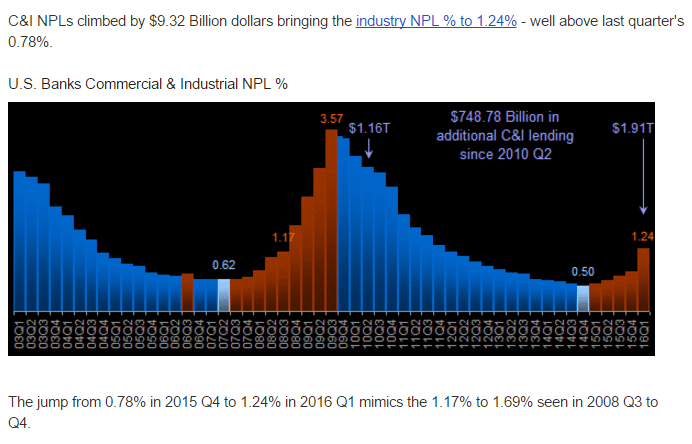

Check out the second chart:

2016 Q1 call report data is available at BankRegData.com. Industry wide assets leapt to $16.293 Trillion adding an amazing $325.59 Billion (2.04%) in the 1st Quarter.

The $325.59 Billion increase is the largest since (you guessed it) the $337.96 Billion jump in 2008 Q1 – a span of 32 quarters.

What’s even more amazing is that the 1.24% would really be 1.28% if C&I lending had stayed flat. The jump to 1.24% was actually lower than it should have been due to the additional $71.168 Billion in additional C&I lending over last quarter.

I would caution that we’re beyond the “it’s Energy related” part of the commentary. C&I delinquencies are rising in most geographies and at most big banks.

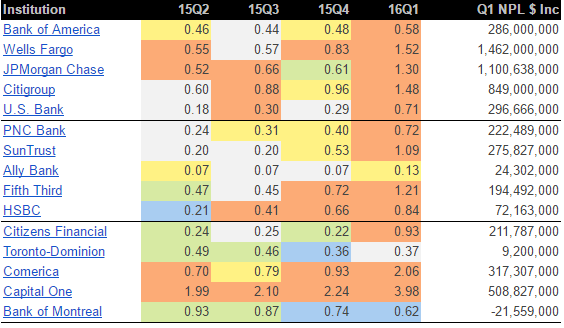

The following table lists the Top 15 C&I lenders top to bottom. At the top is Bank of America with $239.58 Billion in C&I (at an average Yield of 2.97%) and Bank of Montreal is #15 with $24.88 Billion in C&I.

C&I NPL % Heat Map Top 15 C&I Lenders

Wells Fargo has seen it’s C&I NPL % climb from 0.55% in 2015 Q2 to 1.52% in 2016 Q1 – NPL $ climbed $1.46 Billion in the quarter.

Take a gander at Capital One jumping from 2.24% to 3.98%. Even SunTrust which had been performing exceptionally well has seen rates go from 0.20% 3 quarters ago to 1.09% – a fivefold jump in the rate in 6 months.

The two standouts in the group are Toronto-Dominion and Bank of Montreal. Both banks have seen NPL % rates decline over the past year. I’m sure it’s just a coincidence that both are BankRegData clients. Yes, shameless plug and one I hope they’ll forgive me for.

Levity aside, C&I NPLs are getting worse and are likely to climb considerably higher in the next few quarters. We can’t add near $750 Billion in new lending in 6 years and not expect higher subsequent NPLs.

One in three US manufacturing workers are on welfare: Study

Philadonna Wade’s story plays out across middle America on a daily basis but is seldom told. It’s the story of the working poor who labor in tough jobs — like Wade’s position as an assembler for a Ford Motor plant — that don’t pay enough to keep them off public assistance.

In fact, fully 1 in 3 Americans who work in the manufacturing sector are receiving some form of public assistance, according to a study released this week by the UC Berkeley Center for Labor Research and Education. Of those who came to their positions through temp agencies, a category in which Wade falls, half are on some type of safety net program.

It’s not that Wade wants to be on food stamps and Medicaid, among other programs, it’s that the mother of four has no choice.

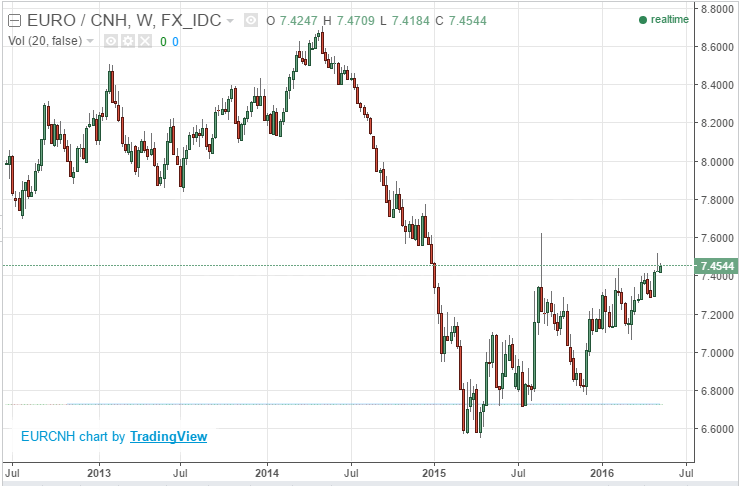

China continues to push exports, including what appears to me to be (re)targeting the euro area by buying euro a year or so after Draghi freightened them into lightening up on their euro reserves:

China Introduces Proposals to Boost Exports

May 9 (WSJ) — In policy guidelines released Monday, the State Council, the government’s cabinet, called for greater lending by banks to support small-scale and profitable exporters and said it would expand rebates of value-added taxes. It also promised to reduce short-term rates for export credit insurance, which protects exporters against nonpayment by foreign customers. “Presently, the foreign trade situation is complicated and severe, elements of uncertainty and instability are increasing and downstream pressures are continuously growing,” the State Council said.

Ferryboat Touches Water for First Time; Launch Trip Projected for Mid-June