Purchase apps down again:

MBA Mortgage Applications

Highlights

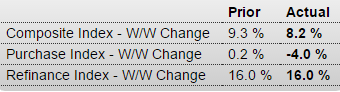

Falling mortgage rates continue to drive refinancing applications sharply higher, up 16 percent for a second straight week. Purchase applications, up 30 percent year-on-year, are also being driven higher though they declined 4 percent in the latest week. The average rate for 30-year conforming loans ($417,000 or less) fell 8 basis points in the week to 3.83 percent.

Again, so much for what’s been forecast to be the ‘driver’ of the 2016 economy.

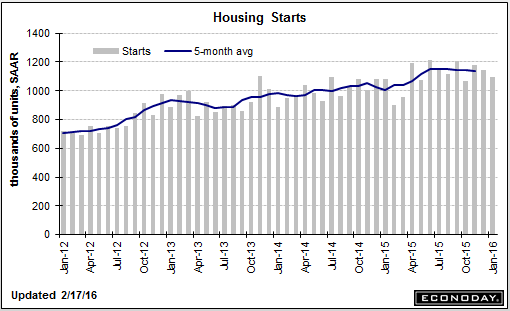

Note how the chart shows starts have been working their way lower for a substantial period of time:

Housing Starts

Highlights

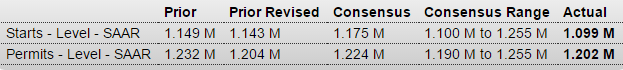

Housing starts and permits proved softer-than-expected in January, down 3.8 percent to an annual rate of 1.099 million for starts with permits down 0.2 percent to 1.202 million. Starts show roughly equal weakness between single-family homes, down 3.9 percent to a 731,000 rate, and multi-family homes, down 3.7 percent to 368,000. Permits for single-family homes fell 1.6 percent to 720,000 while multi-family permits, in the strongest reading of the report, rose 2.1 percent to 482,000.

Multi-family homes remain the center of strength for the housing sector with year-on-year permits up 19.9 percent, surpassing a very solid 9.6 percent gain for single-family homes. Starts are lagging far behind, at a year-on-year plus 1.8 percent overall and reflecting supply constraints in the construction sector, including for labor, as well as January’s heavy weather that hit the East Coast at mid-month.

The housing sector isn’t on fire but trends in permits do point to strength. Watch for existing home sales on Tuesday next week followed by new home sales on Wednesday.

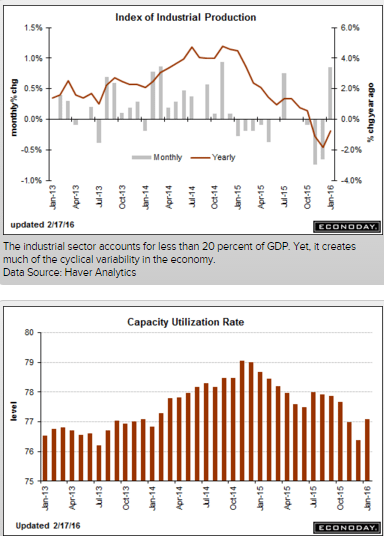

Not good, year over year negative, and the blip up in auto production will likely reverse as auto sales have declined:

Industrial Production

Highlights

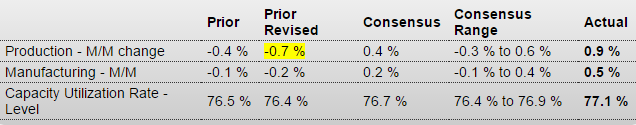

A sharp gain in motor vehicle production underpins a very strong industrial production report where the headline surged 0.9 percent in January which is far above Econoday’s plus 0.4 percent consensus and 0.6 percent high-end estimate. The gain lifts capacity utilization to 77.1 percent for a strong 7 tenths gain from a downward revised December.

Vehicle production surged 2.8 percent in the month and drove the manufacturing component up by 0.5 percent, a gain that compares with a plus 0.2 percent consensus and a high-end estimate of 0.4 percent. But manufacturing was also supported by capital goods, an area that has been weak but which did gain 0.3 percent in the month.

The utilities component, up a monthly 5.4 percent and reflecting a temperature swing from a warm December to a more seasonably cold January, is the major factor behind the headline gain. Mining, hit by low energy and commodity prices, continues to lag, coming in unchanged in the month for a year-on-year decline of 9.8 percent.

Total year-on-year industrial production also remains in the negative column, at minus 0.7 percent, a disappointment but a contrast to manufacturing where the year-on-year rate is modest but accelerating, at plus 1.2 percent.

A negative in the report is a downward revision to December, to minus 0.7 percent from minus 0.4 percent. But the revision doesn’t take much away from the January surprise where strength, based in manufacturing and underscoring January’s rise in retail auto sales, should help ease concern over the economy’s first-quarter performance.

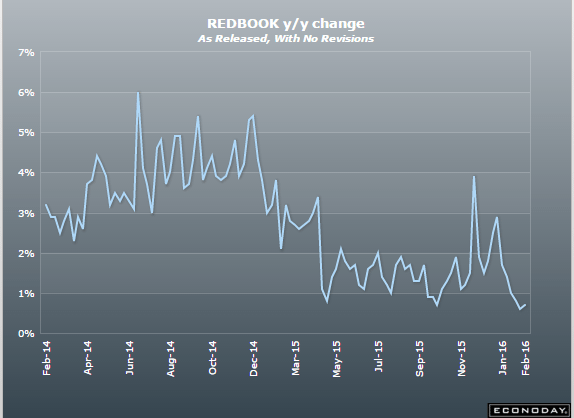

Deceleration here as well:

E-Commerce Retail Sales

Highlights

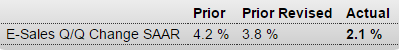

Strength in non-store retail sales and reports of strength for holiday online shopping are only modestly confirmed by the e-commerce report where sales rose only 2.1 percent in the fourth quarter vs a downward revised plus 3.8 percent in the third quarter. Still, compared to the no-change quarterly reading for total fourth-quarter retail sales, the gain does point to relative strength. And year-on-year, e-commerce sales were up 14.7 percent which is far above the 1.3 percent year-on-year rate for total sales. E-commerce as a percentage of total retail sales edged 1 tenth higher in the quarter to 7.5 percent.