This one’s still down:

Kansas City Fed Manufacturing Index

Highlights

Other regional reports have been picking up a sudden turn of strength this month, all except Kansas City where the index came in at minus 6 in March which is however an improvement from minus 12 in February. New orders, in fact, do show improvement, at minus 2 vs February’s minus 15 which, however, is where backlog orders are this month. Production is also deeply negative at minus 14 with employment at minus 12. Price indications remain in contraction. The weakness in the energy sector is still taking a heavy toll in the Kansas City region as it is in the Dallas region where the March report will be posted next week.

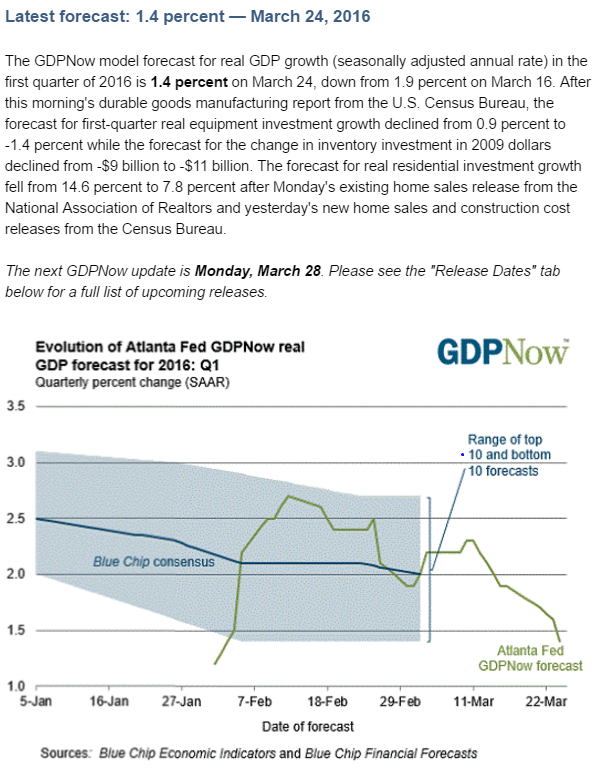

There was lots of cheer leading not long ago when this was over 2.5%, even though the gains were largely from (unwanted) inventory building, as previously discussed:

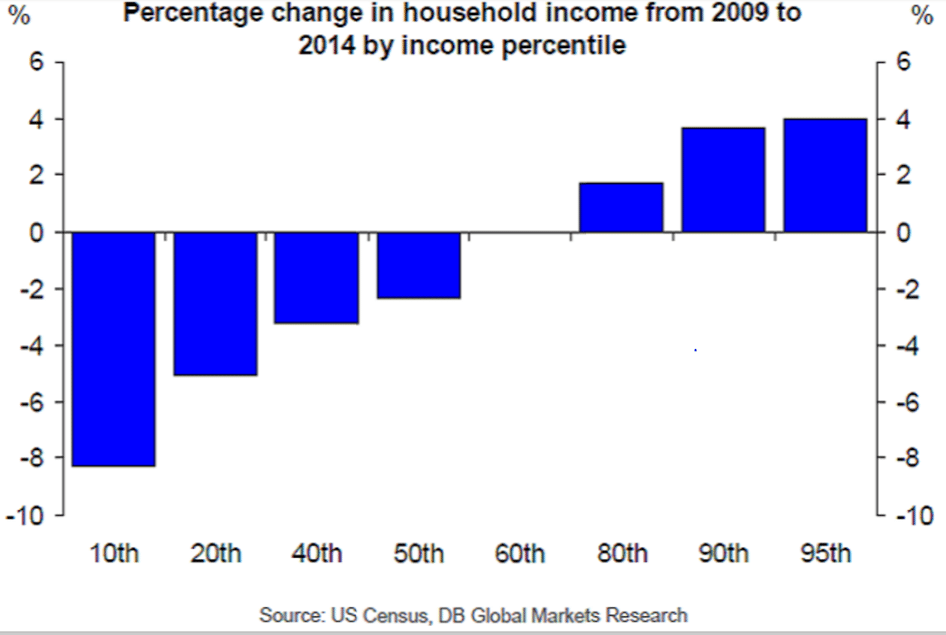

Interesting also is while upper income households did a lot better than the lower income households, in absolute terms those upper income households haven’t done all that well:

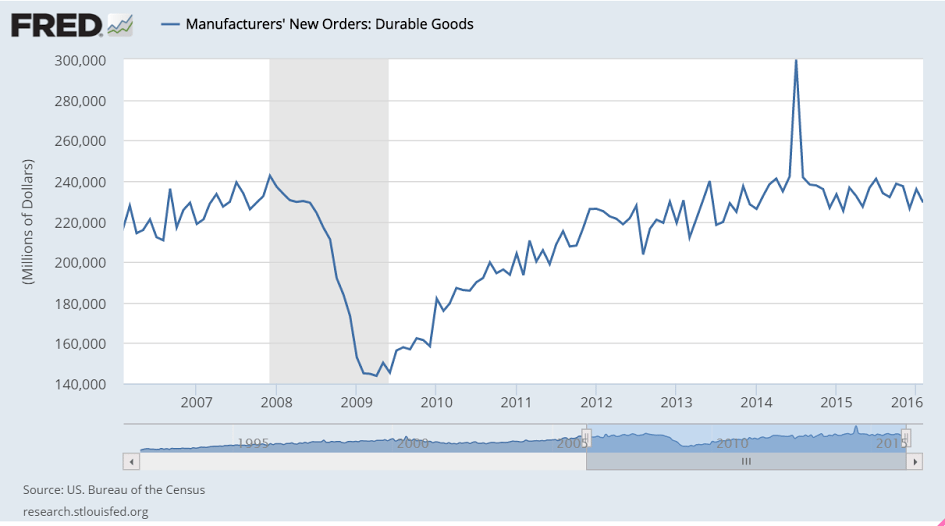

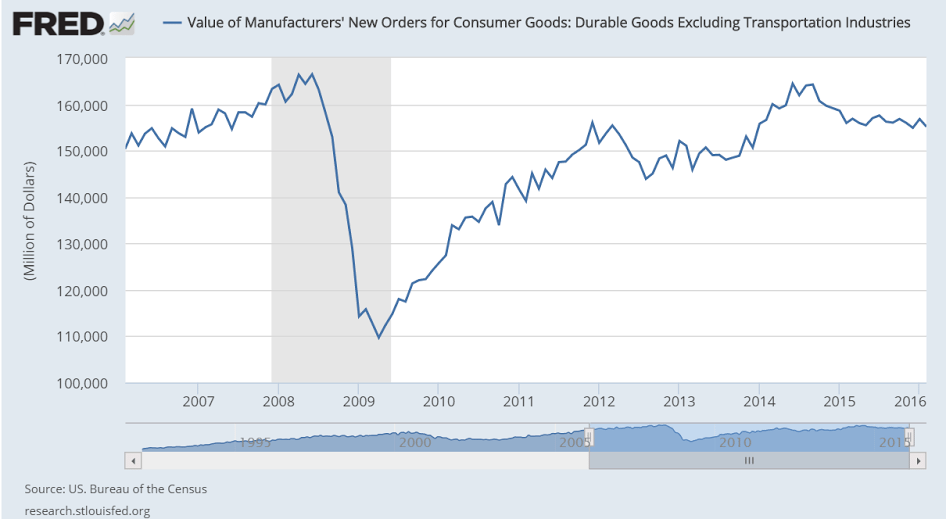

This isn’t adjusted for inflation so you can real orders remain below 2008 levels and is working its way lower: