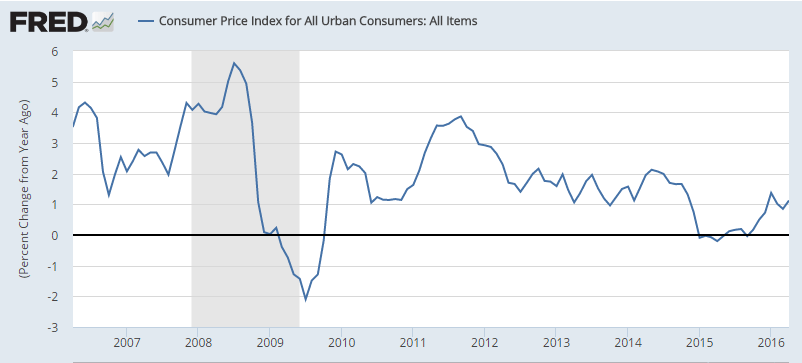

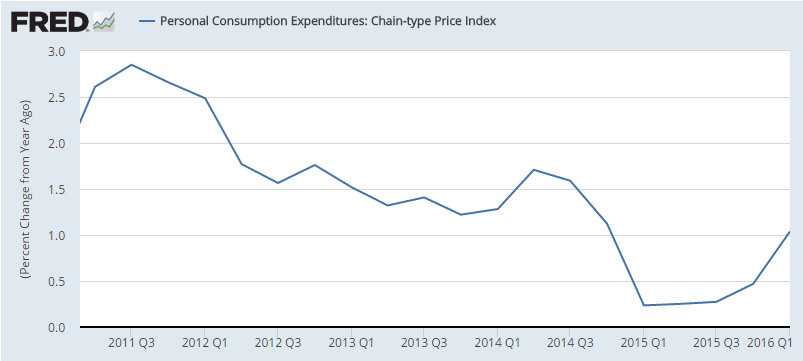

And measures of ‘inflation’ aren’t showing signs of excess demand either: