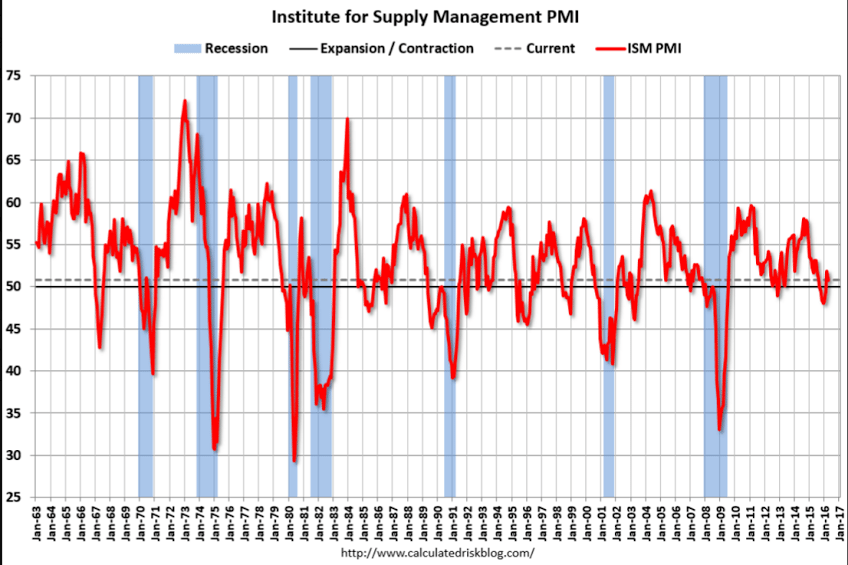

Another worse than expected report, and now it’s been over a year since it all started going bad, even as analysts continue to find reasons to be optimistic that have yet to pan out:

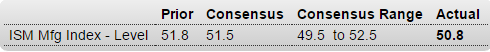

ISM Mfg Index

Highlights

April’s 50.8 for the ISM manufacturing index may be moderately below expectations for 51.5 but details in the report are positive. New orders did slow by 2.5 points but the level at 55.8 still points to a very solid rate of growth. New export orders, offering positive evidence on the effects of the lower dollar, are also positive, unchanged at 52.5 which isn’t dramatically above breakeven 50 but is still very solid for this reading and the best since December 2014. Production did slow 9 tenths but at 54.2 is also more than respectable. Backlog orders are still rising, though just barely at 50.5, but this along with March’s 51.0 are the best two months for this reading also since December 2014.

Now the weaknesses in the report, led by employment which did rise 1.1 points but is still below 50 at 49.2. Supplier deliveries, down 1.1 points at 49.1, pulled the composite index lower in the month and likely reflect lack of inventories at suppliers. And ISM’s sample continues to be very defensive regarding inventories with both raw materials and finished goods in accelerating contraction. Prices paid, at 59.0 for a sharp 7.5 point gain, reflects higher oil-related costs. There are no indications in this report on selling prices but other readings, including from this morning’s April PMI, have been negative.

But there’s reasons for optimism in this report centered entirely where it must be — in orders.

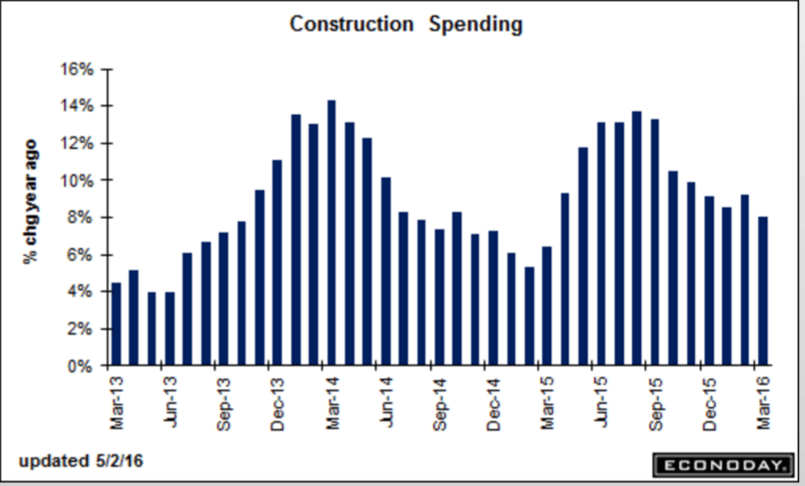

As per the chart, the year over year growth rate continues to decline, meaning this year’s construction activity won’t be adding as much to growth as last year’s did:

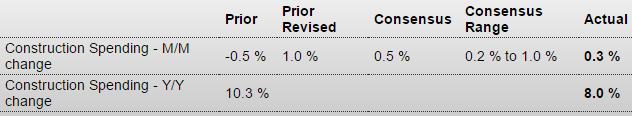

Construction Spending

Highlights

Home sales may be puttering along but construction spending nevertheless remains one of the strongest reports on the calendar. Construction spending did inch 0.3 percent higher in March, which is lower than expected, but February is now revised sharply higher, from a 0.5 percent decline to a 1.0 percent gain. Gains for March and February are positives for near-term momentum though they are offset by a sharp downward revision in January to minus 0.3 percent from plus 2.1 percent.

Back to March, residential spending rose 1.6 percent driven by gains for multi-family homes with single-family homes flat. The latter is a disappointment but does follow a trend of steady strength in prior reports.

Non-residential spending rose 0.7 percent in March led by transportation and including a respectable gain for manufacturing, one that may hint at better results for capital spending. Public spending on educational building and on highways is also up though Federal spending remains weak and state & local spending, which has been strong, fell in the month.

Year-on-year, total construction spending is up 8.0 percent, which includes a 7.8 percent gain on the residential side and a 9.3 percent gain on the non-residential side. These are down from 10 percent rates in prior reports but are still very hard to match anywhere else in the economy.

Also below expectations and not good:

PMI Manufacturing Index

Highlights

The manufacturing sector has started out the second quarter completely flat, based at least on the April PMI which fell 7 tenths to 50.8. New orders did rise modestly in the month but that’s the only good news in the report. Export orders, contracting at the fastest pace in more than a year, are not showing any lift yet from the lower dollar. And higher oil prices are not helping capital spending in the energy sector which remains a major negative for the sample. Output is flat, backlog orders are in contraction for a third straight month, and employment has completely stalled. And manufacturers continue to work down inventories as much as possible. Prices for raw materials, reflecting higher costs for oil-related products, did rise but not selling prices which are decreasing further. This report isn’t closely watched but the ISM manufacturing report is, and similar results for ISM, which will be posted at 10:00 a.m. ET, could shake the U.S. outlook and perhaps global markets with it.